- Home

- Markets and prices

- Dairy markets - Prices - Wholesale prices - UK wholesale prices

UK wholesale prices

Updated 25 February 2026

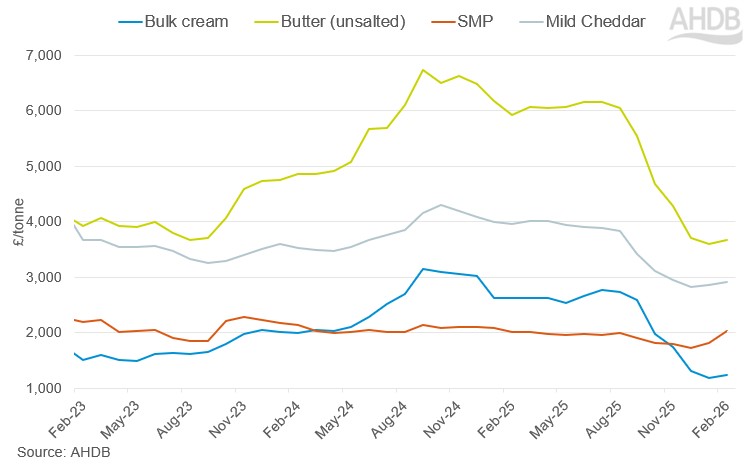

Indicative average prices for butter, skimmed milk powder (SMP) and mild Cheddar cheese on UK wholesale markets. Bulk cream prices are weighted average prices on agreed trades within the reporting period. Product specifications are available to download at the bottom of the page.

Overview

Green shoots of recovery or smoke and mirrors?

Weeks 5-9 (26 January 2026 to 28 February 2026)

The market seems to have turned a corner, at least for now. Despite continuously high milk supplies and product stocks market sentiment seems to have rallied as many speculative buyers were forced to cover positions. With the spring flush now firmly in sight it is too soon to tell whether this shift in direction will be substantive or purely sentimental.

Bulk cream prices have moved in a more positive direction after last months losses and have gained £64/tonne over the period to sit at an average of £1249/tonne for the period. Within that prices have moved overall upwards with some periods of wobble up and down. Although up slightly, prices are still suppressed by an over-abundance of milk and milk fat both here and on the continent. Compared to butter, cream is currently an under-valued commodity.

Butter prices have been described as overall quite flat despite some market volatility early in February with buyers securing product to cover short positions. Buyers not already covered have recognised the market has passed the bottom which has driven some short-term demand. Prices have been reported as competitive versus New Zealand product (although still more expensive than the US) which could unlock some export opportunities and support prices to some extent. The average for the period was £3,670/tonne, a modest rise of £70/t or 2%. The outlook remains constrained by strong milk volumes and high levels of stocks with some imports still coming in. Butter is at a considerable premium to cream which will spur more production.

Mild cheddar has remained quite quiet but also talk of relatively limited stocks given divestments of curd late last year with some trading houses maturing product themselves. Mild cheddar has regained £60 of value and sits at £2,920/tonne with some edging up over the past couple of weeks.

SMP continued its upwards movement following a positive start to the year with the month reported as “busy”. Price movements have not necessarily been linear with some bouncing occurring mid-month. With pricing being competitive globally, export demand is reported to be strong. Stronger demand, as reported last month, has continued with buyers now keen to secure volumes before prices rise further. However, there are reports of this being “trader-led” rather than end user. The average price for the period was £2,040/tonne, a rise of 13% which was the biggest seen amongst the commodities this month.

Table 1. UK Wholesale prices (ex-store)

| £/tonne | Feb-26 | Jan-26 | Feb-25 | |||

|---|---|---|---|---|---|---|

| Average | Range | Average | % change | Average | % change | |

| Bulk cream | 1,250 | n.a. | 1,185 | 5% | 2,626 | -52% |

| Butter | 3,670 | 300 | 3,600 | 2% | 5,920 | -38% |

| SMP | 2,040 | 460 | 1,810 | 13% | 2,020 | 1% |

| Mild Cheddar | 2,920 | 200 | 2,860 | 2% | 3,960 | -26% |

Source: AHDB

(prices refer to spot deals agreed between 26 January and 28 February 2026)

Figure 1. UK dairy product wholesale prices

Source: AHDB

Figure 1 shows average UK dairy wholesale prices, from the past three years.

The vertical axis shows price (£/tonne). Five lines are shown:

- Butter (light green, top line)

- Mild cheddar (grey, second line down)

- SMP (red, third line down)

- Bulk cream (blue, bottom line)

All prices slightly improved in February 2026 after showing steep decline since August 2025. Butter tracks continually higher than the other three while SMP improved the most.

Additional information

The published prices will not necessarily match the overall actual price achieved by a milk processor as this will depend, among other things, on the proportion of product that is sold on the spot market and the proportion sold under longer term contracts and at what price this is done.

The 'average' prices should be used to track trends while the commentary will contain prices seen through the month.

Note there has been a change in the methodology for determining the bulk cream price from January 2021.

Information on prices and market conditions is gathered through a monthly phone survey of dairy product sellers, traders and buyers.

Panel discussions cover ex-store prices on spot trades agreed within the reporting period and delivered within a maximum of 2 weeks for bulk cream and 6 weeks for butter, SMP or cheese.

For butter, skimmed milk powder (SMP) and mild Cheddar, prices are indicative of values achieved for spot trades and exclude contracted prices or forward sales.

For bulk cream, a weighted average price will now be reported. This is based on submissions of an average price for agreed spot trades made within the reporting period along with total volumes traded.

Data is entered by panel members via the AHDB online wholesale price portal.

Prices for bulk cream were not weighted by traded volumes prior to January 2021.

Download UK wholesale prices data

Further information

Product Specification - Bulk cream

Product specification - Unsalted butter

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.