Flexitarians are back on the rise as Covid wanes

Friday, 27 May 2022

Prior to the pandemic claimed meat consumption was declining amongst the British population. The ongoing disruption of Covid put a brake on this trend as the numbers of “flexitarians” or those consciously reducing their meat and dairy consumption actually fell. We look at how this has changed as normality has returned and what may happen moving forwards.

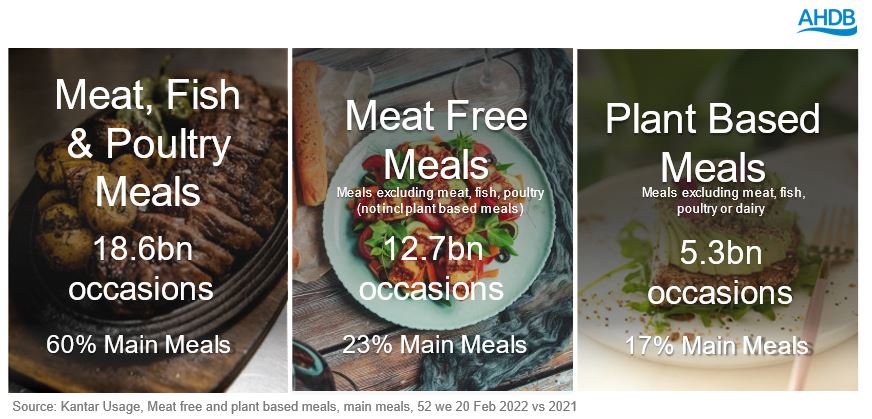

Typically main meals cooked at home are dominated by meat, fish and poultry with 60% of all main meals occasions including these proteins according to Kantar. Vegetarian meals that include eggs or dairy made up 23% of all main meals whilst plant-based meals make up only 17% of main meal occasions. All at-home meal types have been in growth since pre-Covid – meals including meat, fish and poultry are up by 8% compared to 2020 whilst plant-based meals are up by 15%. This is due to more ongoing working from home compared to pre-pandemic. Meals that are meat-free often tend to be simpler and quicker to prepare – pasta or pizza or beans on toast. This also means that the average costs per portion is lower, costing 77p versus £1.85 for one containing meat, fish or poultry according to Kantar.

Return to normal?

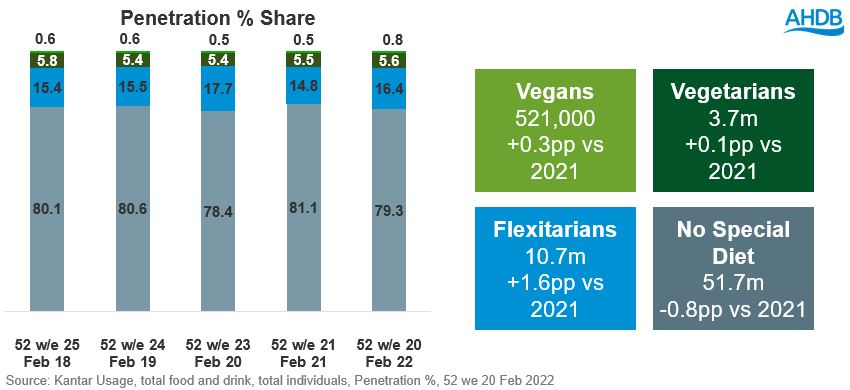

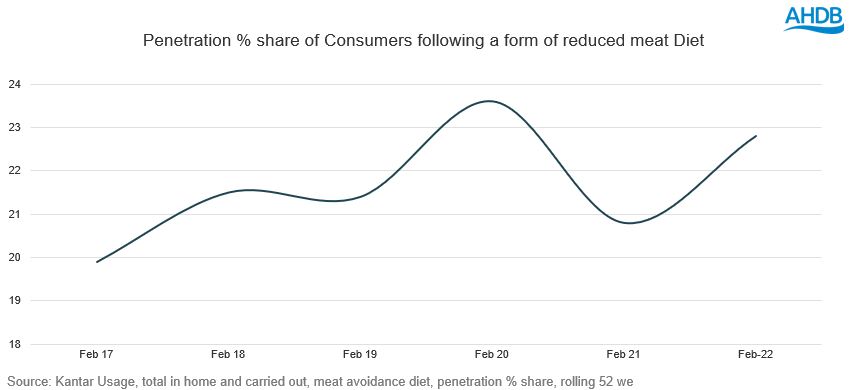

23% of consumers now claim to be following some form of meat reduction diet – up by 2%pts on a year ago. This is not quite back to pre-pandemic levels yet although heading in that direction. 16% of British consumers are flexitarians (up by 1.6%pts versus 2021), 5.6% are vegetarians (flat over time) and only 0.8% are vegan (up by 0.3%pts). Therefore, although conscious reducers remain a small minority they have gained share of the total population versus a year ago, mainly driven by flexitarians.

Interestingly, the uplift in flexitarians is really a recovery as the numbers trying to reduce meat consumption declined during the Covid restriction periods and are only now recovering to early 2020 levels.

Waverers remain the critical group to target

Health has returned as a key motivator for eating habits. It saw a dip in 2021 but is now back to Feb 20 levels with 28.3% food occasions chosen for health according to Kantar.

Flexitarians, who tend to be more health conscious consumers (8% more likely to be concerned about health than the average consumer according to Kantar), are therefore a key demographic. They can be found all over the country although tend to over-index in London, and slightly over-index in young adults and retirees. Health is a prime motivator here accounting for over half of why people claim to be reducing their meat consumption. We know from other studies including our AHDB/YouGov tracker that environment also plays a key role.

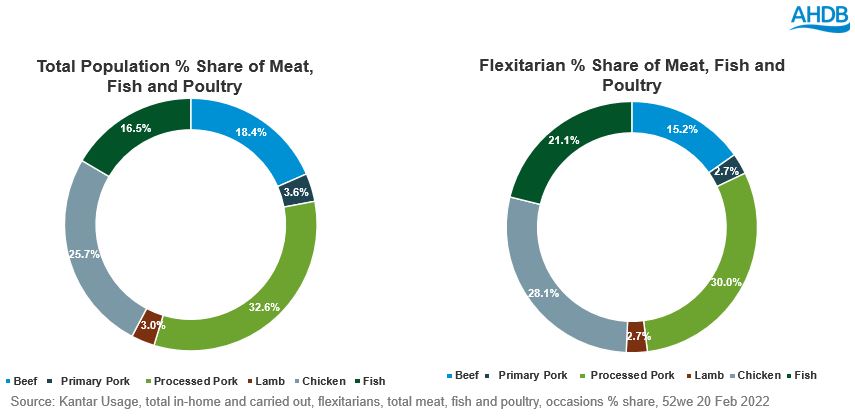

Flexitarians under-index in all proteins apart from fish compared to non-meat avoider consumers. Looking at their share of overall protein consumption, while they eat little fresh pork, processed pork makes up 30% of their consumption. Chicken is also an important protein for them accounting for 28.1% of their consumption and beef makes up a further 15.2%.

The key health needs that flexitarians are looking for are actually areas where meat and dairy can play a role. 16.7% of their food is chosen for the health benefits such as vitamins and 9.3% because it is more natural or unprocessed. Highlighting the benefits of meat including B12 and other specific nutrients and also the less processed nature of primary meat is a good way to appeal to this group.

Beyond health, other need states are also on the rise for flexitarians. Enjoying the taste is always the primary driver of any food choice and choosing food because they enjoy the taste has risen for flexitarians in the past year, with 63% now chosen for enjoying the taste – up by 2.1%pts from the previous year. ‘Filling’ and ‘Makes the meal complete’ are also needs that have risen and that plays well to meat and dairy’s strengths.

Implications for the flexitarian audience

Beef

Compared to the pre-pandemic picture of two years ago, flexitarians are consuming fewer cuts like roasting joints, mince and steaks. However, burgers and grills and also marinated products are growing suggesting there is scope to keep them in the category with more added value options.

Pork

Similarly to beef there has been a switch towards added value products such as marinades and sous vide. However, mince is the notable exception with health-conscious flexitarians boosting their consumption of pork mince that offers a low-fat alternative to some other proteins. Roasting is also up. Conversely they are consuming less sausages, bacon, ham and belly pork.

Continuing to position pork as a healthy option is a good strategy for this group.

Lamb

Lamb makes up a very small part of flexitarian protein consumption but there has been a shift away from fattier cuts such as mince towards steaks and marinades. There may be some scope to try to re-engage flexitarian consumers in lamb by providing inspiration on cuisines such as Indian which are commonly eaten by flexitarians. Highlighting lamb’s credentials as good quality, higher welfare options may also be attractive to this group.

Dairy

Dairy consumption has risen amongst flexitarian consumers with dairy’s share of flexitarian eating occasions rising from 57.2% to 58%. This was largely driven by growth in milk but also butter and cheese. Butter and cheese plays a role in some of the top flexitarian dishes such as cheese sandwiches and pasta dishes.

Conclusions

The large majority of UK consumers aren’t looking to make any radical changes to their diet. However, whilst numbers following more restrictive diets such as vegan and vegetarian are stable, over time there are a growing number of people trying to limit their meat consumption. This leads to more consumers becoming lighter consumers of meat which has the potential to erode volumes over time. The biggest wins, therefore, is in reassuring this audience of the health, sustainability and welfare credentials of red meat and dairy and the role they can play in a truly balanced diet.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.