- Home

- Markets and prices

- Nature markets

- Nature markets FAQs

Nature markets FAQs

Here are frequently asked questions for farmers and landowners about nature markets and carbon markets.

Nature markets present a potential income stream for farmers, alongside contributing to global commitments such as the 2015 Paris Agreement and the 2040 target set by the NFU.

Farmers have their own obligations to reduce carbon emissions and support ecosystem services. But there is an opportunity to sell credits if it is a suitable option for the business.

All calculators do similar things and show similar trends, but they produce slightly different end results.

The best action is to stick with one. A baseline and consistent record gives a better indication of changes to soil carbon stocks on farm when new practices have been adopted.

Read more on Carbon footprint calculators − What to ask to help you choose

Compulsory schemes, such as the UK Emissions Trading Scheme (UK ETS), are regulated as the Government sets a limit on pollution levels, and credits are traded for the amount of carbon emissions over or under this cap. Agriculture does not fall under the UK ETS, and instead voluntary schemes can be used.

Regulated voluntary schemes include the Woodland Carbon Code (WCC) and the Peatland Carbon Code (PCC).

There are also unregulated voluntary schemes that allow farmers to receive money for sequestering carbon on agricultural land.

Schemes vary in many ways, including:

- Contract length, cost and if buffers are held

- Payments for sale of carbon credits

- Early payout schemes

- Whether soil analysis is a requirement

- Monitoring method

- Minimum requirements, such as min./no-till practices

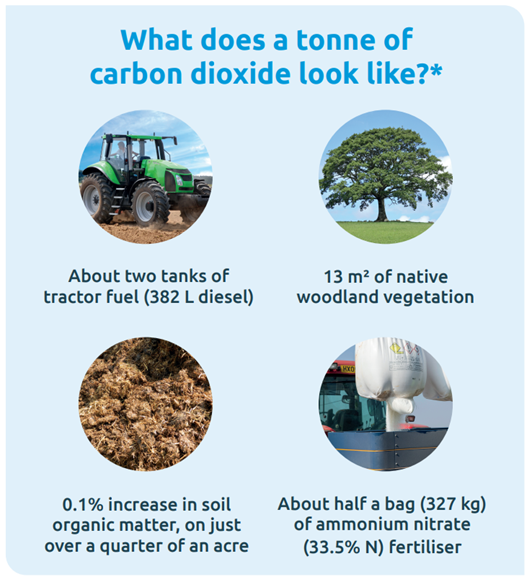

The exact amount of CO₂ emitted or sequestered by an activity will vary depending on many different factors. But here are a few examples of what it could look like:

- Using just under two tanks of fuel in a tractor

Based on a 200 L fuel tank and data from the Government’s Forest Research body on the CO₂ emitted by diesel when combusted (with 382 L diesel producing 1 tonne of CO₂) - 13 m² of native woodland

According to a Natural England report, a 100-year mixed native broadleaf woodland contains 203 t of carbon per hectare in just the vegetation. This is equivalent to 744 t of CO₂, meaning just 13 m² of woodland vegetation will have sequestered 1 t of CO₂ – and even more carbon will have been captured in the soil - A 0.1% increase in soil organic matter on just over a quarter of an acre

According to the Farm Carbon Toolkit, increasing the soil organic matter (SOM) of 1 ha by just 0.1 percentage points (e.g. 4.2% to 4.3%) can sequester 8.9 t of CO₂ per year (30 cm depth, 1.4 g/cm3 bulk density). This is equivalent to 1 t of CO₂ sequestered in just over a quarter of an acre (0.28 ac) - Making and using just over half a bag of ammonium nitrate (AN) fertiliser

Based on a 600 kg bag and using data from Fertilizers Europe on the emissions footprint for producing and using AN (33.5% N). By these figures, making and using 327 kg produces GHGs equivalent to 1 tonne of CO₂ (CO₂e)

Legislation in the Climate Change Act 2008 means that the UK and businesses within the UK have a legal obligation to cut their carbon emissions. To meet these mandatory targets, they have two choices:

- Reduce their own carbon footprint

- Pay someone else to cut their carbon usage

If a farmer is able to reduce or sequester carbon emissions, there is an opportunity to sell carbon credits, which are traded in systems called carbon or nature markets.

The Emissions Trading Scheme (ETS) is focused on UK industry and does not cover agriculture.

But where the compulsory scheme is linked to voluntary offsetting schemes, there may be opportunities for farmers. It is good to have a basic understanding of compulsory schemes as they are a significant part of overall carbon markets, and pricing on these markets may influence prices on the voluntary markets.

Why the regulated UK Emissions Trading Scheme could impact farmers in the future

Within the carbon market, there are regulated and unregulated schemes available for generating additional income for sequestering carbon.

In regulated markets, the Government establishes a regulatory body, which has the function of ensuring compliance within annual rules and limits. The regulator also determines the minimum price for carbon credits.

At present, the two main regulated voluntary schemes in the UK which affect land managers are the Woodland Carbon Code (WCC) and the Peatland Carbon Code (PCC).

To participate, you can:

- Assess your land’s potential for nature market schemes

- Register with relevant schemes, such as carbon credit providers or biodiversity net gain brokers

- Work with land agents, advisers, or organisations specialising in ecosystem services.

- Stay informed about government grants and private investment opportunities

In some cases, yes. For example, a landowner could receive payments for carbon sequestration and biodiversity net gain on the same land, as long as the services are not double-counted. However, rules vary by scheme, so checking eligibility is essential.

More information: Which nature-based scheme is right for your business?

Some nature markets, like biodiversity net gain, are regulated under UK law, while others, like voluntary carbon markets, are industry-led. It’s important to check eligibility, verification standards and contract terms before participating.

More information: Nature markets available

Not necessarily. Some schemes allow tenant farmers or land managers to engage, provided they have a long-term agreement with the landowner. However, contract terms and eligibility vary, so it's important to check the requirements.

What are farm tenants’ rights when it comes to carbon markets?

Continue reading about nature markets

Which nature-based scheme is right for your business?