Takeaways back in growth following coronavirus shock

Friday, 7 August 2020

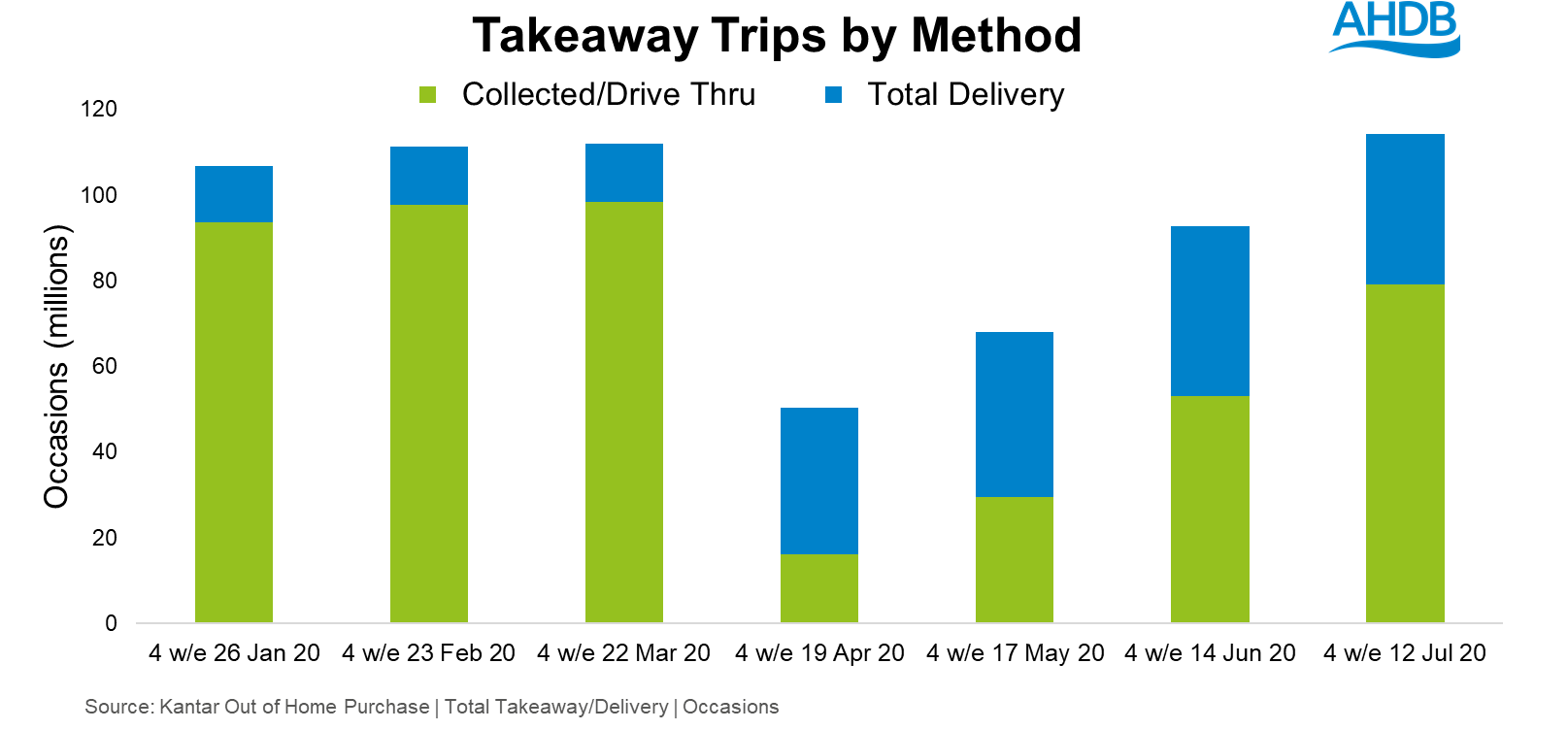

After initial declines at the start of lockdown the takeaway market has returned to, and in the first 2 weeks of July exceeded, its pre-COVID high. This is driven by growth in collected and drive-thru orders, which account for the majority of takeaways, while Britain’s delivery orders are more than double what they were pre-COVID (Kantar Out of Home, 4 w/e 12 Jul 20).

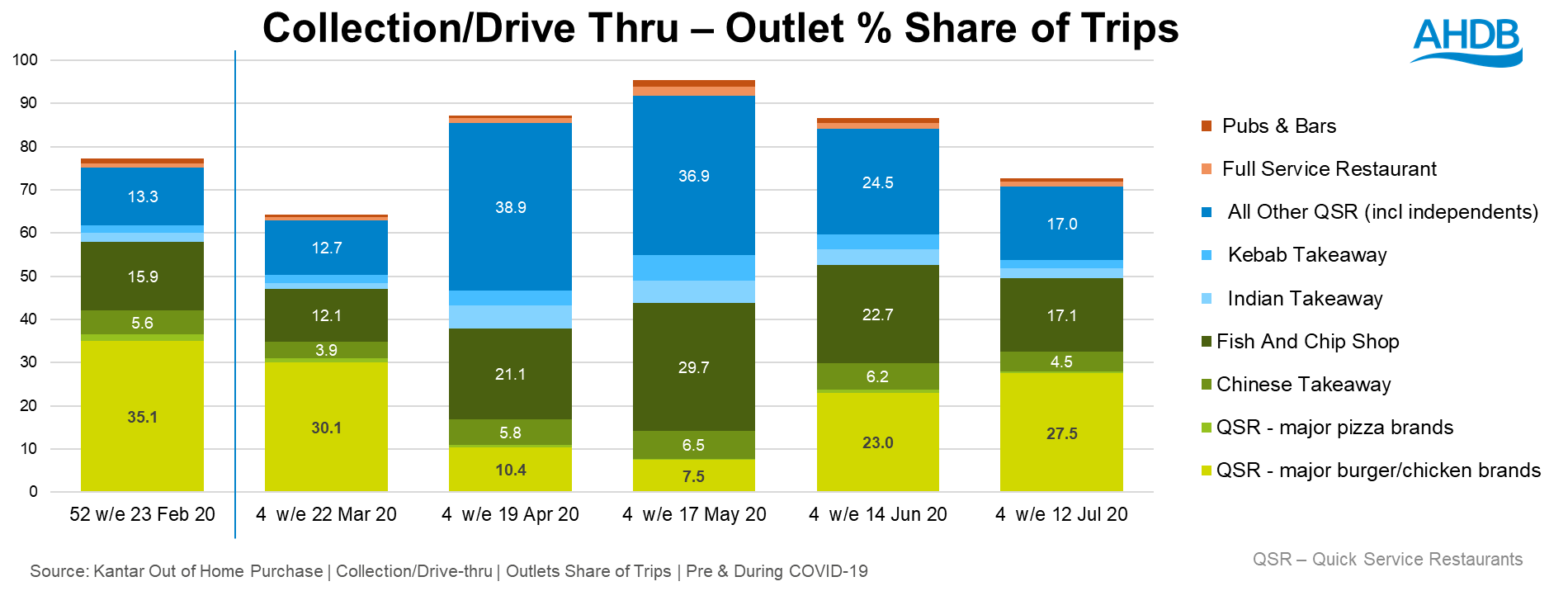

Chains (such as McDonald’s, KFC, Greggs) are key to the performance of the takeaway market, accounting for 58% of occasions pre-COVID. Therefore, their return to collections and drive-thru, following temporary closures at the start of lockdown, have been the main driver of this recovery.

The majority of this data covers the period before the reopening of cafés, pubs and restaurants. Therefore, it is currently unknown if these growth levels will be maintained, particularly as the introduction of the government ‘Eat Out to Help Out’ scheme offers an incentive for consumers to eat out of home during August. However, AHDB believes the in-home dining experience is a trend that many will adopt longer term. Future updates from AHDB will assess the overall impact on the out of home market.

Sector impact

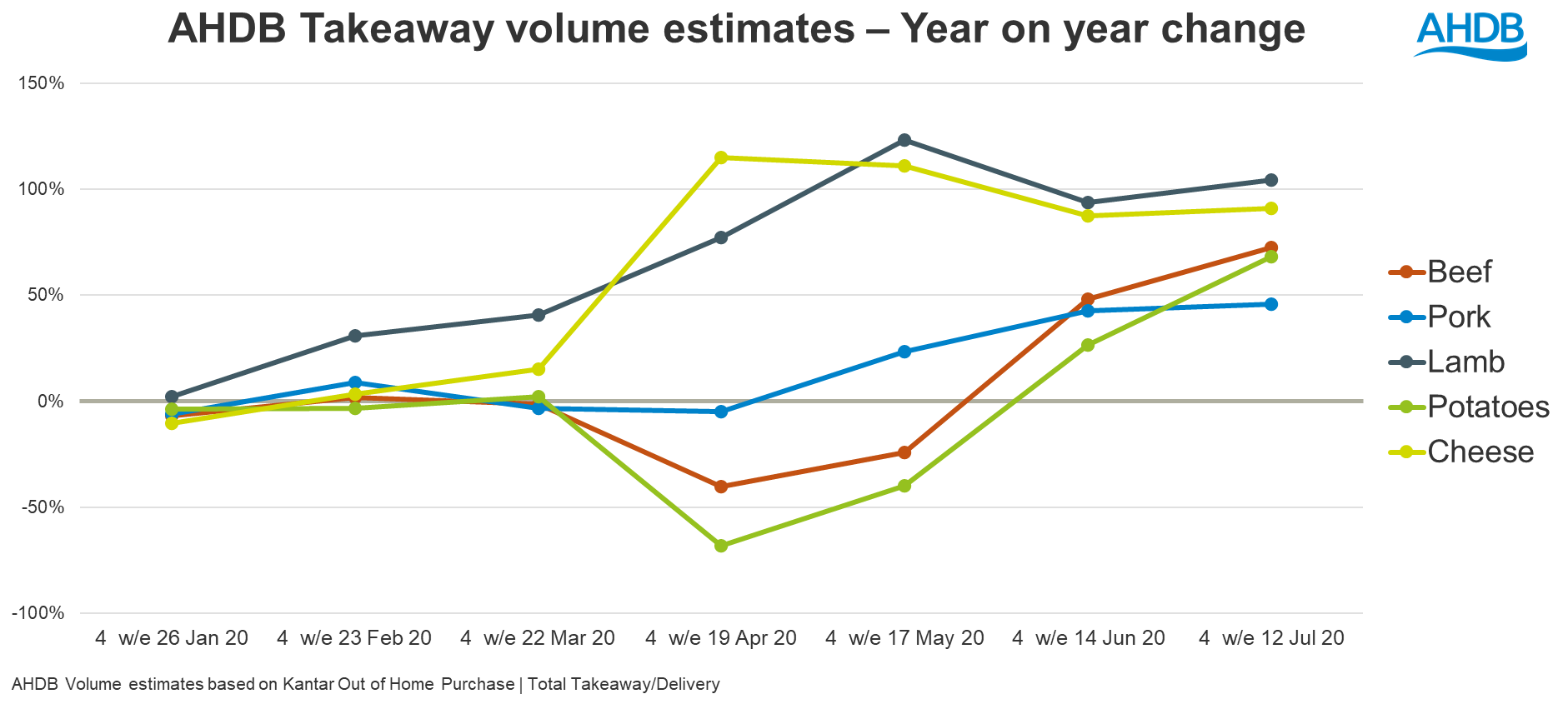

The absence of fast food brands at the start of lockdown hit the potato and beef sectors hard, with takeaway (collected/delivered) volumes in the first twelve weeks of lockdown down 35% and 22% respectively. However, the reduction in takeaway options benefitted cheese and lamb volumes early on, as people switched to pizzas and kebabs.

However, the reopening of most fast food brands has brought good news, with volumes for all sectors rising at pace, without negatively impacting lamb or cheese.

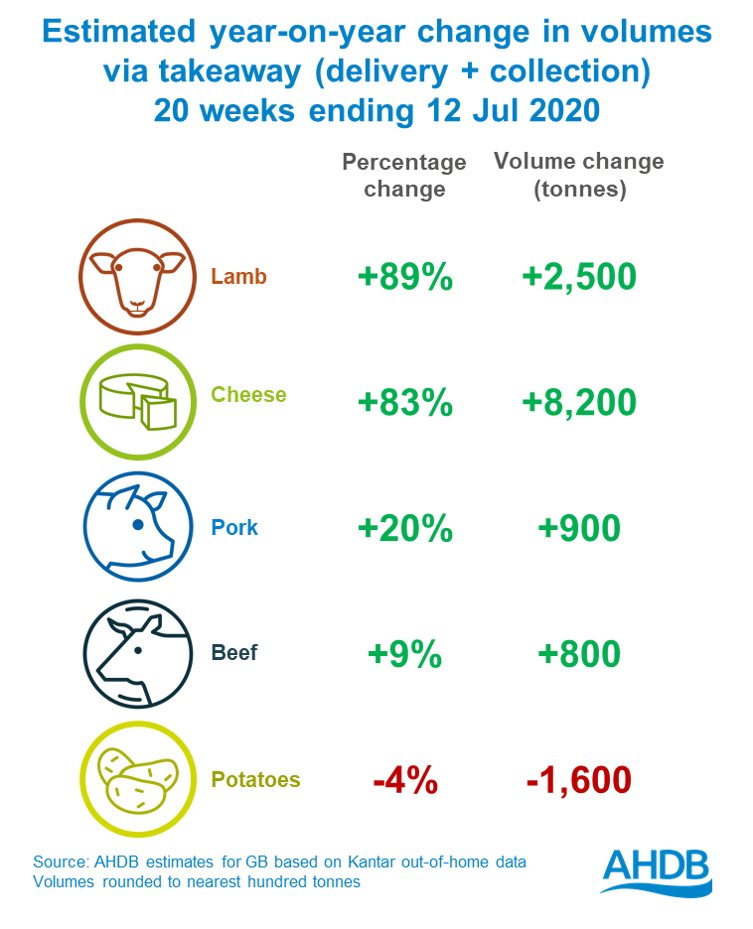

For most sectors, this meant volumes in the past 20 weeks increased significantly when compared to this time last year.

Lamb

Kebabs are key for lamb, accounting for 56% of estimated volume gains over this 20-week period. However, there have been increases for every dish in which lamb is present and Indian dishes in particular are providing further support to lamb volumes, which are up an estimated 700t in these meals.

Cheese

Pizza takeaways accounted for most of the growth in cheese volumes over the 20-week period, due to a move to pizzas at the start of lockdown. While pizza takeaways remain elevated when compared to 2019, increases have eased in more recent months as other operators started to reopen and consumers had more choice. Helping cheese more recently is its presence in cheeseburgers.

Pork

Pork has returned to year-on-year growth, with increases coming from a variety of sources. Ham and pepperoni pizzas are a core part of this, and Chinese takeaways have provided further growth. While breakfasts at many fast food outlets have been limited, the presence of bacon on popular beef and chicken burgers has also aided volumes.

Beef

Mid-July saw McDonald’s launch their ‘Welcome Back’ marketing campaign but even before this, people were hurrying to drive-thru and delivery orders. AHDB estimates suggest Big Macs alone accounted for 24% of beef volume growth in the 4 w/e 12 Jul 20. Combined with growth from other burgers, including those from other operators, as well as an increase in Chinese beef dishes, this has allowed beef volumes to return to overall growth during lockdown.

Potatoes

Despite fish and chip shops having a bigger share of the market under lockdown, potato volumes contracted due to the absence of big brands. June and July have seen better performance for the potatoes sector, however, gains in these months are yet to offset those early losses. These losses were further compounded by consumers dropping the amount of sides they ordered, as well as a shift in the types of meals they were buying. However, things are returning to normal and if the market continues at its current rate, it seems likely it won’t be long until these losses are compensated for; in the latest 4-week period, ending 12 July 20, potato volumes rose by an estimated 6,000t.

Summary

These recent takeaway trends show the extent to which the market is driven by outlets and suppliers, particularly the big brands. Their importance for this market cannot be underestimated. With choice now broadening and largely back to where it was pre-COVID, consumers have generally returned to their pre-COVID habits when it comes to takeaway.

With dine-in footfall still below pre-COVID levels, and takeaways proving to be a safe option for many, it’s likely the takeaway market will remain buoyant for some time. However, it’s worth remembering that takeaways account for a small proportion of volumes for our sectors and with the overall out of home market overall expected to contract by approximately 50% in this second half of 2020, it’s still likely that overall demand will be subdued. Read more in our Agri-Market Outlook forecasts.