COVID-19 behaviours which will stick

Wednesday, 19 May 2021

Over the past year the AHDB Retail & Consumer Insight team have been publishing findings on changing consumer shopping and eating habits in light of COVID-19. However, as the UK starts to see restrictions ease and ‘normality’ in sight what COVID behaviours do we see sticking around for the longer-term?

Future backdrop

The economic effect of COVID-19 will be felt for years to come, with The Office for National Statistic’s best-case scenario of GDP returning in Q2 2022 and worst case Q4 2024. Predicted unemployment levels will rise +6.5% by the end of 2021 (ONS/OBR Economic & Fiscal Outlook Report, March 2021) and unsurprisingly many consumers have become more price conscious.

According to research agency Two Ears One Mouth, 58% of consumers have anxiety about future lockdowns and three in five claim they will be more careful about how they spend their time and money in the future (April 2021).

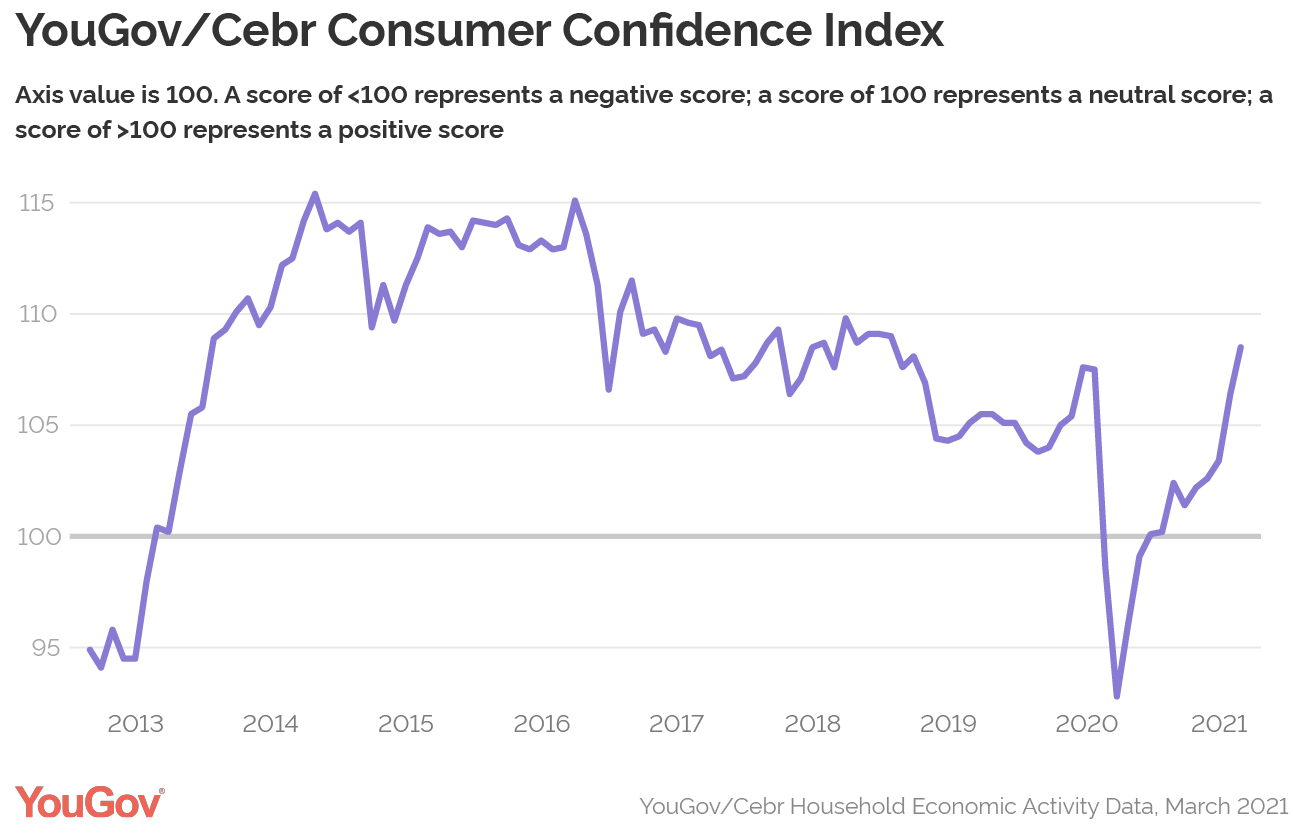

However, there is also a sense of cautious positivity in the air. From the same study, concerns about the impact of the pandemic are at an all-time low, in the context of the continued successful vaccine roll out and reopening of schools for all pupils. Optimism is driving 65% of consumers to feel positive about the next few months, outweighing negative emotions at this point. In line with this, consumer confidence is improving, rising to 108.5 in March 21, the highest level since August 2018 (YouGov/Cebr).

Future behaviours

As a result of this positivity, more consumers are now planning for the future and this is where legacy pandemic behaviours have been identified. Below we look at these and how they impact food and drink offerings.

More in-home breakfast and lunches

The pandemic has forced many consumers to work from home, leading many to appreciate the benefits this presents. According to the AHDB/YouGov consumer tracker, 38% claim they definitely will, or probably will, increase the amount of days they work from home (February, 2021). This means, going forward, more breakfasts and lunches will be consumed at home.

During lockdown, we have seen in-home breakfast occasions grow by 22 million per week and lunch a staggering 101 million (Kantar Usage, 48 w/e 21st Feb 2021 vs average 48 w/e 22nd March 2020). While these levels will not be maintained once some people return to the office, it is safe to say they will remain significantly elevated. Understanding consumer needs within these in-home meals can help when trying to create a more focussed offering to consumers and unlock growth opportunities.

For food producers and retailers, the opportunity lies in inspiring more in-home breakfast and lunch occasions that avoid in-home meal fatigue. This could be taking a traditional dish such as the trusty sandwich and pushing a variety of fillings or options to ‘spice up’ classics, to inspiring hot meals such as a jacket potato lunch or an omelette breakfast. Retailers and other foodservice establishments, particularly in rural areas, can also entice those working from home to pop out and seek different food-to-go options to break up the working week.

More in-home treating meals

While there is evidence of pent up consumer demand for eating-out, research shows 19% of consumers plan to visit hospitality venues less often once they re-open (CGA Consumer Confidence to Re-opening, March 2021). This means more in-home meal occasions, particularly treating occasions which were typically sought out-of-home (OOH) pre-pandemic.

In the last year, food deliveries are booming, giving consumers the comfort of eating at home without the need to cook. Consumers are also not shy about trying to replicate the OOH experience in-home as we see scratch cooking rise and 13% of consumers making restaurant quality food using recipes or ingredients from restaurants (CGA, The Lockdown Consumer, April 2020).

This provides opportunities in retail to trade up consumers, with high quality products such as premium British steak, which over trades OOH, potentially benefitting from inspiration and guidance on how to replicate OOH dishes. Other opportunities lie in restaurant brands, whether that be the centre of the plate, for example the GBK branded beef burger, or the accompaniment or seasoning. An example is chain restaurant sauces which are being sold in the meat aisle. Lastly, inspiration can go beyond the recipe to offering more convenient ‘ready-to-cook’ options such as ‘special occasion’ dine-in meal deals, or jump on the takeaway trend by offering cheaper (and often healthier) ‘fakeaway’ options.

More socialising at home

It is clear the pandemic has put life in perspective for many consumers with people longing for human contact and reconnecting with family and friends. With the foodservice market closed for the majority of 2020, consumers have learnt to appreciate that entertaining can be done at home. Going forward, 39% claim they are more likely to see friends and family at home in the garden once restrictions have eased and 46% are more likely to host social events/parties (Two Ears One Mouth, April 2021).

In the last year, when social gatherings were restricted, we have seen smaller celebrations. Lamb sales suffered Easter 2020 and smaller joints and birds were boosted at Christmas. We also saw a significant rise in BBQ occasions, albeit with less people. However, going forward with social distancing restrictions planned to be eased by Summer the celebrations this year will be different, with many wanting to make them extra special.

With this in mind retailers should capitalise on this boost in at-home entertaining, whether that be around specific seasonal events or more general party occasions. Inspiration and guidance should focus on dinner party friendly dishes, canapés or desserts, quick and easy sharing meals and the ‘perfect’ BBQ spread. New product development and innovation is key around seasonal celebrations such as Christmas, but opportunities lie in strong BBQ offerings, party sized convenience products and savoury and sweet party food ranges.

Related content

Topics:

Sectors: