Red meat opportunities for in home meals

Thursday, 16 March 2023

Last year was the first full year since the pandemic began where restrictions limiting people to being at home were not in place. Despite this, in-home eating occasions remained above those seen pre-pandemic. This may in part be due to the continuation of consumers working from home, but also to financial constraints associated with the cost-of-living crisis hitting the UK as COVID restrictions were relaxed. As a result, there has been an erosion of disposable income which appears to have negatively impacted socialising and eating out-of-home, and shifted consumers towards meals in the home.

Home-cooked family favourites win at mealtimes

Despite these changes, the top 10 lunch options have remained broadly in line with choices made pre-COVID. Lighter options such as sandwiches, soups, and toast-based meals take the top three spots and are particularly popular with post-family households.

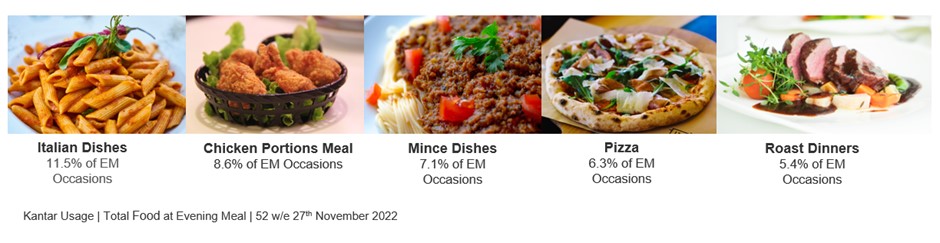

Evening meals, however, have moved away from protein-centred dishes like roasts, pies, and chicken portions, and moved towards cuisines such as Italian and Indian where family favourites remain key decision-makers.

Consumers prioritising speed and ease despite higher cost

While consumers are becoming increasingly aware of their budgets when it comes to mealtimes, there has been continued growth for convenience cooking over scratch and batch. This is despite convenience meals commanding a higher price point than other preparation types. We have seen that consumers are prioritising speed and ease when making meal choices; a trend which is anticipated to remain throughout 2023. According to latest Kantar data, the time taken to prepare an evening meal in the 52 weeks ending 27 November was at an all-time low, averaging 32.6 minutes, and lunchtime meals were down to just 15 minutes, back from 15.5 minutes in the previous year.

There has also been an observed simplification of meal occasions, with the desire for variety becoming less of a priority and a shift towards dishes with fewer ingredients becoming the norm. This not only has the benefit of reduced cooking times, but also of managing constricted budgets. On average, consumers are spending slightly more on lunches at home, while evening meal spend is holding steady on last year. This is below inflationary levels and indicates cutbacks are being consciously made for in-home mealtimes. However, a reduced repertoire and simplification of meals does not equate to less indulgence. Food selected for treat, enjoyment and taste reasons is at an all-time high, which red meat is well placed to deliver.

Red meat inclusion at home

Meat, fish, and poultry presence in meals has slowly been increasing and, whilst below the peak seen pre-COVID, at present feature in 50.1% of mealtimes up from 49.6% a year ago. However, red meat presence remains flat year on year (YoY) at 28.4%. So, what are the opportunities to grow red meat inclusion at mealtimes in 2023?

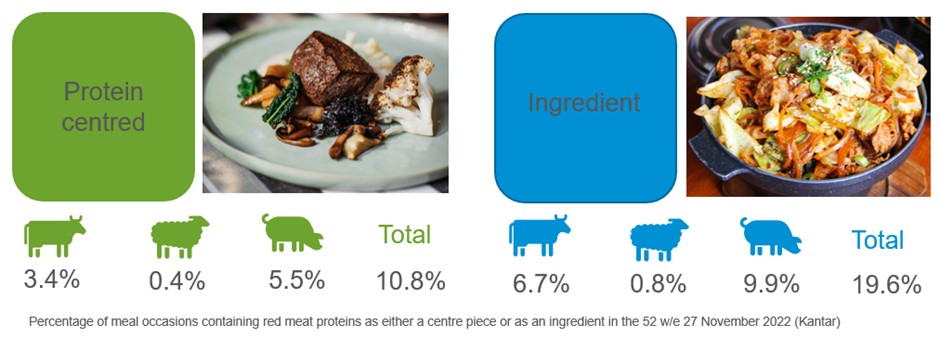

Primarily, red meat can feature in meals by two forms: as a centre piece, or as an ingredient. At present, centre piece proteins feature in 37.9% of mealtimes, back 5.8% YoY. Ingredient presence, however, has held steady and was included in 19.6% of mealtimes in the same period. Pressure from price rises may have influenced some consumers away from centre piece protein dishes and towards cheaper cuts where they are more often used as an ingredient than a focus for the meal. With the increased occurrence of home eating occasions consumers are looking to replicate cuisines and restaurant-style meals where frequently red meat features as an ingredient.

Taco Tuesdays and speedy burgers can offer a boost to beef

Beef presence has seen a steady decline at mealtimes over the last few years. While processed and added value beef presence continues to grow, primary beef, particularly when used as a centre piece, has been struggling. Beef roast dinner occasions are back 29% YoY and steak meals are down 26.8% in the 52 weeks ending 27 November 2022. Burgers, however, bucked the primary beef trend by showing growth in this time. They have proved popular with consumers 25-34 and 65+, both up 1.2 percentage points (ppts) by fulfilling the need for quick-to-prepare meals.

Mexican has also proved an important emerging area to support growth for primary beef. In the 52 weeks ending 27 November 2022, 5.7% of beef meal occasions were Mexican, up 0.3ppts year on year. Chilli and tacos have helped drive this, with a shift away from chicken towards beef mince usage in this cuisine proving particularly popular with affluent female consumers, where they account for 51.5% of consumers. Targeting younger consumers by promoting ease, speed and taste of ‘exotic’ dishes found in cuisines such as Mexican could be a key opportunity for beef.

Treating and pester power proves helpful for lamb

Lamb has a smaller presence in mealtimes compared to other red meat and has eased back a further 0.2ppt compared with last year. This was notable among less affluent families where the inclusion of lamb in centre piece meals became less common, and so lamb presence was reduced to around 1% of meals in the 52 weeks ending 27 November 2022. There was a drop in classic lamb centre pieces such as chops and mince-based dishes, however roast dinners saw market share growth compared with 2021 and 2019, up 2.8ppt and 4.1ppt respectively. Treating behaviours and pester power, particularly from 16-24 year olds, accounted for much of this gain, as did seasonal synergies whereby the right time of year played a part in lamb being selected as a centre piece meal.

Outside of roast dinners, Indian dishes are a key area of growth for lamb being used as an ingredient, especially in pre-families. For similar reasons as for roast dinners, lamb fulfils a treat element within Indian cuisines, and particular growth has been seen in pre-family and less affluent consumers who account for 60% of in-home Lamb Indian dishes, up from 36% last year. Targeting lamb on a budget with cheaper cuts or pushing scratch cooking for cuisines such as Indian could, therefore, be a real opportunity.

Practicality of pig meat sees potential gains for processed products

Pig meat presence at mealtimes has seen continuous gains in 2022, with 0.6ppt growth year on year. This recovery is predominantly down to an increase in processed pig meat being included in lunch and dinner, as classic centre pieces such as sausage and chops are seeing dips compared with pre-COVID levels. Gains can be seen with cooked meat meals, such as alongside scrambled egg meals and ham, egg, and chips. These styles of dishes are considered easy to prepare and tasty. Salads and sandwiches remain popular lunchtime dishes, and the inclusion of sliced meats like ham are at a record high. This is largely due to practicality, ease, and speed, however there is growing focus towards indulgent behaviours, such as ‘fancied a change’. Sliced meat offers a treatiness to these meals and results in over indexing on enjoyment. Opportunities for sliced meat can play on this treatiness and desire for ‘a change’, by offering options such as honey roast, oak smoke, and maple glazed to classic sliced meats.

Aside from cooked sliced meats, there is real opportunity for primary or added value pork in East Asian cuisine, led by sweet and sour and Thai dishes. When targeting this area, highlighting pork as a variety option is key as 31.1% of pig meat oriental dishes are chosen because consumers fancied a change. Opportunities include featuring marinades, especially for frying/grilling steak and diced and cubed pork.

How red meat can capitalise on opportunities available for in home dining

There is real opportunity for red meat growth if they can align to emerging consumer needs for meals which are quick and easy to prepare, as well as managing budgets in tough economic times. Highlighting how certain cuts can be included in popular cuisines, such as Italian, Indian, and Mexican, can help consumers recreate restaurant-style meals at home could help boost sales, as well as indicating how red meat is well-placed to add variety, taste and treatiness to mealtimes.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: