Primary lamb demand continues to fall despite a strong Easter

Thursday, 29 June 2023

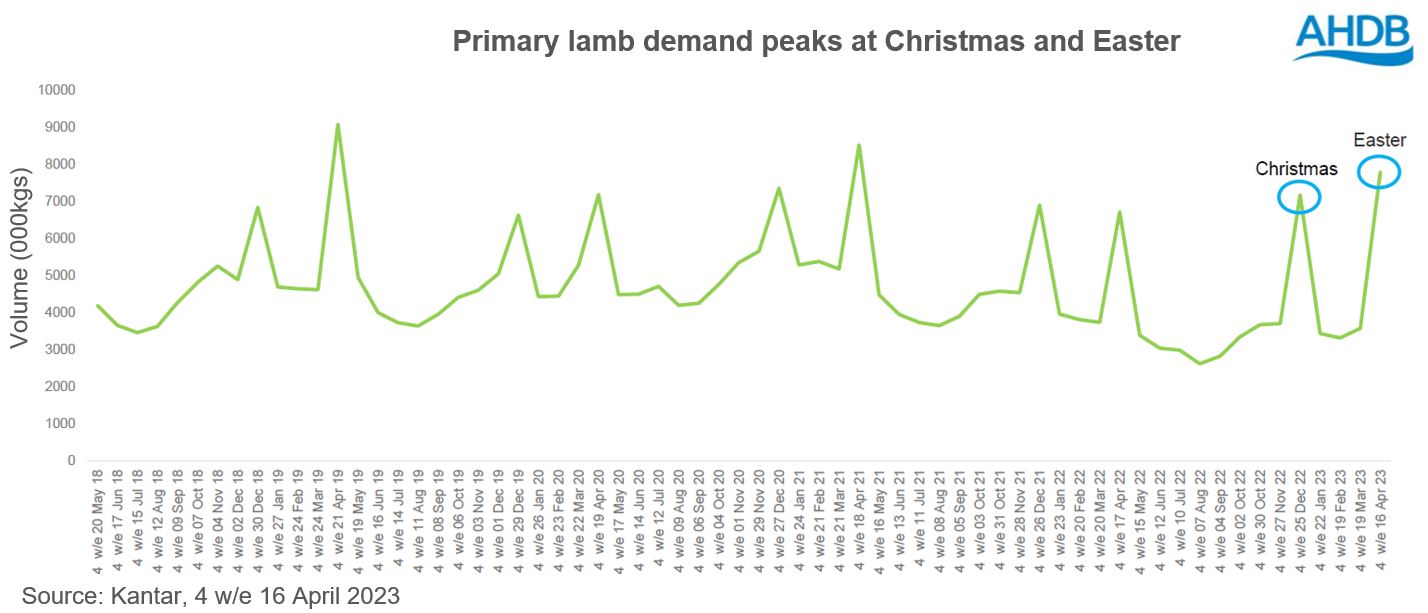

Demand for primary lamb is seasonal, with sales at Christmas and Easter sharply rising due to increased desire for roasting joints as people look to tuck in with family and friends to celebrate.

While primary lamb (steaks, roasting joints, chops, mince, stewing and diced cuts) makes up just 11.2% of primary red meat volumes, it is the largest part of lamb, contributing 63.4% of total lamb volumes according to Kantar (52 w/e 16 April 2023). The recent seasonal peaks in demand have dampened some of the overall 11.6% decline in lamb volumes we have been seeing as cost-of-living pressures limit the amount that people can afford.

Strong seasonal demand

The recent seasonal peaks in primary lamb demand last Christmas and the Easter just gone have increased slightly year-on-year (YOY) for the 4 w/e 25 December and 16 April 2023 respectively (Kantar).

Roasting joints are in high demand during these special occasions and account for just under half of primary lamb volumes in the last year (52 w/e 16 April 2023). Consumers’ return to celebrating these events after Covid-19 is clear, and roasting joints saw an uplift of over 300% for the 4 weeks containing Christmas and Easter compared to an average 4 weeks. These two key periods account for over 40% of all primary lamb sales in the year.

Some of this volume increase in Easter came from people switching from other areas of meat, fish and poultry (MFP) to lamb, and it is no coincidence that this occurred when the proportion of roasting joints on promotion spiked close to 50%. Temporary price reductions were the main method retailers used to promote lamb sales, with some even reducing prices by 50%.

Declining primary lamb volumes

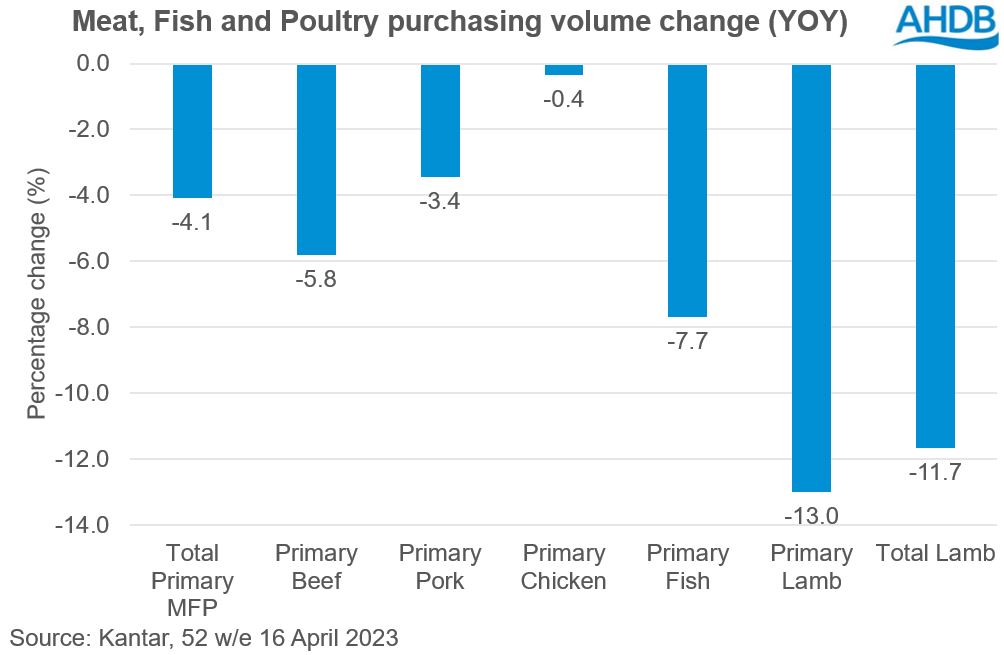

Yet over the last year primary lamb is the worst-performing protein within primary MFP, with volumes down 13.0% YOY at 50.9 million kilograms (Kantar, 52 w/e 16 April 2023).

Primary lamb is also losing share of the total lamb market, with a decline 1.3 percentage points greater than the YOY decline for total lamb volumes.

This decline in volumes purchased can be directly attributed to primary lamb’s high price, at £11.34/kg compared to £7.93/kg for the overall average price of primary red meat. While volumes of all MFP have reduced, we have seen shoppers switching away from lamb to other proteins, especially to primary chicken which is the cheapest protein in the market at just £4.69/kg. Within primary lamb we have seen shoppers switching, with greater volumes going to roasting joints from other key products such as chops, steaks and mince. Roasting joints are priced at £11.17/kg, slightly cheaper than the average price for primary lamb. Therefore, this switching between cuts of primary lamb indicates increased demand for roasting joints while demand for other cuts has fallen, but trading down within primary lamb is occurring less than with other proteins.

The age profile of primary lamb consumers

Primary lamb cuts are bought, for the most part, by older consumers, with shoppers over 45 years old making up 78.9% of primary lamb volumes (Kantar, 52 w/e 16 April 2023). This age bracket is also the most likely to be a heavy shopper (purchasing above 7.23kg of primary a year).

Overall heavy lamb shoppers have the highest frequency of shops for primary red meat, and the highest volume per shop. Therefore, while heavy shoppers only make up just over a quarter of all buyers, they are the most valuable shoppers for primary lamb with average yearly spend on primary totalling £87.30, over 3.5 times greater than that of medium shoppers. Heavy primary lamb buyers are also much more likely to buy roasting joints. With these consumers more willing to spend money on lamb, this provides an opportunity for retailers to increase the variety of their lamb purchases, including more chops and steaks. Improved purchases across this category could be achieved by greater promotions of all cuts, not just roasting joints.

While the YOY decline in lamb volumes has continued to slow since October, primary lamb is struggling as some consumers switch out of lamb entirely to cheaper proteins or reduce their meat consumption. Those lost lamb consumers tend to be younger, light shoppers (those who purchase less than 2.48 kg primary lamb per year), and these lighter shoppers tend to be more affluent but buy cheaper cuts of primary lamb. Therefore, in order to reverse the declining trend retailers should seek to tap into opportunities to grow lamb demand and increase sales, such as through targeting younger shoppers to widen lamb’s consumer base.

Retail opportunities for primary lamb

Mobilising new lamb consumers can be done through presenting vibrant and seasonal meal ideas, as well as midweek meal suggestions, helping to change opinions by showing the ease of cooking and versatility of lamb. Improving the visual aesthetic of lamb product packaging could also extend to how the aisles themselves are designed, such as through greenery to indicate sustainability and health associations, and by providing inspiration for meals. The effectiveness of better in-store communication at improving red meat shopping experiences was explored in a recent study by AHDB. Together, this could also help increase the frequency of purchases and shift consumers from viewing lamb as just for special occasions.

Showing consumers how to cook more cuts of lamb, alongside promoting meal ideas, may entice shoppers to spend more money on lamb more often and in higher volumes. But this has to be accompanied by a larger range of lamb products as currently; many retailers have a lack of lamb offerings but those that have a larger range see increased demand for lamb.

Finally, discounters account for a smaller percentage of total primary lamb volumes compared to their total shares for MFP. As a result, tapping into the large market share owned by these types of stores could help introduce people to primary lamb and increase sales. We have also seen the success of strong promotions at encouraging this, especially during traditional celebrations. Retailers that don’t use promotions are losing share of lamb during these periods. However, heavy promotions such as half price deals may not be sustainable, and we predict that lamb demand could struggle if retailers pull this key promotional support in future years.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: