Summer 2023: BBQs took a hit as sunshine hours lower in August

Wednesday, 22 November 2023

This summer (16 w/e 3 September 2023) was a tale of two halves, with soaring temperature in the early part of June yet a wet July and August. Average sunshine hours hit a four-year low in July, which had significant impacts on consumer eating habits, particularly BBQs.

Eating out and takeaway occasions increased since last summer, indicative of wider consumer trends prioritising convenience, but have still not recovered to pre-pandemic levels. They were also impacted by the weather, with eating out occasions peaking in June with the good weather, and more occasions moving into the home during the duller August.

Meat, Fish and Poultry (MFP)

Taste remained the highest ranked need this summer, reaching a five-year high in importance to the consumer (Kantar, 16 w/e 3 Sept 2023). The majority of MFP occasions remain firmly within the evening meal, although lunches have increased in overall importance since the pandemic. We see growth in servings picked for their practicality, driven by the need for the meal to be filling, alongside increasing influence of pester power from children or a partner (Kantar, 16 w/e 3 Sept 2023).

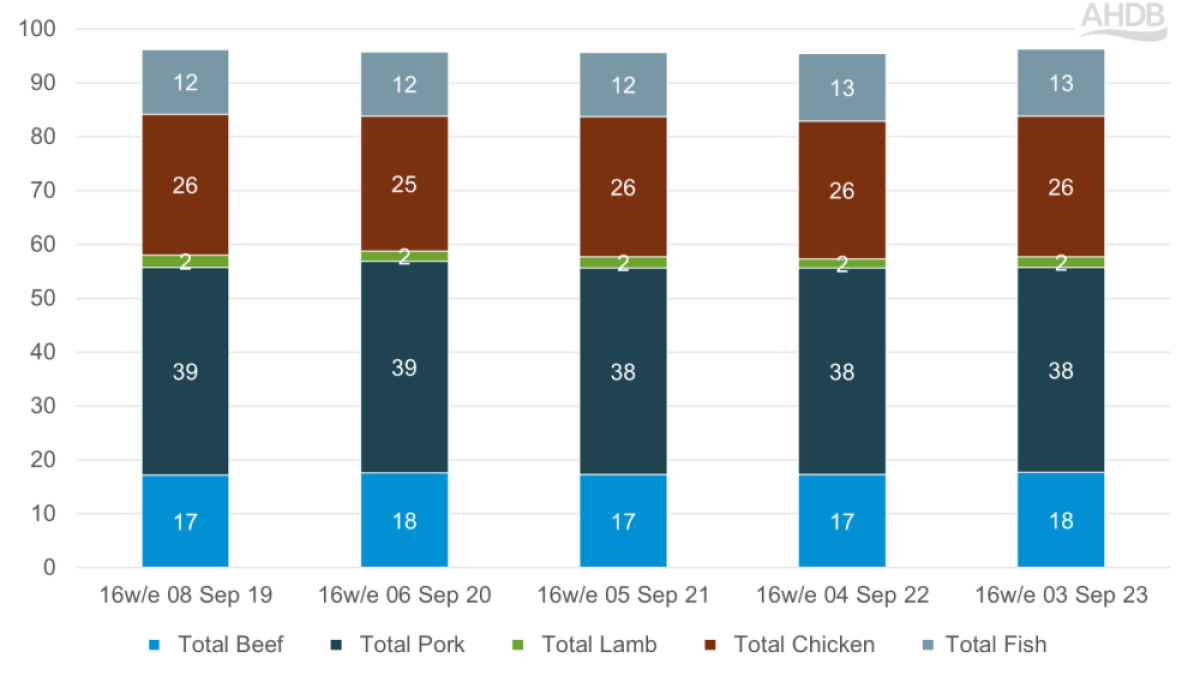

% share of total MFP servings

Source: Kantar Usage | Total MFP | 16w/e 03 September 2023

Pork dominates the market in summer

Pigmeat takes the greatest share of total MFP servings over the summer, a trend we have seen consistently over the last five years. The importance of sausages grows over the summer, owning just over one fifth of all pigmeat occasions (Kantar, 16 w/e 3 Sept 2023). They are considered a budget friendly cut and are gaining shoppers, switching from protein sources with a higher price point.

Pigmeat scores highly with consumers for taste and speed of preparation and saw a five year high in scores for treat or reward. This may present opportunities for growth particularly at breakfast time and snacking, where pigmeat can provide a tasty treat.

Budget beef cuts important for consumers

Beef saw an increase in consumption compared to last summer, driven by young families, families with children aged 10+ and older dependants, with all categories showing increases of over 10% in consumption (Kantar, 16 w/e 3 Sept 2023).

Looking at the different cuts, burger and grill occasions saw a 26% uplift this summer, compared to pre-pandemic numbers in 2019 (Kantar, 16 w/e 3 Sept 2023 vs 2019). However, volumes for fresh and frozen burgers have declined by 5.4% year on year, a greater decline that we saw in the wider beef category, which was down 2.2% on last year (Kantar, 52w/e 3 September 2023).

Beef steaks and roasting joints have seen large declines, down 33% and 37% respectively, when comparing this summer to the same period in 2019 (Kantar, 16 w/e 3 Sept 2023 vs 2019). This can be attributed to trading down behaviours as consumers feel the squeeze of the cost of living. In light of this, mince remains an important cut due to its affordable price point and versatility, with the greatest share (30%) of beef occasions this summer (Kantar, 16 w/e 3 Sept 2023).

Increases in lamb consumption as consumers recognise the health benefits

Lamb showed the greatest increase compared to both last summer and the total MFP category, with consumption occasions up 17% on 2022. This was particularly driven by increased engagement in young families and growth at lunch occasions (+7.3 million occasions vs 2022) (Kantar, 16 w/e 3 Sept 2023 vs 2022). Year round we see that 79% of primary lamb volumes was made up of shoppers aged over 45, so this drive in younger consumers over the summer indicates good potential for future growth of lamb if it can be maintained.

The primary motivation for serving lamb remains enjoyment (claimed just under 80% share of servings). However, this year we have seen lamb more likely to be chosen for its perceived health benefits compared to 2022, with consumers citing themes such as “naturalness” and “varied diet”. Despite this, lamb is viewed as less easy to prepare than other MFP, showing the importance of meal inspiration and clear cooking instructions on labels and in store.

Dairy products selected for enjoyment

A greater proportion of consumers selected enjoyment as a reason for choosing dairy this summer, in comparison to pre-pandemic. Breakfast is the key mealtime for dairy products within the summer period, accounting for 40% share of consumption occasions (Kantar, 16 w/e 3 Sept 2023). The summer recorded occasions rose for milk (+2% YOY) and cream (+8% YOY) however we did see declines in cheese (-3% YOY) and yoghurt (-2% YOY). Butter consumption also declined (-2% YOY), whereas there was an increase for margarine (+5%YOY), potentially indicating switching behaviours being utilised as a cost saving method.

BBQs

This summer there were 64 million BBQs, the equivalent of one BBQ per consumer in the 16 w/e 3 September 2023 (Kantar Usage). This is a five-year low, a decrease of 15% on the same period last year, and down 28% on the highs seen in the summer of 2020 (Kantar, 16 w/e 3 Sept 2023 vs 2022 and 2020).

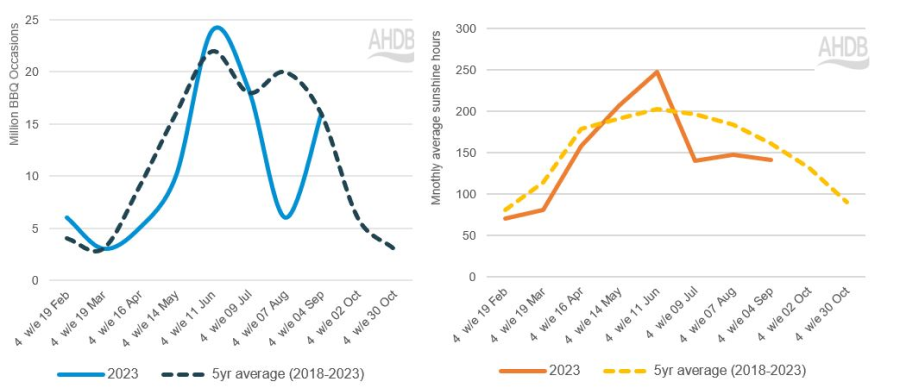

BBQs heavily affected by weather

Consumer views reiterated the importance of seasonality of BBQs, with taste and right weather taking the top two spots on reasons for a BBQ occasion. Therefore, it not surprising that we saw an early peak for BBQs in May and June, before occasions plummeted in the poorer weather of the school holidays, and then recovered slightly into September.

BBQ occasions versus sunshine hours

Source: Kantar Usage | BBQ Occasions (excl. takeaway) | 4w averages w/e 03 Sept 23

Changes to gathering size at BBQs

Another key reason for the decline in BBQ occasions has been the types of gatherings consumers are choosing to BBQ at. Small gatherings (2-4 person occasions) struggled, down 11.1 million occasions on the same period last year. However, gatherings of 5+ increased by 20% year on year, although this only accounts for an additional 1.7million occasions (Kantar, 16 w/e 3 Sept 2023). As such, it appears that this year BBQs are less likely to be used as a cooking method for an everyday meal, and more likely to be used for a planned gathering or party, possibly providing a cheaper alternative to eating out of home.

Product choice at BBQs is changing

We also saw change in what was being cooked at BBQs, with reductions in both total MFP and red meat. Breaking it down, this summer recorded declines in share for beef alongside small uplifts for lamb and fish and some upwards movement for chicken. However, these losses in MFP didn’t appear to be movement into meat alternatives or vegetables, and we instead saw share growth in bread buns and salads.

Classic BBQ cuts of burgers, sausages and steaks all had year on year consumption declines, however, treat and fancied a change scored highly on consumer reasoning, indicating that red meat BBQs fulfil an indulgent moment and that feeling of a special occasion.

Recommendations for next summer

- Ensure good availability of classic red meat BBQ choices, with marketing emphasis on their great taste and treating potential.

- Safeguard against poor weather by pushing products that are suitable for both oven and BBQ cooking.

- Provide inspiration for the consumer at point of sale (online or in store) around how lamb and other red meats could be cooked on BBQs and in other summer meals to drive growth.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.