Premium should not be ignored despite trade down within red meat

Monday, 26 June 2023

As is evident by the theme of many recent AHDB articles, the cost-of-living crisis is impacting a large majority of the population, resulting in a change in how people shop. Specifically, we have seen a trend towards shoppers trading down product tiers. In the last 12 weeks, data by Kantar shows that within the meat, fish and poultry (MFP) own label category, value is the only tier to see volume growth year-on-year at +36.7%, versus premium at -6.0% and standard at -3.0% (Kantar, 12 w/e 14 May 23). While value is evidently king, however, the market should not ignore the need for more in-home treating occasions. This is known as the ‘lipstick effect’ – a theory that when faced with an economic crisis, consumers are more willing to buy affordable treats and/or indulge in guilty pleasures, albeit less often.

Nearly three in five consumers whose household finances have worsened claim they are going to spend less on eating out (AHDB/YouGov Tracker, May 23). This offers the opportunity within retail for trade up of certain treaty meal occasions, specifically consumers replicating out-of-home (OOH) meals in-home and special events such as parties and BBQs. When treating OOH, we know consumers favour meat-based dishes such as lamb, steaks and burgers, and what is evident in recent demand data is that some of these areas are actually seeing some positive trade up within retail, bucking the overall grocery and total MFP trend.

Within beef, steaks overall are seeing volume declines of -7.3%, driven by all steak cuts. However, when delving deeper into the data we can see that among the cheapest steak cut, rump (average price of £15.40 per kg versus total steaks at £16.37 per kg), the premium tier has actually grown by 0.2%, stealing 0.5% share of the rump category. Looking at how people are switching between different steak cuts highlights that some shoppers who have in the past purchased standard sirloin steaks and premium fillet steaks, both higher cost, are now buying premium rump steaks instead. Therefore, among some consumers buying premium, but cheaper, steak cuts are a way to save money and not leave the category.

Within pork, we have seen premium tier growth in a number of areas, specifically shoulder roasting, chops*, belly* and mince*. Therefore, premium pork cuts may offer an opportunity for those who feel the need to trade down protein to save money but still want to deliver a treaty meal opportunity.

*Based on 24 w/e data due to low base size on 12 w/e

Within beef, pork and lamb we have seen a positive trend for premium added value offerings. In the sous vide category, the premium beef tier has seen volume growth of 17.9%, pork 63.7% and lamb 12.0% (Kantar, 12 w/e 14 May 23), with direct switching seen from the standard tier. Within lamb we also see premium tier growth for marinades of 37.4%, stealing just over 7% volume share of the lamb marinade category. Therefore, for added value products which offer a convenient but special meal opportunity, encouraging this continued trade up for taste and quality will benefit the category. Within the convenience category we have also seen growth in the premium lamb ready meal market.

What does premium mean to shoppers?

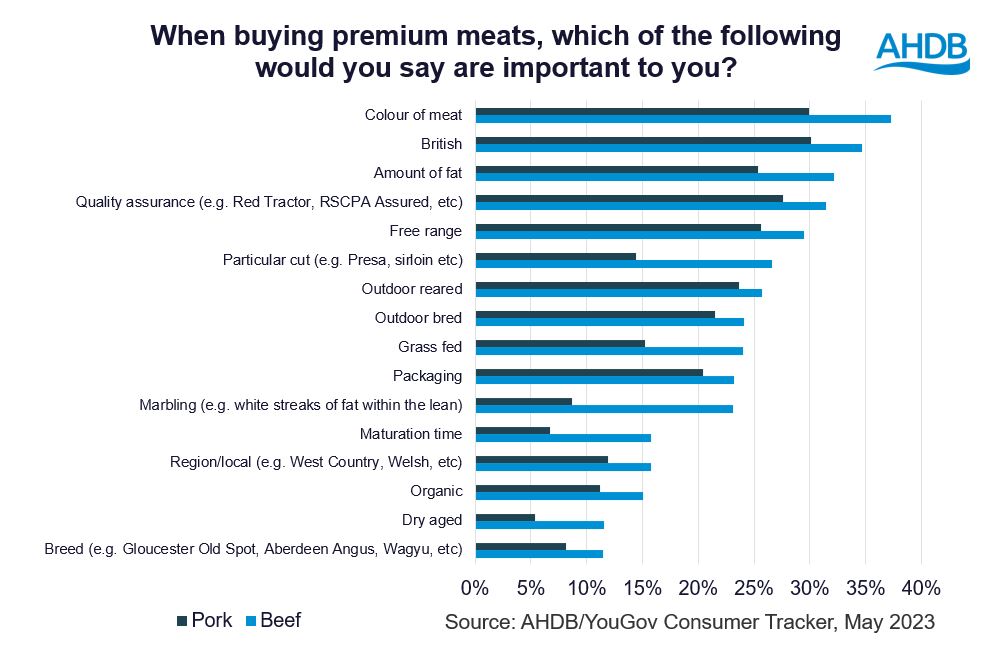

55% of shoppers, even in these tough economic times, agree they would be willing to pay extra for better quality meat (AHDB/YouGov Tracker, May 23). But what does better quality meat look like to a consumer? Forty six per cent agree meat with a quality assurance mark is worth paying more for. That leaves just over half the population who disagree or are indifferent, providing an opportunity to educate around quality assurance. Within the beef category, of highest importance when buying the premium tier is the colour of the meat, it being British and the amount of fat. This highlights that pushing sourcing credentials is key, but so is the appearance and perceived standard of the actual cut in pack when compared to the lower tiers. For pork the top factors are similar, but less so amount of fat as it is naturally a leaner protein.

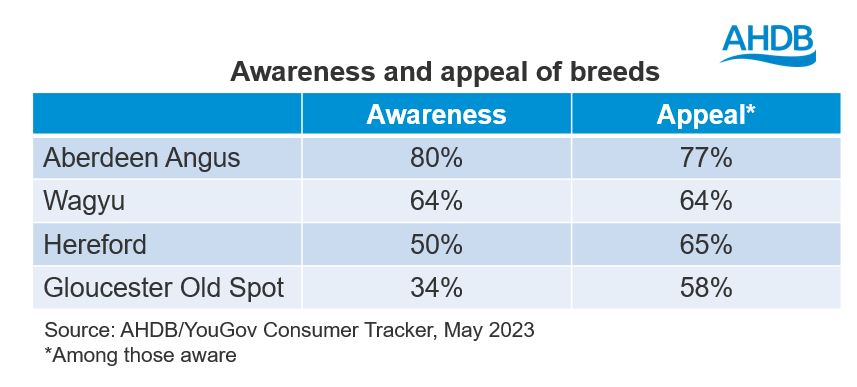

Grazing and housing methods are a general theme among approximately a quarter of these premium shoppers, so communicating farming standards on pack or at shelf for the premium tier would resonate. Preparation methods such as maturation time and dry aged, as well as breed are scoring lower in importance. Awareness and appeal of breeds differs, with Aberdeen Angus beef being most well-known among 4 in 5, compared to Gloucester Old Spot pork being least well known among only just over 1 in 3. Education on why unique preparation methods and breeds command a price premium would be needed to ensure shoppers understand why they cost more.

While current financial difficulties favour the lower priced tiers, the ‘lipstick effect’ still provides opportunities for treating meals. Capitalising on these occasions is vital, with treaty red meat meal inspiration and reassurance around premium quality meat at point of purchase. For more information on best-in-class communication in-store, please see our Reinventing Retail report.

Sign up

You can subscribe to receive the consumer insight newsletter straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: