Gen Z: a generation of health-conscious consumers

Thursday, 21 November 2024

As a generation of approximately 10 million, Gen Z (those born between 1997 – 2012) are the shoppers of the future, and are anticipated to account for 11% of UK retail spend by the end of 2030 (Barclays, 2023).

AHDB have explored the importance the social media for this generation, particularly as a source of information and how these platforms can influence food choices. But what are Gen Z’s perceptions of red meat and dairy, and what might this mean for our levy payers?

How important is healthy eating to Gen Z?

While many may consider Gen Z to be more health conscious than older generations, it appears that this is only the case for some.

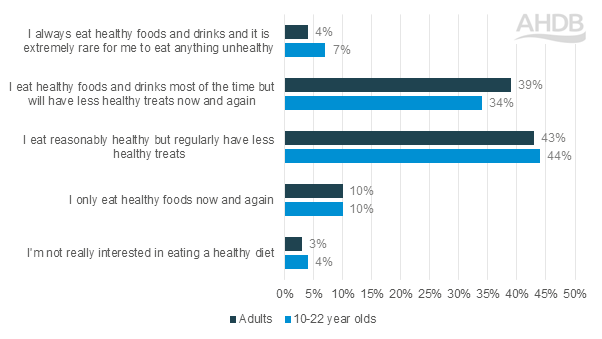

Consumer attitudes to healthy eating

Source: IGD ShopperVista Research, 2023

Overall, those who claim to eat ‘reasonably’ to ‘always’ healthy see very similar levels to the total population (85% for 10–22-year-olds, vs 86% total adult population).

However, these younger consumers are almost twice as likely to claim to always eat healthily and rarely eat unhealthy foods at 7% compared to just 4% for the adult population (IGD, 2023). This indicates that, for some Gen Z, health is very much a priority to them and something that they are prioritising when making food choices.

Functionality of food

The view of ‘food as fuel’ is apparent for Gen Z, particularly when it comes to the functionality of the nutrients, with 50% strongly agreeing that food was important to them because they need it for energy (IGD, 2023).

Research by AHDB and YouGov indicates that Gen Z are more likely to be concerned about the protein content of their food when eating or choosing what to eat than the rest of the adult population (+6%). They are also significantly less likely to be concerned about the salt (-11%), sugar (-9%) and fat content (-11%), often factors that many would consider to be more highly associated with health (AHDB/ YouGov, August 2024, 18–27-year-olds vs 28–65-year-olds).

This same research by AHDB and YouGov further highlights differences between Gen Z and the total population. Overall, Gen Z are more likely to associate red meat (e.g. Beef, Lamb, Pork) as being a good source of omega 3 fatty acids (up to +5%), and less likely to believe that red meat should be eaten in moderation (up to -7%). Protein content is also one of the most recognised health benefits for beef (51%), lamb (43%) and pork (36%) by Gen Z consumers (AHDB/ YouGov, August 2024).

For dairy, almost two thirds (62%) of Gen Z agree dairy products are a natural source of vitamin B12, and 83% agree that dairy products are good source of calcium (AHDB/ YouGov, August 2024).

It is therefore important to highlight where possible any health claims relating to the naturally occurring protein, vitamin and mineral contents. This could be on pack, as well as in any advertising used to promote red meat and dairy to cement these products in the mind of Gen Z shoppers as functional, healthy foods they should be including in their diets.

A generation returning to meat and dairy consumption

Given their understanding of the nutritional benefits red meat and dairy can offer, it is unsurprising that 99% of shoppers under 28 purchase meat, fish and poultry (MFP) (Kantar, 52 w/e 29 September 2024), and 98% purchase cows dairy for their households (NIQ Discover, 52 w/e 5 October 2024, shopper aged <34). In fact, almost 20% of all meal occasions containing red meat are chosen for health reasons by Gen Z, more than 3% pts higher than for the total population (Kantar Usage, 52 w/e 1 September 2024, consumers aged 18-27 years old).

Cutting out these important food products does not seem to appeal to Gen Z, with almost half claiming they have no interest in trying a vegetarian or vegan diet (IGD, 2023).

And for those who have followed a vegetarian or vegan diet in the past, almost a fifth of those aged 19-22 had subsequently stopped, with 45% saying that they didn’t think the diet was healthy for them.

‘…I used to be vegetarian and vegan, but I had to introduce [red meat] for my own nutrients because I wasn’t getting enough from my veggie diet…’ Female, 16-22 (IGD, 2023)

However, retail data from Kantar indicates that volumes of meat, fish and poultry (MFP) and red meat purchased by shoppers under 28 years old have decreased at a greater rate than for some other age demographics (52 w/e 29 September 2024). However, this isn’t being driven by shoppers under 28 leaving the category. Instead, these younger consumers are cutting back the volumes they are purchasing, likely driven by costs as younger shoppers may be impacted more by rising prices.

We also see that the meals that Gen Z are eating are likely to influence their MFP and red meat purchases. Top evening meals are more often cuisine based for Gen Z, with Italian, Indian, and Mexican meals all more likely to feature in these younger consumers repertoires than for the total population. While traditional meals like pies, stews and casseroles are less likely to be featured in their diets. However, they do like roast dinners (Kantar Usage, 52 w/e 1 September 2024).

While cuisine-based dishes usually feature MFP, and red meat specifically, this does tend to be more as an ingredient rather than a main focus for the meal. This would then impact on the volumes of MFP that need be purchased in retail, and further compound that Gen Z consumers are not necessarily leaving the category, just changing the way they are engaging with it.

This indicates that red meat and dairy are still going to be an important part of consumers diets in the future. But, just like older generations, flexitarian diets are more likely to pose a threat to red meat consumption for this age group, particularly for unconscious reducers of red meat and dairy consumption. It is therefore important that the health and functional benefits of these products are highlighted clearly to ensure they retain a place in these consumers diets.

Due to the similarities between Gen Z and the wider adult population, it is unlikely that demand for healthy foods and drinks going forward will suddenly increase as this demographic takes a greater share of food purchases.

However, we do expect similar trends to be seen as with the current adult population, such as an increase in demand for healthy, higher welfare or other reputational areas of red meat and dairy production as periods of financial strain decrease.

Key recommendations

- Continue to advertise the health benefits of incorporating red meat and dairy into the diet, making clear call outs on pack and through advertising for any tangible claims which can be made, particularly to protein and vitamin and mineral contents

- Provide inspiration for how to cook with red meat and dairy to help prevent losses from unconscious reduction of these products from dishes and at mealtimes

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.