Summer staples sausages and burgers see mixed performance

Wednesday, 22 November 2023

Pork sausages and Beef burgers can be recognised as a staple across many plates in British households. However, within the current competitive market how are they performing?

Pork Sausages

According to the most recent Kantar data pork sausages account for 18.2% of the total pork category. They are closely followed by sliced cooked meats (17.3%) and bacon (16.1%), making them key competitors for sausages within the pork category (Kantar, 52 w/e 03 September 2023). Sausages saw volume growth of 2.1% year-on-year (YOY), making it one of main cuts to experience growth within pork. This is a result of existing pork sausage customers buying a larger quantity per shop, now averaging 0.6kg per shopping trip in the 52 w/e 03 September 2023 (Kantar). Penetration has fallen slightly but remains high with 80% of households buying pork sausages in the last year.

Price is a key purchase driver for consumers, and as a result, lower tiers such as economy are seeing a 29.9% uplift in volume sales vs last year, while premium and healthy branded sausages, which command a higher price point, have seen volume reductions of 1.5% and 13.1% respectively. Competition in terms of price is also noticeable amongst non-pork sources of protein. More budget friendly alternatives such as chicken wings, leg, and thighs, have been the only cut to see switching from sausages to them within the past year. Chicken wings, legs and thighs sit at an average price point of £3.43/kg whereas pork sausages can be priced at £5.15/kg, significantly higher. Despite this, pork sausages are still considered a budget friendly cut and are gaining shoppers.

Switching volume (000s) to pork sausages

to pork sausages72.png)

Source: Kantar| Total pork sausages| 52 w/e 03 September 2023

In terms of frozen pig meat, sausages take up the largest share and account for 20% of all pork sausage volumes. Frozen sausages sit at an affordable price point of £2.99/kg and continue to gain share of the sausage market with a YOY increase in sales of 9.1% (Kantar, 52 w/e 03 September 2023).

Meat-free sausages have seen volumes decline significantly over the last year, down 14.2%. However, chicken sausages have seen volumes increase by 4.4%. Taste remains a key need for shoppers and as they look to cut back on the number of ingredients in dishes to save money, they are looking to meat to provide taste. We have seen this in sausages with caramelised onion and pork and apple flavours seeing the biggest growth.

Pork sausages are a versatile cut and can be consumed throughout the year at various mealtimes, within multiple dishes including British staples such as sausage and mash, toad in the hole, and a full English breakfast. Please see our Lovepork.co.uk page for easy sausage meal ideas.

Beef Burgers

The story for beef burgers is not as positive as that of pork sausages. Burgers account for 10.1% of the total volume share within the beef category, however their volumes are in decline with a fall of 3.4% year-on-year (Kantar, 52 w/e 03 September 2023). Frozen beef burgers and grills however have seen a 1.5% increase in volumes. Despite beef burgers being a cheaper cut of beef, they are still perceived to be a more expensive protein source priced at £7.45/kg, compared to more affordable options such as total chicken (£5.89/kg) and beef mince (£6.40/kg). They face competition from these other protein sources, with shoppers switching to options such as chicken, bacon and even pork sausages. Within the beef burgers category, value burgers were the only tier to see volume increase, with higher price point options such as standard, premium, and branded declining. However, the uplift in value does not counteract the declines in the other tiers as this is where the majority of the market remains.

Burgers are not solely dedicated to beef, and this presents further competition for beef burgers. Despite beef being one of the cheapest burger options, they have seen the biggest actual volume decline, down 3.3 thousand tonnes over the last year. Some burgers have seen faster declines with meat-free burgers down 6.8% and lamb burgers down 10.2%. However, pork burgers have had a strong performance, up 14.7% albeit from a small base.

Demographic also plays a key role within the performance of beef burgers. Despite being the group, which buys the highest volumes of beef burgers and grills, retired shoppers are also a significant contributor to the decline in recent sales. Trends have however shown that pre and young families are responsible for growth within the beef burger category accounting for 38.5% of new shoppers (Kantar, 52 w/e 03 September 2023).

Beef burgers are not just for consumption during the busy summer BBQ months, but can be enjoyed throughout the year. Demonstrating this to consumers and providing them with inspiration is a great way to drive sales. Please see our beef burger recipes for some inspiration!

Seasonality

Both pork sausages and beef burgers are recognised as a staple element of a summer BBQ. However, how does this impact their all-year-round performance?

Burgers are much more reliant on a good summer than sausages, which actually see an over index around Christmas.

During this year’s summer period, the consumption of beef burgers saw an uplift of 58.6% versus the rest of the year. The volumes of beef burgers declined by 6.8% versus last summer (20 w/e 03 September 2023) , with very little growth in terms of new shoppers, as well as existing buyers reducing the frequency they purchase per shop. Furthermore, despite increased beef burger promotion from retailers during the summer period, 2023 promotions were not as successful as previous years. Temporary price reductions failed to entice shoppers, but Y for £X deals saw burger volumes grow by 27.9% (Kantar, 20 w/e 03 September 2023). However, despite an increase in sales in summer due to light buyers (customers who purchase a product infrequently or in smaller quantities), this is not a long-term occurrence, and sales tend to fall once colder weather conditions return.

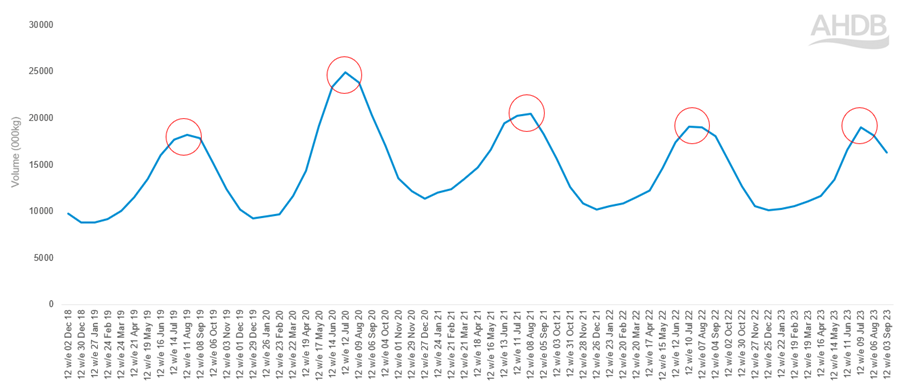

Burgers and grills – volume (000kgs)

Source: Kantar | Total burgers and grills volumes| 12 w/e 03 September 2023

Pork sausages under traded slightly during the summer, with the average 4 weeks period 2% smaller than the rest of the year. Despite this, volumes of pork sausages grew by 2.4% versus last summer (20 we/03 September 2023).

The promotional situation with pork sausages mimics that of beef burgers, with retailers also increasing promotional activity for them during the summer months. However, despite retailers increasing promotions in summer, data collected by Kantar demonstrates that the sales of sausages increase over the Christmas period, even when promotional activity is not so evident. Pork sausages saw a 15% uplift versus the average 4 weeks for the 4 weeks ending 25 December 2022. This data does not include pigs in blankets, and may indicate that shoppers are having a go at making their own. This is backed up by data which shows that regular pork sausage is the flavour of choice over the Christmas period, with a jump in volume share from 41% to 47% compared to alternative flavours.

Pork sausages – volume (000kgs)

72.png)

Source: Kantar | Total pork sausages volumes | 12 w/e 03 September 2023

This prompts the question of whether seasonality is a good thing? Particularly within the UK climate where ‘BBQ weather’ is now a scarce occurrence. Perhaps positioning and marketing beef burgers and pork sausages in alternative dishes, other than at a summer BBQ could help to drive popularity.

Opportunities

- Improve in-store shopping experience more attractive and engaging for shoppers - displaying foodie imagery to increase appeal, engage and connect consumer to British farming

- With current beef burger promotions proving ineffective, shifting to a Y for £X predominant strategy could encourage an uplift in sales

- As beef burgers are generally one element within a burger recipe promote a meal deal offer to increase affordability

- Increase promotion of pork sausages around Christmas

- Provide recipe ideas for shoppers to increase appeal and assist them in discovering new pork sausage and beef burger dishes

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: