Prices of goods rise, but not for food

Wednesday, 21 July 2021

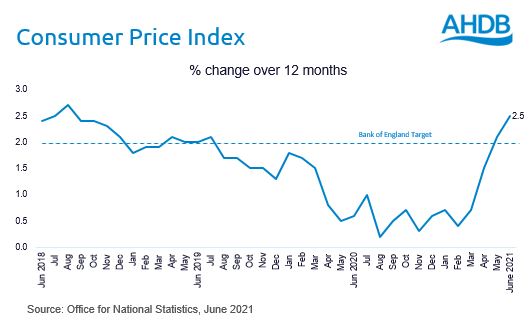

Inflation is a measure of how much the price of goods and services increase over time. Significant price rises can have a big impact on how much disposable income a consumer has to spend on items such as food, drink and leisure activities. According to the Office for National Statistics (ONS) the Consumer Price Index (CPI), which is a measure of this inflation, shows that in June price rises were at their highest level for nearly three years. So what does this mean for the food industry?

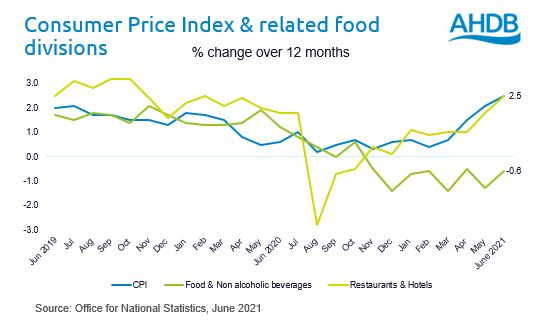

The CPI rose by 2.5% in the 12 months to June 2021, accelerating from 2.1% in May. This rising inflation is a concern, hence why the Bank of England have a target to keep inflation at 2%. However, according to the Governor of the Bank of England, higher inflation is set to continue, above target, for the rest of the year as the British economy recovers from the Covid-19 pandemic. This inflationary pressure comes from prices returning to pre-Covid levels and demand outstripping supply. He stated that if inflation was not to slow down, the Bank would not hesitate to introduce new measures to reduce high spending, such as increasing interest rates.

The biggest contributors to this 12 month inflation rise are transport and housing/household services. More recently rises have been driven by increasing prices for clothing, motor fuel, furniture and meals and drinks consumed out-of-home. However, these were partially offset by a large downward contribution from food and non-alcoholic beverages, where prices fell this year -0.6%. Part of the drop is because prices rose a year ago at the start of the pandemic as promotions were de-prioritised. According to ONS meat is a large contributor to this, at -1.6% in the 12 months to June 2021, and dairy is at -0.2%. Bucking the trend and seeing price inflation gains in food are bread, cereals, oils and sugar.

Despite this, when looking at Kantar data the average price paid for meat, fish and poultry (MFP) in the last year has actually risen 2.9% (52 w/e 13th June 21). This highlights that some people are trading up within the category, with premium being the fastest growing tier for MFP in the last year. This is a consistent picture for total food & drink according to Kantar as consumers spent more time at home treating.

Looking forward

There appears to be a tale of two halves. According to the AHDB/YouGov consumer tracker 50% of consumers claim they have become more price conscious or have allocated their shopping budget differently (May 2021). This means they may have bought more on deal, traded down and shopped around at cheaper stores like discounters. Unemployment, while recovering, remains above pre-Covid levels, and wage growth is stilted, according to ONS. This will result in some consumers mirroring more recessionary times in the months ahead; looking after the pennies and making sure they budget to make their money go further. Consumers will eat-out less, scratch cook more from home and look to get the best value during their weekly retail shop.

On the other end of the spectrum however are consumers who over the last few months have had their spending power limited due to lockdown. As restrictions ease we know there is pent up demand for eating-out with post-Covid opportunities for eating-out establishments to entice people back through the doors. There are opportunities in retail to stretch the purse strings further by capitalising on legacy Covid behaviours such as more socialising and entertaining at-home, providing opportunities to trade these consumers up, balancing the trade down mentioned above.