- Home

- Markets and prices

- Dairy markets - Prices - Wholesale prices - EU wholesale prices

EU wholesale prices

Updated 18 February 2026

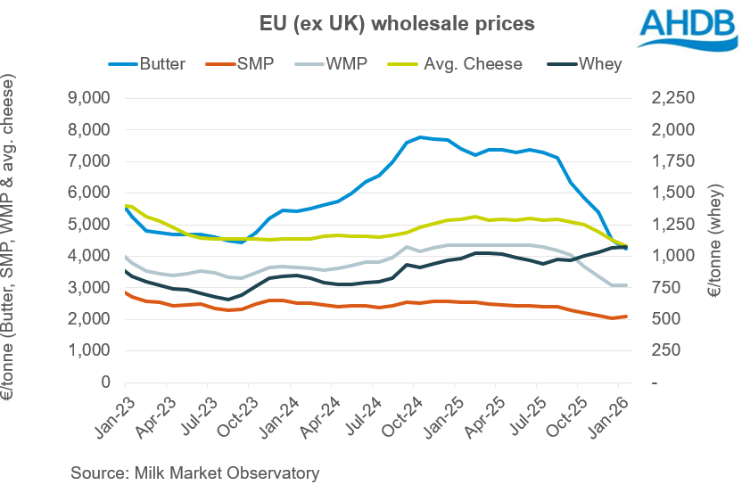

An overview of how the dairy markets are moving in the EU. Price series comparing average EU wholesale prices of butter, SMP, WMP and cheese. They are updated on a monthly basis.

Monthly overview

In January, wholesale price movements of most dairy products in Europe continued the downtrend (apart from whey and SMP, which recorded positive movement, showing signs of market recovery).

Milk production picked up in the second half of the year following late spring calving caused by bluetongue in the major producing countries like Germany, France, the Netherlands and Belgium.

Good economics, forage quality and favourable weather also supported the growth.

Butter prices saw another significant decline of 5.9% month-on-month. Butter supplies grew following higher production in the domestic market and globally, weighing on prices.

SMP prices increased by 2.9% month-on-month in January. Higher milk deliveries resulted in more production and stocks available, however, firm demand held up prices.

WMP prices were stable, having seen a marginal 0.1% decline month-on-month. Domestic consumption decreased and exports remained on the lower side due to lack of global competitiveness.

The average cheese price declined by 4.1% in January compared to the previous month. Cheddar saw a significant decline of 7.7% during the month, followed by Emmental, Gouda and Edam declining by 4.9%, 2.2% and 1.4%, respectively.

Table 1. EU (ex UK) wholesale prices

| Price (€/tonne) | Jan-26 | Dec-25 | Monthly change | Jan-25 | Annual change |

|---|---|---|---|---|---|

| Butter | 4,252 | 4,521 | -5.9% | 7,417 | -42.7% |

| SMP | 2,097 | 2,037 | 2.9% | 2,558 | -18.1% |

| WMP | 3,076 | 3,078 | -0.1% | 4,342 | -29.2% |

| Whey | 1,072 | 1,065 | 0.7% | 984 | 9% |

| Average cheese* | 4,338 | 4,525 | -4.1% | 5,184 | -16.3% |

Source: Milk Market Observatory

*Simple average Emmental, Gouda, Edam anmd Cheddar prices

Figure 1. EU (ex UK) wholesale prices

Source: Milk Market Observatory

The graph shows average dairy wholesale prices, from January 2023 to January 2026.

The vertical axis shows price (€/tonne). Five lines are shown:

- Butter (light blue, second line from the top)

- SMP (orange, bottom line)

- WMP (grey, middle line)

- Average cheese (green, top line)

- Whey (dark blue, second line from the bottom)

Additional information

Please note that prices can vary markedly within each market sector: the prices above are intended to give a guide to trends in price changes, but the absolute values experienced in the market place may differ from those shown.

As of 1 February 2020 the MMO changed its data reporting to EU (excluding UK), including historic data back to January 2016. For historic EU-28 prices up to Dec 2019, please download the spreadsheet using the link below.

Download dataset

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.