- Home

- Markets and prices

- Nature markets

- Choosing the right scheme

Which nature-based scheme is right for your business?

Here, we go into the three types of scheme – private, regulatory and public – and whether they can be combined.

Each scheme has different funding sources, requirements and level of risk. The value of credits often varies between them, and the cost of running a scheme also varies.

Private or voluntary markets – common examples of types of market that are private include voluntary carbon markets and biodiversity credits.

Regulatory markets – regulated carbon markets and nutrient neutrality fall within this category and can be located within the public or private domain but may be legislated for by the Government.

Public schemes – include sustainable farming incentive (SFI) and countryside stewardship schemes; these are controlled directly by the Government.

Private or voluntary markets

Private markets (sometimes called voluntary markets due to the choice of participation) allow landowners to sell environmental services to companies seeking to offset their impacts.

These schemes can be flexible and can offer higher returns, but payments depend on market demand and buyer confidence.

They may require third-party verification, and prices can fluctuate. These markets suit businesses that can tolerate a less predictable income in return for potentially better financial outcomes.

To build trust and ensure environmental benefits are real and credible, the British Standards Institution (BSI) Flex standards have been developed to support the growth of high-integrity nature markets in the UK.

BSI Flex standards for nature markets

The BSI Flex 70x series provides adaptable standards that promote transparency, accountability and strong environmental outcomes in nature markets.

- BSI Flex 701 – Nature markets – Overarching principles and framework: Sets the core principles for how nature markets should operate, ensuring environmental claims are robust and credible

- BSI Flex 702 – Nature markets – Supply of biodiversity benefits: Provides detailed guidance on how biodiversity improvements can be measured, verified and sold as marketable units

Further standards are being developed, including:

- Flex 703 for nature-based carbon markets

- New frameworks for nutrient markets, community engagement and governance

The flexible nature of these standards ensures they can quickly evolve as markets grow and new needs emerge.

Regulatory markets

A regulatory market, also known as a regulated or controlled market, is one that is subject to specific rules and regulations set by regulatory bodies. Regulatory markets encourage landowners to deliver outcomes that help companies buying the credits to meet legal environmental obligations.

These schemes offer structured, more stable payments than tend to be offered in private markets. They often have rigorous entry requirements, monitoring and reporting.

Regulatory markets can offer longer-term income for land managers who are comfortable with compliance frameworks and understand the impact to their business of getting involved in a scheme.

Public schemes

Government-funded schemes offer reliable, fixed payments for actions like soil health improvements, habitat restoration and reduced tillage.

They are often more accessible and lower risk than other schemes. But payment rates are typically lower than private markets, and activities are more prescriptive. Examples are the Sustainable Farming Incentive (SFI) and other Environmental Land Management Schemes.

Such publicly funded schemes offer businesses stability and alignment with government agri-environment policy.

Can you combine them?

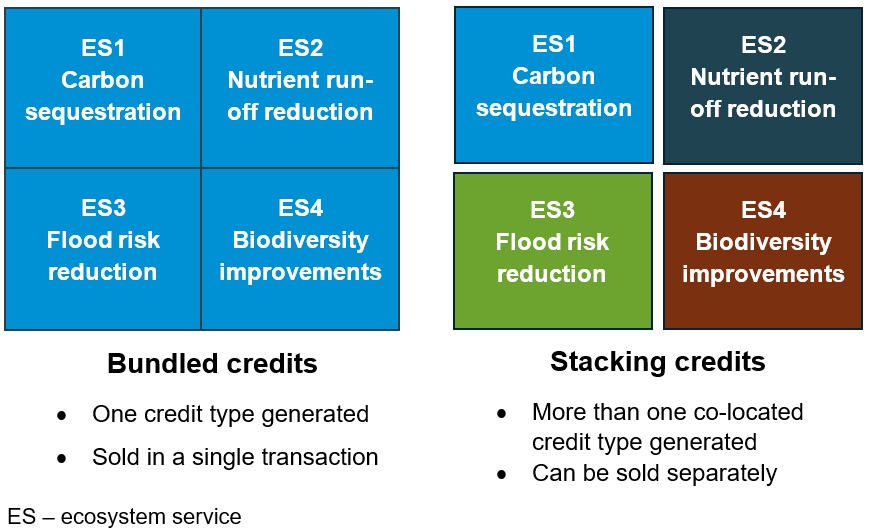

There are two ways schemes can be combined: bundling and stacking. They differ in terms of requirements, process and outcomes.

Bundling vs stacking

Stacked credits are individual ecosystem services provided by a single piece of land which can be sold off as separate individual credits.

Bundled credits are a combination of ecosystem services that are provided by a piece of land and sold as a single credit to a buyer. The Environmental Policy Innovation Centre (EPIC) provides more information on types of bundled credits.

Comparison of bundled and stacking credits

Stacking schemes

Stacking schemes – combining multiple payments for different environmental outcomes on the same land – is allowed under specific circumstances. For example, you can receive Sustainable Farming Incentive (SFI) funding for soil management while earning carbon credits for carbon sequestration on the same piece of land. However, double funding the same activity is not permitted.

Missteps can lead to repayment demands or loss of eligibility. Always check scheme rules carefully and seek independent advice before stacking.

Bundled credits

Bundled credits combine multiple ecosystem services – such as carbon sequestration, water quality improvement, flood mitigation and biodiversity – into a single, marketable credit. This approach reflects the full environmental value of a land management activity and may appeal to buyers seeking benefit from their broader impact.

Bundled services are packaged and sold as a single unit. Having buyers purchase the full bundle ensures that the combined environmental benefits are recognised and valued together.

While bundled credits can simplify transactions and potentially unlock greater value, they require careful measurement across all services included.

Bundling schemes are still evolving. Land managers should seek expert advice to understand opportunities and eligibility before participating.