Red meat proves a winner at Christmas dinner

Wednesday, 11 January 2023

Grocery sales breached the £12 billion mark for the first time, as grocery price inflation drove value sales (Kantar, 4 w/e 25 Dec 22) and celebrations were very much back on the cards post pandemic. However, volumes were down 1% year-on-year, despite December being the grocery market’s busiest month since the start of the pandemic.

Please note, this article was updated on 1 March, due to a revision to Kantar's gammon data following previous publication.

As forecasted in our pre-Christmas article, shoppers managed to treat themselves while managing their budgets. They continued to trade down from brands to private label, while the discounters (Aldi and Lidl) remained the fastest growing grocers. Within this, there was still a positive performance for premium private label, while the men’s World Cup boosted the take-home beer market.

Meat, fish and poultry

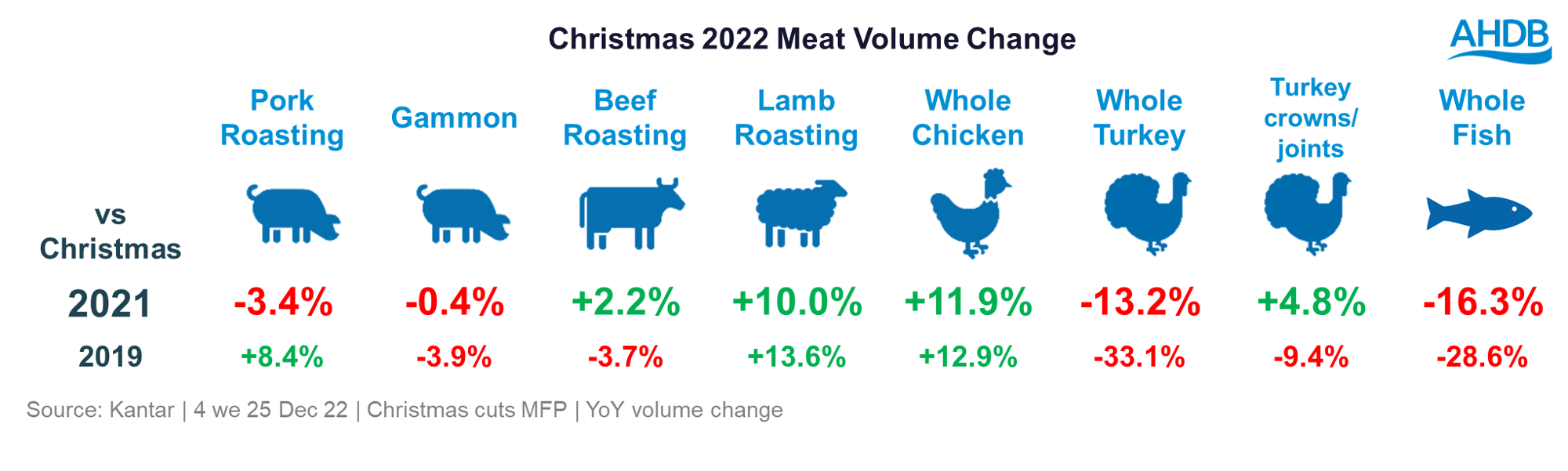

Overall volumes of meat, fish and poultry (MFP) were largely flat (-0.3%) in the month of December, with total volumes of red meat seeing marginal gains. Given the total grocery context of -1% volumes, this is a real positive for the category.

Within this, it was a positive Christmas for beef and lamb roasting joints, which were in year-on-year volume growth. Gammon and pork roasting didn't see the same uplift, with the 3.4% decline for pork roasting driven by leg and loin joints, while shoulder joints remained in growth.

Despite this, pork roasting volumes were up nearly 9% when compared to 2019, the last ‘normal’ Christmas. In addition to this, pork and gammon combined accounted for just under a quarter of all roasting volumes in December.

Lamb was the standout performer, with both leg and shoulder joints gaining. Leg roasting volumes increased by 10.6%, while shoulder rose by 3.9%. The gains for leg roasting joints even put volumes ahead of 2019.

Chicken was the main challenger to red meat and turkey, with volumes of whole chickens rising 11.9% year-on-year. This resulted in it accounting for 23% of roasting volumes in December, an increase of two percentage points year-on-year. Despite the price of whole chickens rising 11.0% over this period, it remains much lower in cost than other proteins, and this volume increase continues a trend seen in recent months.

With warnings of supply issues in the run-up to Christmas, whole turkey volumes took a significant hit, down 13.2%. Crowns and smaller turkey joints experienced an uplift in volume of 4.8%, reflecting a trend seen in previous years, with shoppers moving to smaller joints. However, this wasn’t enough to compensate for the whole turkey losses, and overall roasting volumes for turkey were down 3.2% versus 2021 and 20.6% versus 2019.

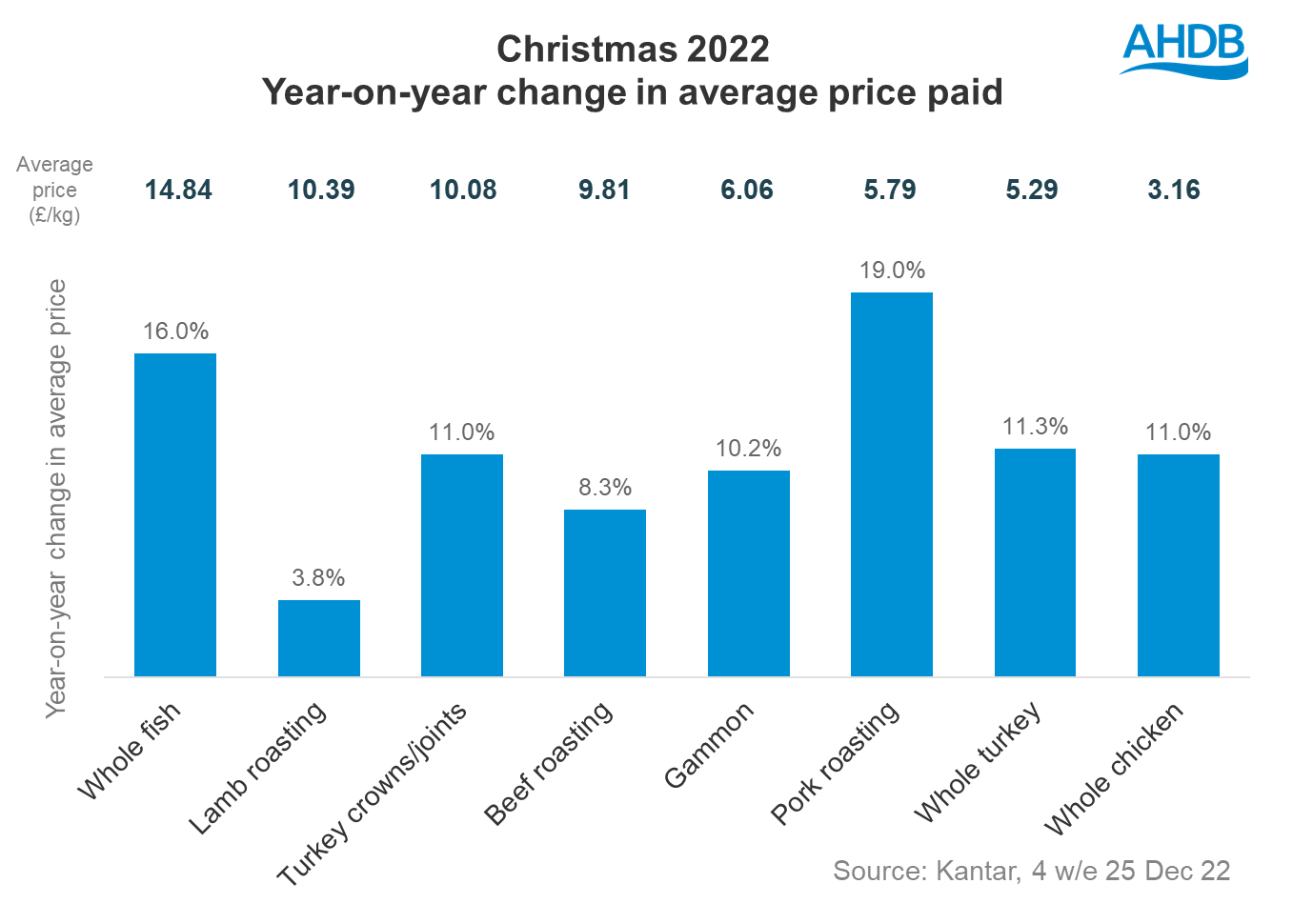

With Kantar’s measure of grocery price inflation standing at 14.4% in December, prices were up across the board. Pork roasting experienced the largest overall increase in price, linked to a reduction in promotions. While lamb roasting remains the most expensive meat, it had the smallest year-on-year increase in average price. The volume of lamb sold on promotion was up slightly (at 49%), but it was the depth of discount that rose and likely enticed shoppers to the category.

This highlights how promotional activity can be used to attract shoppers to more expensive cuts, despite the cost-of-living backdrop. Prior to Christmas, lamb in particular had been struggling with volume losses. Given that 59% of consumers say their household finances have worsened in recent months (AHDB/YouGov Tracker, Nov 22), it’s unlikely that these volume uplifts will continue into 2023.

Further data for beef, lamb and pork’s recent category performance can be found in our retail data dashboards.

Dairy

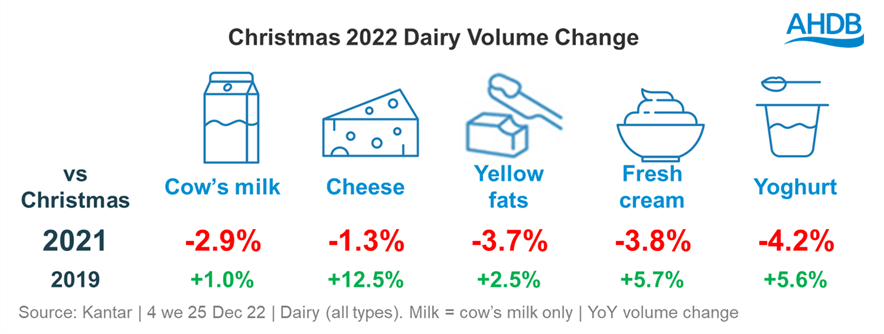

In December, British shoppers spent over £1.1bn on dairy in retail. However, in a similar manner to the total grocery market, this was driven by price increases, which were up 24% overall. Overall dairy volumes eased back 2.6%.

The strongest performing dairy category was cheese, with volumes down 1.3% year-on-year, but up 12.5% when compared to 2019. Varieties in growth included mild and mature cheddars. However, losses for medium and extra mature resulted in overall volume losses for cheddar, as well as signalling a level of downtrading within cheddar itself. Stilton and blue cheeses experienced a loss of 6.0% year-on-year, due to a reduction in household penetration, with some as predicted potentially reducing basket size by cutting back on a traditional cheese board option. Regionals collectively lost 5.1% volume, with only Red Leicester in growth (+1.4%).

December accounted for 14% of all cream retail volumes in 2022, and volumes remained 5.7% higher than in 2019. However, there was a year-on-year decline for the category due to a loss of shoppers as well as a reduction in volume purchased per buyer. Flavoured, single and aerosol creams all experienced year-on-year growth, but it was synthetic cream (e.g. Elmlea) that made the biggest contribution to cream’s overall volume losses. This meant that cream made from cow’s milk outperformed the non-cows milk alternatives in December.

Further data for dairy’s recent category performance can be found in our dairy retail dashboard.

A full analysis of Christmas sales will be published in early February, and our projections for 2023 will be included in the next update of the Agri-Market Outlook, also released in early February.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: