Beef and dairy winners this Christmas

Tuesday, 2 February 2021

Covid-19 delivered a Christmas like no other. National and local lockdowns created a lot of uncertainty during the run up to the festive period, with many Christmas plans forced to change last minute due to government restrictions.

But all that uncertainty did not stop us from celebrating. 2020 was the biggest ever Christmas for food retail, with food and drink sales excluding alcohol growing by £912m to £8.1bn (Kantar, 4 w/e 27 Dec 20). However, this was not enough to outweigh the losses we saw in the out of home market, which declined by £1.4bn.

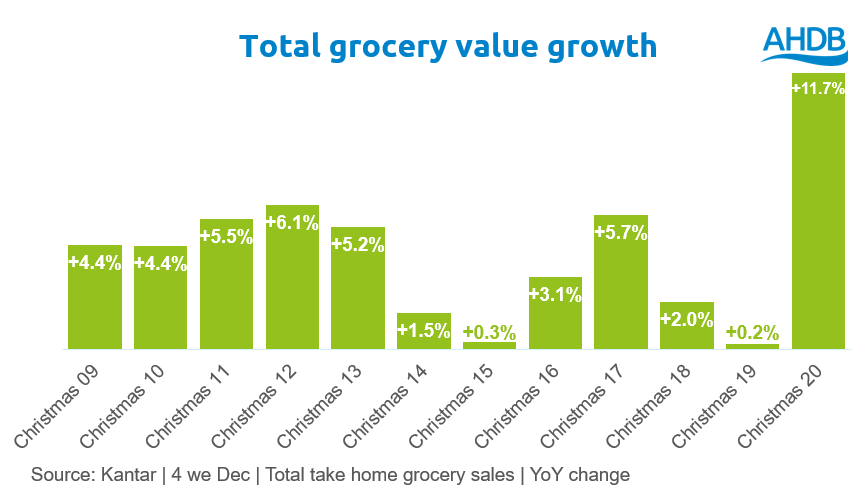

Grocery

With grocery sales up 11.7% year-on-year, 2020 saw the strongest Christmas growth ever in retail – a stark contrast to the previous year when sales saw minimal growth. Online was the big winner with an extra £695m spent in the 4 weeks to Christmas, benefitting those retailers with a strong online presence. The ‘big Christmas shop’ grew in size, with the average basket up £8.58 compared to the previous year. Consumers also shopped around less, in a continuation of shopping habits seen throughout 2020.

Preparations for Christmas started earlier than usual, with Monday, December 21st being the biggest shopping day for groceries. In previous years, the 23rd was the main shopping day. Therefore, we could assume that shoppers may have headed out earlier than usual due to concerns around stock levels and changes to household mixing, announced by government on December 19th.

Dairy

This was a great Christmas for dairy with spend up 14.1%, growing faster than the market. All categories in dairy saw strong growth.

Cheese volumes have been elevated throughout 2020, as households consumed more during lockdown. Christmas provided an additional boost, with volumes rising 16.7% in December to 47k tonnes. Cheddar was the biggest contributor to growth (+3k tonnes), but the fastest growing cheeses were halloumi (+62%) and mozzarella (+51%). This shows that consumers opted for more everyday cooking cheeses rather than cheese board selections, which lost share this Christmas due to smaller gatherings during lockdown.

December is usually the biggest month for cream and this year was no exception. 13% of total cream volumes in 2020 was sold in December. Synthetic and double cream contributed the most overall but crème fraiche was the fastest growing. Alcoholic cream, a typical Christmas favourite, grew slower than total cream. We also saw consumers buying less Christmas specific products and more everyday products due to their versatility.

Opportunities for dairy in Christmas 2021

- Over half of consumers want to go back to a ‘normal’ Christmas next year. Therefore, growth could come from encouraging cheese boards as an essential part of a normal Christmas.

- Inspire people to use cream with traditional Christmas desserts by pairing with Christmas pudding or mince pies and recipe cards for desserts which use cream, such as trifle.

- For shoppers with health concerns, remind them that the category still has healthier alternatives on offer, such as crème fraiche or reduced fat.

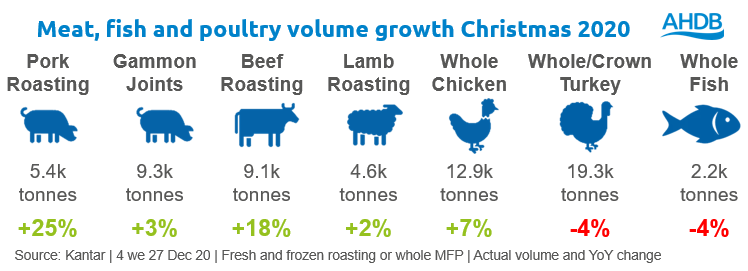

Meat, fish and poultry

Red meat enjoyed the best Christmas on record, out-performing both turkey and whole fish. Roasting joints and gammon saw an uplift of £62m in the 2 weeks leading up to Christmas compared to the average 2 weeks of 2020. All roasting joints saw volume growth, but gammon was bought by more households (26%) than any other Christmas cut. Turkey remained an important part of Christmas, being the second most popular protein, but more households adopted the trend of buying smaller birds and crowns. Primary fish had a strong December, up 20% in volume, but whole fish struggled.

With many Christmas gatherings this year being smaller than usual, it is no surprise that smaller cuts did particularly well. Despite shoppers buying smaller joints, an increase in the number of households buying roasting joints meant we still saw volume increases across most proteins.

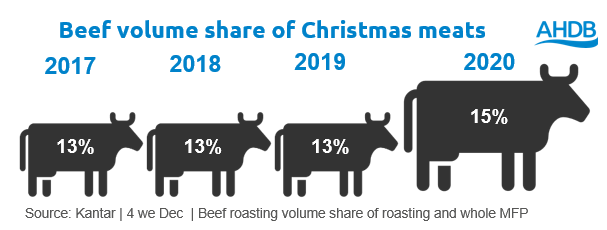

Consumers broke with traditions this Christmas as fewer, or no, guests meant people could cater to their personal tastes. Beef benefitted most and was the biggest contributor to volume growth (+1.4k tonnes), up 18%. This growth was driven by new shoppers as some consumers switched to beef roasting joints instead of turkey. This is the culmination of a strong year for beef, increasing its popularity, taking its share up to 15% of roasting and whole cuts.

According to IGD, half (49%) of consumers want to return to a normal Christmas for 2021, so maintaining this momentum when there are larger gatherings may mean reminding consumers about the great taste of beef.

Processed pig meat also had a great Christmas with volumes up 9.8%. Bacon contributed the most growth (+1.9k tonnes) followed by sausages (+1.3k tonnes).

Like the market, online was a great channel for MFP (although it still under trades) but red meat also performed strongly at butchers over Christmas with volume growth faster than total market for beef roasting joints (+62%) and lamb roasting joints (+38%). For more information read our article on butcher performance over Christmas and 2020.

An area which struggled this year was party foods containing meat. Fewer parties and large family gatherings meant chilled party foods saw a volume loss of 1.2%. With over a quarter (27%) of us planning a bigger than usual Christmas for 2021 (IGD shopper vista, January 2020) pushing party foods at bigger gatherings could see them return to growth.

Opportunities for red meat in Christmas 2021

- Customers broke with tradition and many switched from turkey to beef. As people look to return to a more traditional Christmas next year, reminding consumers of the great taste of red meat will help maintain momentum and keep the new tradition.

- Shopping online has been a huge trend of 2020. How can meat make its online share equal to that of in-store? Retailers can’t put meat right at the front of the store to attract people, but they can advertise on the homepage of the website.

- With many planning a bigger than usual Christmas next year, party foods can capitalise on additional social gatherings.

Related content

Topics:

Sectors:

Tags: