Volume declines for organic red meat and dairy outpace conventional products

Thursday, 9 November 2023

The organic market is now worth £3.1bn, growing by 1.6% year-on-year (YoY) according to the Soil Association 2023. However, while value may be growing, organic meat and dairy volumes have seen declines. With the cost of living still at the forefront of consumers’ minds, to what extent have volume sales struggled as a result, and are people still buying into the perceived premium qualities of organic red meat and dairy?

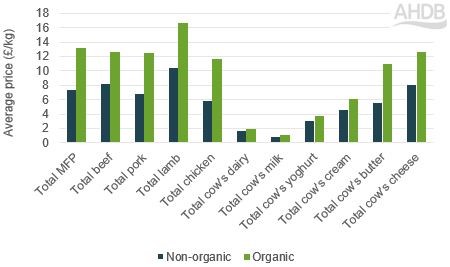

Organic food commands a premium price for its products with the average price of organic Meat, Fish and Poultry (MFP) costing nearly twice as much as conventional MFP, with organic dairy also more expensive.

Price difference between organic and non-organic meat and dairy

Source: Red meat data – Kantar 52 w/e 03 September 2023; Dairy data – Nielsen 52 w/e 09 September 2023

The cost of living crisis has driven consumers to change their purchasing habits to limit spending, for instance through trading down product tiers. Whilst the crisis has not moderated views towards organic food, as the percentage of consumers who say they are concerned about whether it is organic has remained unchanged YoY at 11% (AHDB/You Gov August 2023), demand for organic meat and dairy has fallen. The importance of organic meat has also dropped with just 27% of consumers claiming buying organic meat is important, down 3 percentage points YoY (AHDB/You Gov November 2022).

Even struggling households are likely to spend more when the perceived benefits, not just the price, influence the consumers view of the value of a product. GB consumers as a whole spend an extra 6% on meals or ingredients which meet 2 needs and this rises to 10% for those meeting 6 needs across such topics as enjoyment, practicality and health (Kantar Usage, 52 w/e 22 January 2023). Organic products specifically are viewed by consumers to be of a higher quality due to believed health benefits and sustainability credentials. However, as organic products have a higher average price and are not an affordable everyday item for many, few customers are trading up and purchasing them.

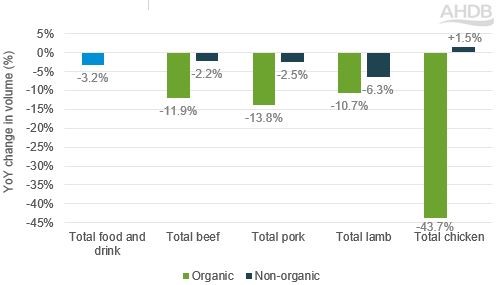

Red meat

Organic red meat makes up just 0.2% of red meat volumes and organic volumes have declined by more than their conventional counterparts over the last year (Kantar, 52 w/e 03 September 2023).

YoY volume changes for red meat

Source: Kantar 52 w/e 03 September 2023

Staple organic products have seen declines, with organic beef mince volumes falling by 9.2%, and organic pork sliced cooked meats also seeing declines (-29.1%). Meanwhile non-organic versions of these products have seen much slower declines. This indicates that the high price of organic products is causing consumers to trade down to non-organic or leave the category altogether. This has resulted in 677 thousand fewer organic MFP shoppers this year versus last.

The fall in organic volumes in retail comes despite the average price for organic red meat decreasing by 2.5% YoY, driven by price declines to beef and pork whilst lamb saw price rises.

Average prices for organic pork in retail declined by 13.9% over the last 52 weeks. This drop in prices may have been due to a drop in consumer demand for more expensive organic pork within retail, which is likely one factor putting pressure on non-standard farmgate pig prices, squeezing the premium compared to standard pigs. This is one example of what economists term ‘demand destruction’ in response to cost of living concerns.

With the slight price declines seen for organic red meat over the last year, it is now priced more in line with premium products, at just 30.2% more expensive than premium private label compared to just over 50% more a year ago. Consumers are also still willing to indulge in more expensive products every once in a while, and are willing to spend 16.0% more for emotive occasions over functional ones, and this also applies when saving money elsewhere such as not going out to eat (Kantar Usage, 52 w/e April 2023). Therefore, retailers could tailor messaging around specific organic products like steaks and roasting joints to target consumers looking to treat themselves.

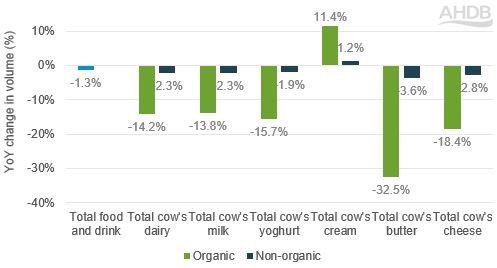

Dairy

Organic dairy volumes account for 3.0% of total volumes but volumes have fallen YoY (Nielsen, 52 w/e 09 September 2023). Organic milk and yoghurt volumes combined account for 97.0% of total organic dairy volumes.

YoY volume changes for dairy

Source: Nielsen 52 w/e 09 September 2023

We are continuing to see a trading down from organic milk to conventional milk. Whilst the YoY price rise of total organic dairy (20.9%) was similar to non-organic dairy, organic dairy still costs 18.5% more. Some consumers looking to save money are trading down rather than reducing or stopping consuming dairy. For example, volume declines for both milk and yoghurt saw a large proportion of these volumes switched to their conventional counterparts - 65.3% and 27.5% respectively.

Organic butter saw such large YoY volume declines since it had by far the largest YoY price rise (+34.1%) out of all dairy products, leading to shoppers purchasing smaller volumes of these products.

Organic cream was the only dairy category to see volume growth YoY, outpacing growth in conventional cream. Whilst organic cream is nearly a third more expensive than non-organic cream, its price increased less than that for non-organic. So this strong performance is due to people buying more organic cream and more often, as well as new buyers entering the market.

Opportunities to reverse the current declining trend

For the most part, organic meat and dairy volumes have been declining over the last 2 years as consumers battle with inflation, which may push retailers to reduce organic offerings on shelves. However, research from IGD indicates consumers are starting to shift from focusing solely on the cheapest price, and more towards value for money. This could provide an opportunity for retailers to promote the perceived benefits of organic products.

Research from AHDB showed that within the shopping journey, farming and production information was most impactful for consumers within the bay. Therefore messaging on in-store signage, such as barkers or fins, mentioning perceived benefits could give consumers a reason to buy organic as they meet more consumer needs, making purchasing them more worthwhile.

Consumers also spend more for weekend meals, especially where a higher quality product is a centrepiece to the meal (Kantar Usage, 52 w/e April 2023). Therefore, organic brands might consider targeting their products to these occasions by highlighting the luxury nature of these products through meal deal promotions, added value products or on-pack meal ideas.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: