Easter supermarket spend hits record high

Tuesday, 28 May 2024

Easter remains a popular occasion for British households and is a great opportunity for meat and dairy sales to spike as families load up their fridges with lamb and splash out on chocolate goodies.

£100million was spent on Easter Eggs and confectionary in the week leading up to Easter this year, the highest spend ever seen in the UK! While higher prices played a role in this record spend, the number of chocolate eggs sold in the 7 days leading up to Easter Sunday increased by 3% on last year, and over a third of shoppers purchased at least one egg that week. Hot cross buns proved to be even more popular, with 45% of Brits treating themselves during the Easter week (Kantar).

Meat, fish, and poultry (MFP) proved ever popular this year, seeing both volume and value growth. The average household spent £36.60 this Easter on MFP alone, up 4.3% on Easter 2023 (Kantar, 2 w/e 31 March 2024). When compared to an average two weeks for the rest of the year, households spent an additional £4.25. And while price increases will have contributed to this growth, there was also a 2.2% increase in volumes purchased, highlighting the important role that MFP plays in how households celebrate the early festive holiday.

Lamb leads the way

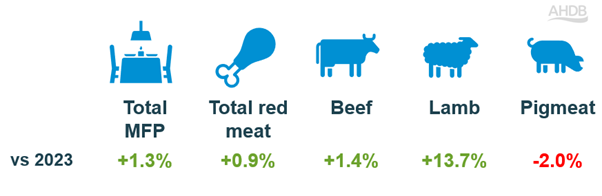

We had predicted another bumper Easter for lamb this year, and unsurprisingly, lamb saw the best performance of the MFP category.

MFP and red meat performance at Easter 2024

Source: Kantar | Total MFP | Volumes | 2 w/e 31 March 2024

This win was due to volume growth year-on-year (+13.7%), but also because lamb was almost three times more likely to be purchased compared to an average 2-week period for the year (Kantar, 2 w/e 31 March 2024).

An Easter roast remains a popular choice for the big Easter meal, and this strong lamb performance was driven mainly by roasting joints, as volumes purchased increased by 24.1% year-on-year and accounted for almost three quarters of all lamb sold (2w/e 31 March 2024). Roast lamb benefitted, as a significant number of consumers swapped into the category from all other main cuts and proteins, including those much cheaper, such as chicken wings, legs, and thighs. As a result, lamb roasting gained almost 300,000 new shoppers compared with Easter 2023. It is therefore clear that shoppers value the tradition of Easter and its association with lamb, and are willing to treat themselves on special occasions, despite financial pressures.

Roasts reign at Easter celebrations

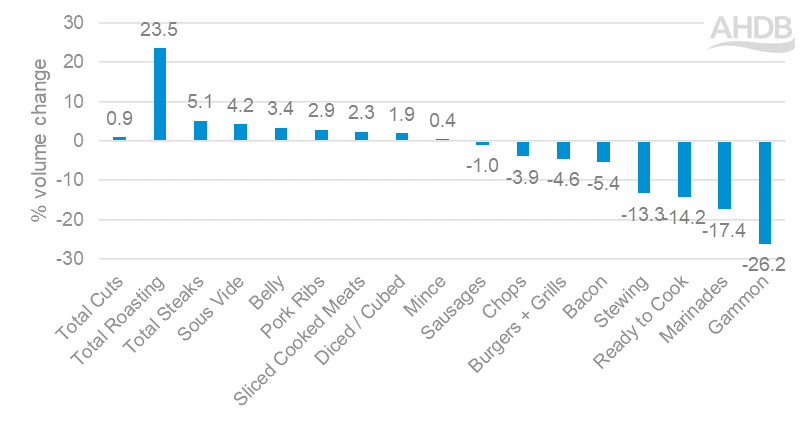

It wasn’t just lamb roasting joints that saw good performance this year, as from an MFP perspective, total roasting saw the largest year-on-year increase in volumes purchased out of all cuts, up 23.5% (Kantar, 2w/e 31 March 2024).

Overall, MFP was seen to outperform an average 2-week period over Easter, and while Lamb was very much the star, beef purchases also saw a 4.1% uplift. Pork was the only red meat to see a dip in performance this year. This was driven by a reduction in shopper numbers year on year, as pork saw shoppers switching into all other proteins. As a result, key cuts such as Gammon saw volume sales down by 26.2% year-on-year, and sausages and bacon also saw sizeable declines.

BBQ products were also hindered, with Easter falling early this year, and the cold and unsettled weather making most people look to move their celebrations inside and towards more cosy, traditional meals. As a result, marinades, burgers and grills, and sausages for all red meats saw volume declines this year, while cuts which are more likely associated with kitchen cooking such as steaks, sous vide and diced red meat saw volume increases.

Performance of red meat cuts at Easter 2024 vs Easter 2023

Source: Kantar | Total red meat | 2 w/e 31 March 2024

Retailers draw in shoppers with promotions

While the total market saw volumes of red meat sold increase year-on-year, supermarkets and discounters were the channels to see volume growth. Notably, it was butchers that were unable to maintain the strong performance they had experienced at Christmas 2023.

Butchers saw almost a fifth less sales of red meat than Easter last year (Kantar, 2w/e 31 March 2024). This isn’t the first-time they have struggled at Easter, and long-term declines have been apparent in data going back to 2019. So why do we see this reduced performance for butchers for a seasonal event which has such strong ties with red meat?

In recent years, where price has been at the forefront of shopper minds, the inability for butchers to compete on price with supermarkets has likely contributed for this drop in demand. This Easter, butchers charged on average £1.65/kg more than the total market for red meat, and their promotions tended to be limited and less well publicised than other retailers. Price isn’t always going to be top of mind for consumers, and that is when key reputational topics of health, environment, Britishness, and welfare will become a higher priority for consumers. Butchers should publicise the credentials of their meat, and their expertise to remind consumers why they should shop with Butchers. Of those who have shopped at a butcher, 68% say they choose to buy meat from a butcher because of the quality, followed by wanting to support local businesses (60%) (AHDB/YouGov, Nov 2023).

On the other hand, supermarkets replicated the successes they saw at Christmas, and many were seen to adopt strong promotional activity with temporary price reductions, particularly around key cuts, such as roasting joints, this Easter. This resulted in almost all retail channels seeing volume growth for red meat when sold on promotion.

Overall, promotional activity was seen to increase for red meat products this Easter compared to the rest of the year, and this resulted in increased spend for all of the red meats. However, lamb was the only red meat to see non promotional related growth, highlighting the importance that promotional activity has for driving sales within the red meat category.

Key recommendations for Easter 2025:

- Easter falls much later in 2025, towards the end of April. This means weather is likely to be better than we have seen the last couple of years, so outdoor dining could be back on the menu for celebrations. BBQ products should therefore be considered and included in promotional activity

- Promotions were once again strong this Easter and proved to be an effective driver of sales. We have seen the benefits of promotion in lamb performance, and retailers should continue to support these promotions and perhaps consider expanding to outside that of roasting joints to boost sales of other lamb products.

- While less popular than lamb, there are opportunities to grow beef and pork sales, particularly through non-traditional cuts. Over the last year, marinades and other added value products have gained popularity with shoppers, and while this was not seen this year, these products could work well for later Easter celebrations for beef and pork cuts.

- There are similarities with those who shop at premium retailers and those who shop with butchers. This presents an opportunity for butchers to win shoppers back through highlighting more competitive pricing for key cuts than seen at premium retailers, as well as indicating any key sourcing or premiumisation messaging that can be made which we anticipate will become more important to shoppers.

Note – Easters are compared to equivalent Easters in previous years due to the event moving on an annual basis. Easter 2024 refers to 2w/e 31 March 2024, Easter 2023 refers to 2w/e 9 April 2023.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: