Organic deliveries decline as consumers continue trading down

Wednesday, 26 July 2023

The inflationary economic environment and the consequent cost of living crisis has been a consistent theme in consumer behaviour and market trends since 2021. Staple products, such as dairy, have been scrutinised in the media as key indicators of inflation.

Consumers have sought to manage their overall basket costs by trading down, wasting less and buying less volume. Historically, organic sales have been particularly vulnerable to price sensitivity. In the current climate, what has happened to organic sales and how has organic milk production responded?

Price rises and falling sales

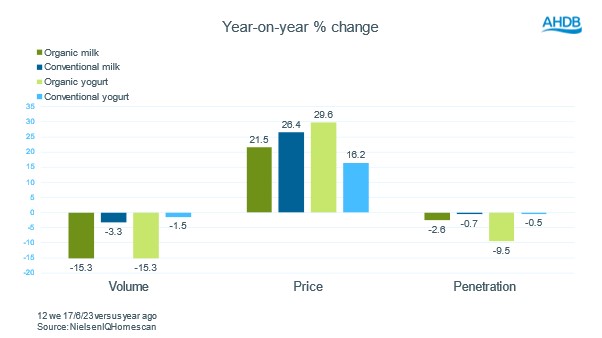

The cost of dairy in retail has risen across the board, despite recent headlines and price wars on milk in the supermarkets. According to NIQ Scantrack, in the 12 weeks ending 17/6/23 the cost of conventional milk was 18ppl, 26.4% higher than the same period a year ago. The price of organic milk was 20ppl, 21.5% higher. However, this took the average cost of organic milk to £1.14 per litre, compared to only £0.84 for conventional, leading consumers to seek trading down options. Although all milk saw volume losses, organic milk lost 15.3% of volumes compared to only 3.3% for conventional cow’s milk.

The slightly better news is that over the past 12 months household penetration losses (the number of households buying the product in the last 12 weeks) have slowed, and penetration seems to have stabilised at around 8% of households buying organic milk. This suggests there is still a core shopper buying the product.

Yogurt sees a similar pattern in terms of volume losses although penetration has fallen by a larger amount (9.5%), perhaps in reaction to conventional yogurt going up in price much less than organic (16.2% versus 29.6%). At this differential price, promotions would need to be quite deep to retain shoppers.

Has production kept pace with these changes?

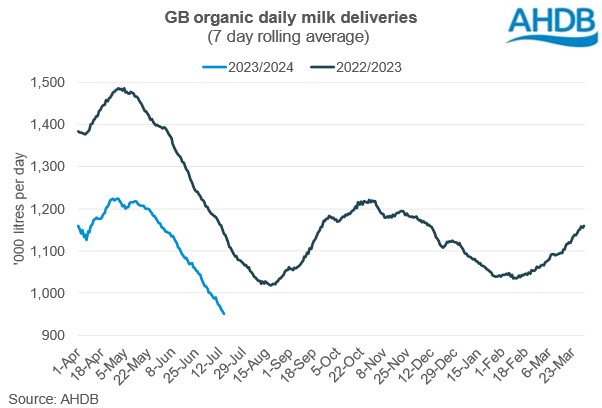

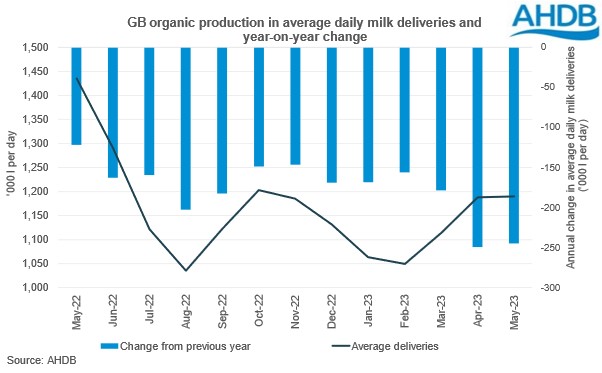

Organic production has been falling with May deliveries down by 245,000 litres per day, 17%, compared to the previous May. This may well have been impacted by organic milk processors being slower to increase milk prices when prices were rising towards the end of 2022. Input costs were rising for all farmers, but organic feed costs, in particular, have become prohibitively expensive for some, meaning the milk-to-feed price ratio is looking less favourable for many organic farmers.

With the organic milk pool declining, there could be less milk available to service future requirements, particularly if inflation eases and demand begins to return.

There is still an organic premium available, and organic prices have been slower to fall than conventional. It was reported in Farmer’s Weekly that Omsco held their prices at 49ppl in July, Arla had a 5ppl organic premium and Müller 10ppl at 48p. Although domestic demand for organic – certainly in liquid milk – has reduced, pledges of key food service operators, such as McDonalds, to only use organic milk are also helping to shore up some demand.

There may be more opportunity coming down the line for exporters of organic produce. The new CPTPP trade deal coming online may offer some support to access global demand and potentially support organic prices in future. Time will tell as to what extent the UK organic milk market will contract.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.