Christmas 2023: A Christmas cracker for meat sales

Thursday, 18 January 2024

This Christmas saw a record £13.7bn spent during the month of December and in the lead up to the big day, both total grocery spend and pack volumes grew by 7% and 2% respectively Year-on-Year (YoY), according to Kantar. Whilst inflation is slowing, consumers are still mindful of the cost-of-living. Therefore, promotional activity was key to retail sales this festive period, as expected in AHDB’s Christmas predictions.

During the 2 w/e 24 December 2023, spend on total meat, fish and poultry (MFP) grew by 11.6% YoY with inflation driving some of this increase (Kantar). However, volumes also grew by 6.4% over the same period versus Christmas 2022, largely driven by an increased frequency of shopping trips. This may have been due to shoppers visiting more stores to find the best value for money products, as well as people spreading the cost of Christmas dinner with family members leading to more people shopping (IGD).

Across the red meat category, total volumes for each protein performed well with YoY volume growth outpacing that of total grocery. With cost pressures still at the forefront of consumer’s minds, it was surprising to see demand for all the trimmings increase YoY, with chilled gravy volumes up 11% over this period (Kantar). Total turkey was also the only protein in the MFP category to see volumes down on pre-Covid levels. Could this mean the image of a traditional Christmas dinner with turkey as the centrepiece is slowly fading?

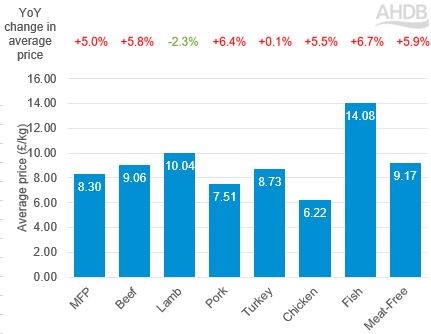

Demand for meat centrepieces grew this Christmas

Source: Christmas cuts MFP - Kantar, 2 w/e 24 December 2023

Turkey is still the UK’s favourite roasting joint at Christmas with 56% of shoppers preparing it according to IGD. Looking at cuts specifically, whole turkey and crowns/joints accounted for 7.5% of total MFP volumes and 31.9% of Christmas centrepiece volumes in the two weeks to Christmas. Meanwhile, whole chicken was the only cut to see volumes decline YoY.

Pork roasting joints (£6.05/kg) and gammon (£6.48/kg) are also the next cheapest roasting cuts available, perhaps explaining the strong YoY growth in retail volumes especially when compared to Christmas 2019. This may explain why gammon is the second most popular MFP roasting joint, behind turkey. Sausages and bacon volumes also saw growth.

Both beef and lamb roasting joints saw strong performance which drove most of the YoY growth across the total beef and lamb categories. For lamb, this growth came as 69.6% of roasting joints were on promotion in the two weeks leading up to Christmas which caused a 4.0% decline in prices compared to last year.

Total protein performance

Sales of poultry drove the YoY increase in MFP volumes, with both total turkey and total chicken seeing YoY increases of 16.4% and 6.1% respectively in the 2 w/e 24 December 2023 (Kantar). This outpaced growth in demand for red meat. For total chicken, this strong performance across the category can be explained as it is the cheapest protein, averaging £6.21/kg so is favourable for consumers looking to limit their spending. However, total turkey volumes remain lower than pre-Covid levels and the YoY rise in demand may be due to a return to more normal levels following the Avian flu outbreak limiting supply in 2022. This would explain the large YoY increase in volumes switching from other proteins to turkey (+385.9k kgs), gaining large volumes from beef for the 4 w/e 24 December 2023.

Despite its higher average price, total beef volumes grew by 2.8% YoY for the 2 w/e 24 December 2023. Whilst total beef gained shoppers overall, it was the only red meat to see switching volumes decline overall (-428.8k kgs), with most volumes switching to pork, but also to turkey and chicken. However, beef volumes gained overall through existing shoppers buying more as well as new shoppers buying into beef.

Total lamb saw a 17.3% YoY rise in volumes, which all came from fresh lamb, specifically roasting joints as mentioned earlier.

Whilst pork was the only red meat to have lost shoppers through switching to other proteins, those who did buy pork bought more of it, resulting in total pork volumes growing by 3.7% YoY.

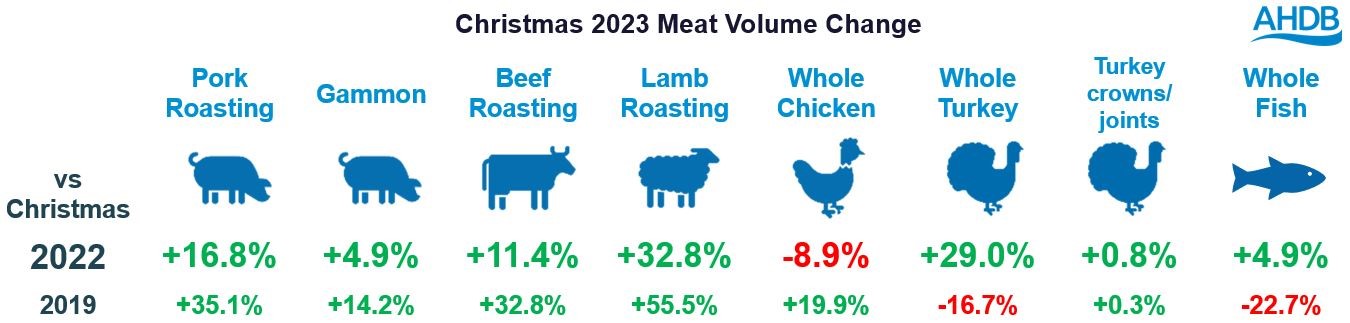

Year-on-Year change in average prices for each protein

Source: Kantar, 2 w/e 24 December 2023

Meat-free volumes fell by 12.6% this Christmas as it remains a more expensive choice and its YoY price rise has outpaced that of most other proteins. This mirrors the falling demand seen recently as people turn to meatless meals to save money, not by increasing their consumption of meat-free products but by eating more carbohydrates and cheese (Kantar).

Tiered products and retailer performance

Whilst consumers are still mindful of the cost-of-living, AHDB’s most recent consumer tracker indicates household finances have plateaued with fewer households seeing their finances get worse (YouGov). Christmas is also a time for indulgence, hence why in the 2 w/e 24 December 2023 we saw premium MFP volumes grow 13.6% YoY, particularly driven by increased demand for premium pork and turkey products. However, the majority of this growth did not come from roasting joints and whole cuts. This shows when cost pressures remain, consumers are more likely to spend more on all the MFP trimmings, perhaps trading up for these products as they are less expensive overall compared to the Christmas centrepiece. Premium own-label offerings performed particularly well as retailers looked to offer value for money in a bid from retailers to gain business, according to Kantar.

Value tier volumes remained relatively stable, although these only make up a marginal proportion of total MFP sales. However there was a big increase in economy roasting sales, up 40.7% although from a very small base. More notably, the standard tier continues to dominate the market, with volume sales accounting for 85.5% of total sales in the 2 w/e 24 December 2023. Notable YoY volume increases were seen for standard-tier whole turkey, lamb and gammon products, with beef roasting joints also seeing large increases with some volumes switching from the premium tier. For both turkey and beef roasting joints, this increased demand is likely related to the large volumes on promotion at 35.5% and 49.2% respectively which caused the average price to decline YoY for both cuts, which was also the case for lamb roasting joints as mentioned earlier.

All major retailers saw YoY MFP volume growth in the 2 w/e 24 December 2023 but the traditional top 4 outperformed the discounters seeing growth of 9.8% versus 7.4% respectively. With the top 4 offering large discounts in the lead up to Christmas this is not surprising, as people were once again swayed by deals. Whilst consumers were slightly more frivolous with their overall spending this Christmas, the hard discounters saw a 3.0 percentage point YoY rise in household penetration (38.2%) once again showing that some shoppers remain cost conscious. Discounters also continue to see the biggest change since before covid with volumes up 29.2% versus Christmas 2019. Butchers also had a positive Christmas with YoY volume growth of 3.9%.

AHDB’s update on dairy’s performance over the festive period is coming soon. Our projections for 2024 will be included in the next update of the Agri-Market Outlook in early February.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: