Delivery continues to drive takeaway growth during Lockdown 3

Friday, 30 April 2021

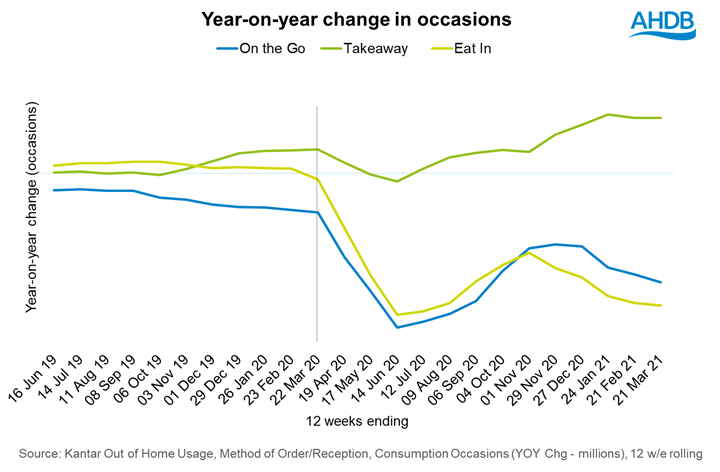

With Britain spending the first quarter of the year in its third lockdown, consumers continued to turn to takeaways. According to Kantar data, takeaways* were up 79% in the 12 weeks ending 21 Mar 21, when compared to the same period a year earlier.

Despite this increase in takeaways, it hasn’t been enough to compensate for losses in other parts of the out of home market. Over the same period, eating out dropped by 92% while on-the-go consumption occasions declined by 46%. Takeaways haven’t fully compensated for these losses, instead the area that’s gained has been retail grocery, with in-home occasions up 21% during that 12-week period.

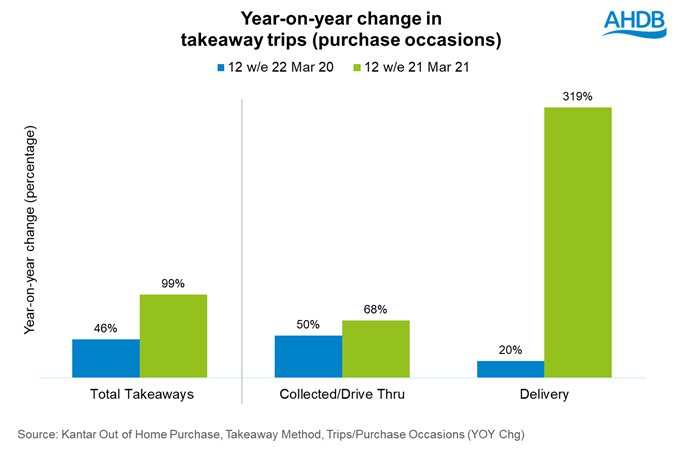

Consumers are still more likely to collect their orders in person (including the use of drive-thrus), accounting for 74% of takeaway trips in the 12 w/e 21 Mar 21. However, deliveries are now much more important, representing a 26% share of takeaway trips, up from just 15% two years ago. This is due to the phenomenal growth rate in deliveries, which increased by 319% year-on-year over that 12-week period.

For the full year 2020, Lumina Intelligence reported that the delivery market reached £11.4bn. Third-party services (such as Just Eat and Deliveroo) have been key to this; almost half of consumers who ordered takeaway/home delivery as of November 2020 did so via a third-party service (Mintel, Attitudes towards home delivery and takeaway, UK, Feb 2021).

While there has been continued diversification into the takeaway market, with many pubs and independent restaurants setting up for deliveries for the first time during the pandemic, they remain a small part of the market – accounting for just 2% of all takeaway trips in the 12 w/e 21 Mar 21. Major chains are still the most popular option to turn to for takeaways. McDonalds alone accounts for almost a quarter of takeaway trips, while Greggs remains the next most popular individual chain, despite experiencing declines over this past year.

Sector impact

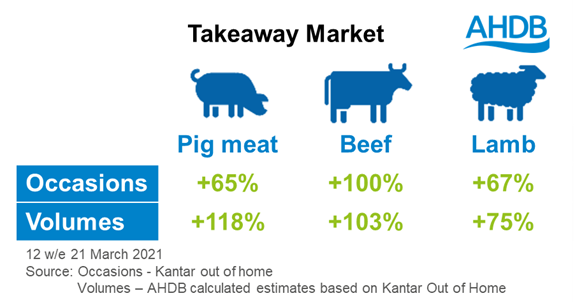

The popularity of certain dishes at takeaway mean that some sectors tend to gain when takeaways thrive. There has been differing impact across proteins for both occasions and volumes, which are estimated by AHDB based on Kantar data.

Pork

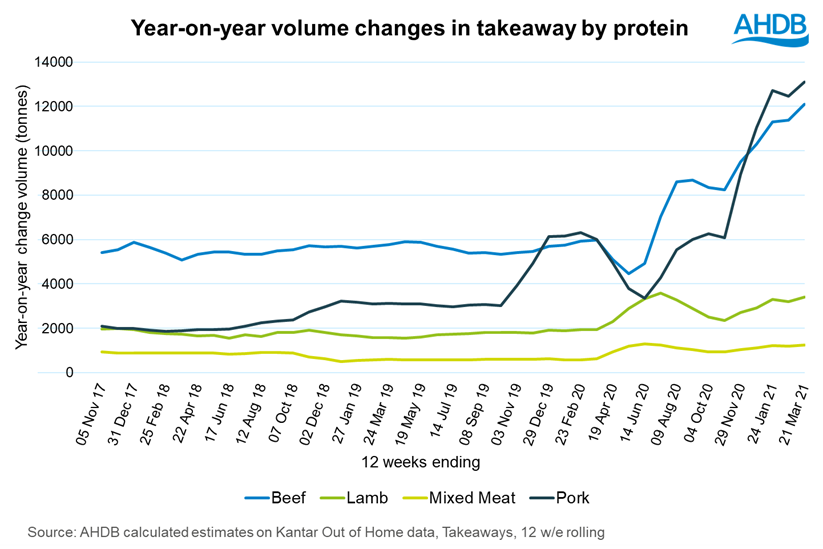

Pork was the biggest growing red meat in volume, up 118% on the same period last year. Sandwiches have been the most popular pork dish for takeaways since the easing of the first lockdown, in the last 12 weeks there have been 52.7 million pig meat takeaway sandwiches (incl wraps, paninis etc) bought, up 218% compared to last year. Before the pandemic it was breakfasts which were usually the most popular occasion for pig meat but lunchtime takeaways have become more popular, as fewer people are eating lunch on the go or in the office and many turn to drive-thrus and deliveries for lunch instead.

Strong growth meant pig meat gained share of the takeaway market and overtook beef as the biggest protein in volume terms. Despite sandwiches being the biggest growing dish, much of the pork volume growth was driven by savoury pastries. Greggs rolling out its delivery service across the country with partners Just Eat, just prior to the pandemic, is likely having a major impact on the pig meat delivery market.

Beef

Burgers are the most popular takeaway meals which means that beef tends to gain when takeaways thrive. The number of takeaways featuring beef doubled in quarter 1 of 2021 compared to the same period last year, leading to a volume increase of 103%. Mexican was the fastest growing dish for beef in volumes, but burgers contributed the most to volume growth, accounting for 63% of volume growth in beef takeaways from an additional 41.5 million occasions in 12 w/e 21 March 2021. Pubs and independent restaurants make up such a small section of the takeaway market, but a good level of interest and uplift boosted beef centred meals, such as steak and chips or roasts, which accounted for 10% of beef volume uplift.

Lamb

Lamb saw particularly good growth at the very start of the pandemic, as kebab shops were one of the few takeaway services which remained constantly open. However, despite lamb takeaway volumes growing 75% in the last 12 weeks, it has lost share to beef and pork and has not seen the heights we saw back in June and July of last year. Kebabs are the main dish for lamb takeaways, and they are least reliant on eat-in or on-the-go channels, so lamb has been less affected by the pandemic. They remain the most popular lamb dish for takeaways with an additional 6.6 million occasions in the last 12 weeks.

Conclusion

- Takeaways are likely to continue to track well above 2019 levels, however they are expected to ease versus 2020 as pubs, restaurants and cafés reopen for dine-in service. Lumina Intelligence forecast a 7.6% decline in takeaway deliveries (full year 2021 vs 2020), however takeaways as a whole remain an important revenue stream for operators.

- Therefore, diversification in terms of products and day parts will still be important. Products and brands not traditionally associated with takeaway deliveries, such as savoury pastries (led by Greggs), clearly have a role to play. Therefore, even if the product doesn’t initially fit with delivery, there is an opportunity to innovate, such as in packaging to ensure the product travels well. With only 22% of consumers having opted for takeaway/delivery for lunch and just 6% for breakfast (Mintel, Attitudes towards home delivery and takeaway, UK, Feb 2021), there is also an opportunity to encourage trial at different occasions perhaps via the use of promotions.

Notes

*Takeaways based on occasions as measured by Kantar Out of Home panel data, 12 w/e 21 Mar 21

Volumes from AHDB calculated estimates based on Kantar OOH data.

Related content

Topics:

Sectors:

Tags: