Flexitarian numbers decreasing, but challenges remain for meat and dairy

Friday, 7 July 2023

Meat, fish, or poultry-based meals accounted for more than half of all main meal occasions (57%) in the 52 w/e 19 February 2023, according to data from Kantar. However, over the last year these have reduced by 6% year-on-year.

Main meals that do not feature meat, fish or poultry have also dipped, but at a lower rate (-4%), meaning they have grown in importance. These meals account for a larger share of meals eaten in the home last year (43%), as well as when compared to pre-COVID, in particular for evening meals.

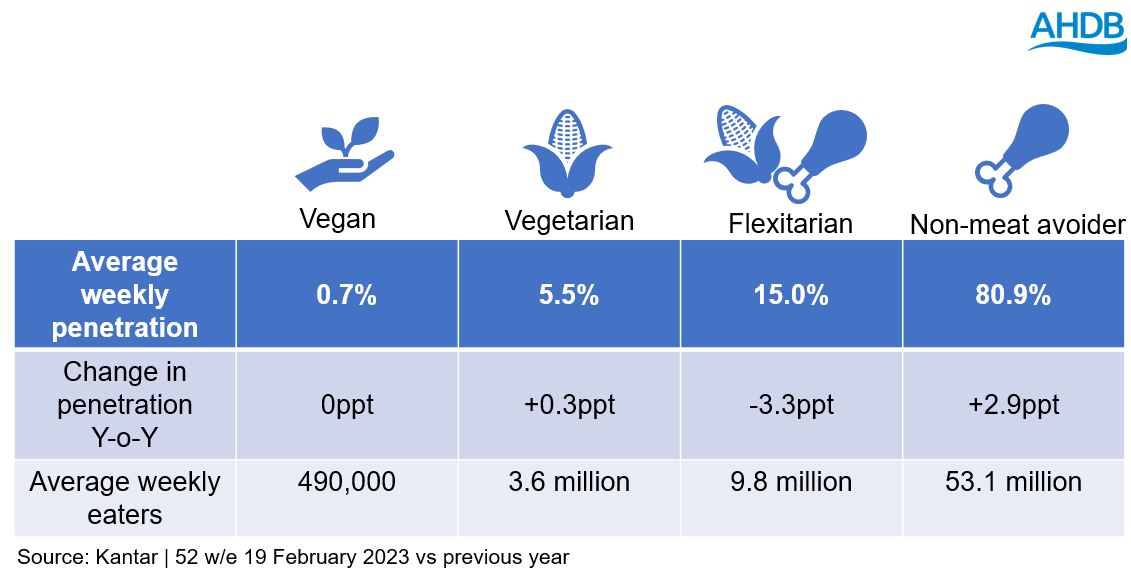

While the numbers of vegans and vegetarians have remained relatively stable, those classifying themselves as flexitarians or non-meat avoiders has seen some change (Kantar).

Figure 1: Infographic showing average weekly penetration of vegan, vegetarian, flexitarian and non-meat avoider meals vs the previous year

The number of consumers who identify as flexitarian (self-identified as reducing their red meat consumption) has decreased year-on-year. Those who see themselves as non-meat avoiders (consumers who don’t identify with vegan, vegetarian or flexitarian description) has increased year-on-year, accounting for the largest proportion of the market. This suggests that the number of meat-based meals consumed would also increase, but instead we are seeing an increase in meals not featuring meat, fish, or poultry.

Costs an important factor in unconscious meat reduction

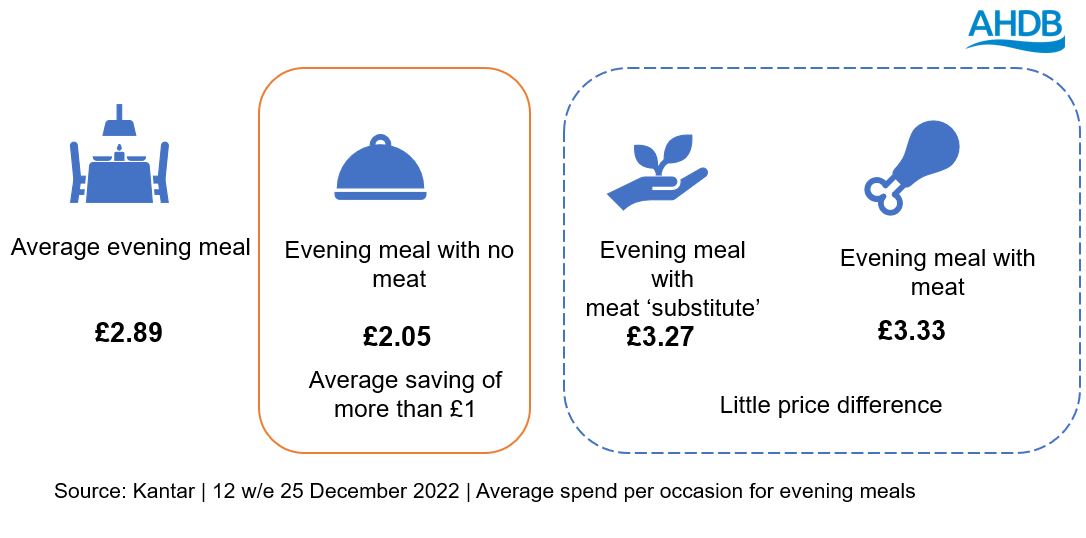

Historically, consumers have cited health as a reason for adopting a flexitarian diet. But costs are seemingly more influential in the reduction of meat-based meals for both flexitarians and non-meat avoiders alike.

For the first time in several years, meat-free products are beginning to lose shoppers. Instead, in an attempt to save money at mealtimes we are seeing the ‘non-meat avoider’ consumer reducing the number of main meals containing meat (Kantar, 52 w/e 19 February 2023).

Figure 2: An infographic showing average spend per occasion for evening meals

Trends continue to shift towards simpler meals which need fewer ingredients, as well as a smaller repertoire of recipes which is now at a five-year low. This coincides with consumers selecting meals because they ‘fancied a change’ at one of the lowest points in two years, highlighting that priorities at mealtimes are very much shifting away from variety and health towards being quick, easy and cheap. These groups of unconscious meat reducers were also present in a 2020 AHDB study.

Opportunities for red meat and dairy

Consumer needs can vary by mealtime, and opportunities for red meat and dairy should be targeted accordingly.

At lunchtime, quick and easy are the priority more than ever, and sandwiches lead the way in fulfilling many of these needs. Consumers are also looking for reassurance in their meals, with ‘fancied a change’ featuring less prominently when deciding on a meal than in previous years (Kantar, 52 w/e 19 February 2023). This offers ham and cheese products an opportunity, as their inclusion in sandwiches appeals to both flexitarians and non-meat avoiders.

For evening meals, Indian cuisine offers opportunities to red meat and dairy for non-meat avoiders and flexitarians. For flexitarians, biryani with lamb remains a taste driven choice. For non-meat avoiders, beef biryanis and baltis are chosen for enjoyment reasons. However, when yoghurt is added for flexitarians, enjoyment increases above that seen over the previous two years. This is driven by treat and reward motives, and highlighting meat and yoghurt in these terms is a key opportunity. Although some proteins may be more expensive, which consumers may shy away from, highlighting these as in home (and, therefore, cheaper) choices may sway some consumers towards them.

Summary

We have seen that meals not featuring meat, fish or poultry have grown in importance over the last year. This is not due to consumers pushing towards flexitarianism as seen last year, but is instead indicative of how consumers are struggling with rising food prices. Highlighting the taste and enjoyment aspects associated with meat and dairy products to all types of consumers is key to helping them engage with these categories.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: