Lamb products and cow’s dairy felt the love this Valentine’s Day

Monday, 18 March 2024

Does Valentine’s Day still have a place in the hearts of shoppers? When questioned, just over a third of Brits said they were planning on celebrating this year (YouGov, January 2024). And while the majority of those celebrating were planning on doing so with a romantic partner, a significant proportion (16%) said they would celebrate with family and friends (YouGov, January 2024), suggesting that perhaps romance isn’t the only driver of festivities for cupid’s day.

Valentine’s day fell on a Wednesday this year, and historically mid-week celebrations can be muted in comparison to those on a weekend due to busy lifestyles and work commitments. However, it was clear that shoppers still felt the love for the romantic holiday, as sales of flowers, cards and Valentine’s gifting increased to £174 million this year (NIQ Scantrack, Valentine’s Gifting Categories, Total coverage inc Discounters, 2w/e 17 February 2024).

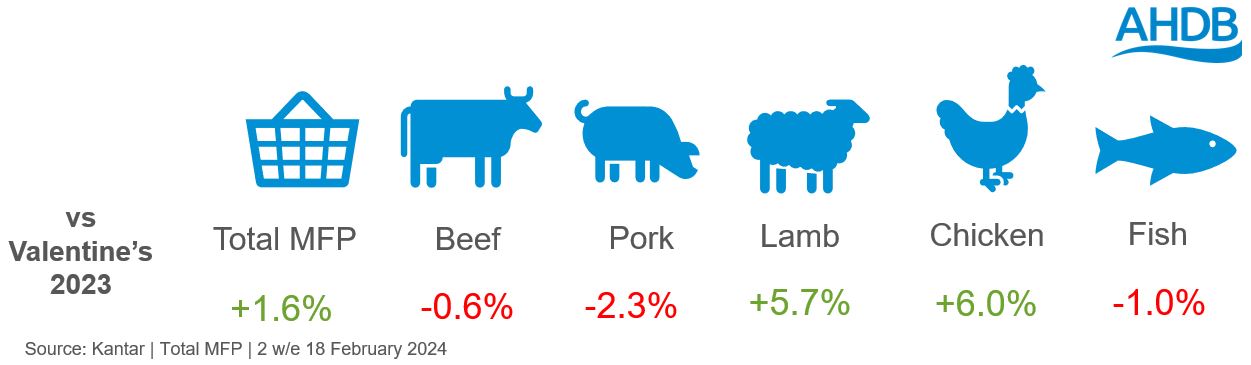

Meat, Fish and Poultry performance

Meat, fish, and poultry (MFP) are well associated with Valentine’s Day, and this year saw improved performance compared to Valentine’s Day 2023. Higher prices ensured that there was value growth, but increased demand for lamb and chicken also contributed to overall volume growth.

Valentine’s Day 2024 protein volume change year-on-year

Beef steaks remain a firm favourite

Earlier this year, we predicted that beef steaks would be a standout option for many celebrating. This was correct, as overall volumes purchased in the 2 w/e 18 February increased by 7.6% year-on-year, outperforming the total beef category which saw a slight decline.

Those who chose to indulge in steak this year seemed to be less constricted by budgets, as overall increases in purchases were driven by the more expensive cuts, with fillet, ribeye, and sirloin all seeing year-on-year increases. Shoppers switched into these more expensive cuts from rump steaks, which saw volumes purchased decrease by 14.3% year-on-year.

Rump and sirloin steaks were also seen to be featured heavily in many retailers’ meal-deal promotions. However, due to inclusions of butters in many of these packs, they are classified as an added-value marinade, rather than primary cut. When looking at beef marinade performance for this Valentine’s Day, volumes sold increased by 16.0% year-on-year. This volume increase came from both on and off promotion, which would indicate that new products may have played a part in this improved performance, and that promotions can be key in activating shoppers into different cuts.

A Valentine's Day surprise

Lamb is not classically associated with Valentine’s Day; however, this year saw volumes purchased increase by 5.7%, and outperform the total MFP market. A key driver of lamb’s performance was due to the success of added value products (such as marinated or sous vide products). These cuts saw an average price decrease of £1.52/kg (-11.0%) during the 2 w/e 18 February, and as a result, volumes purchased in the increased by 66.7%. There was a small increase in volumes of stewing, leg roasting joints, and mince purchased in the 2-week period, however added value products accounted for the majority lamb’s growth this Valentine’s Day.

Added value products during the Valentine’s period saw a significant uplift compared with the average two-week period for the 52 w/e 18 February 2024 (excluding the 2 week lead up to Valentine’s Day), whereas overall primary and processed lamb products underperformed.

Overall, promotional activity was reduced for lamb this year (-4.7%) which may have impacted demand. However, added value saw volumes purchased increase both on and off promotion, indicating that new products may have had a role in this.

Chicken also saw volume growth, however there was a reduction in the number of shoppers purchasing chicken products versus Valentine’s Day 2023.

Promotions = persuasion

The Valentine’s period is a key time for promotional activity, and this year was no different. Year-on-year promotional activity for MFP increased, and when compared to the rest of the year (50 w/e 4 February 2024) promotions saw an uplift of 1.4ppts, highlighting that retailers see the importance of supporting these special events.

Meal deals are often opportunities for shoppers to indulge and create a three-course in-home meal occasion, similar to one they might experience in the out of home market, but on a budget. This year in the week leading up to Valentine’s Day £36 million was spent on meal deals costing £10 or more (Kantar, week ending 14 February 2024). While volumes sold on meal deal promotions in the 2 w/e 18 February 2024 increased compared with the rest of the year, they decreased by 1.8ppts on Valentine’s 2023, and any promotional growth seen came from temporary price reductions and Y for £X deals.

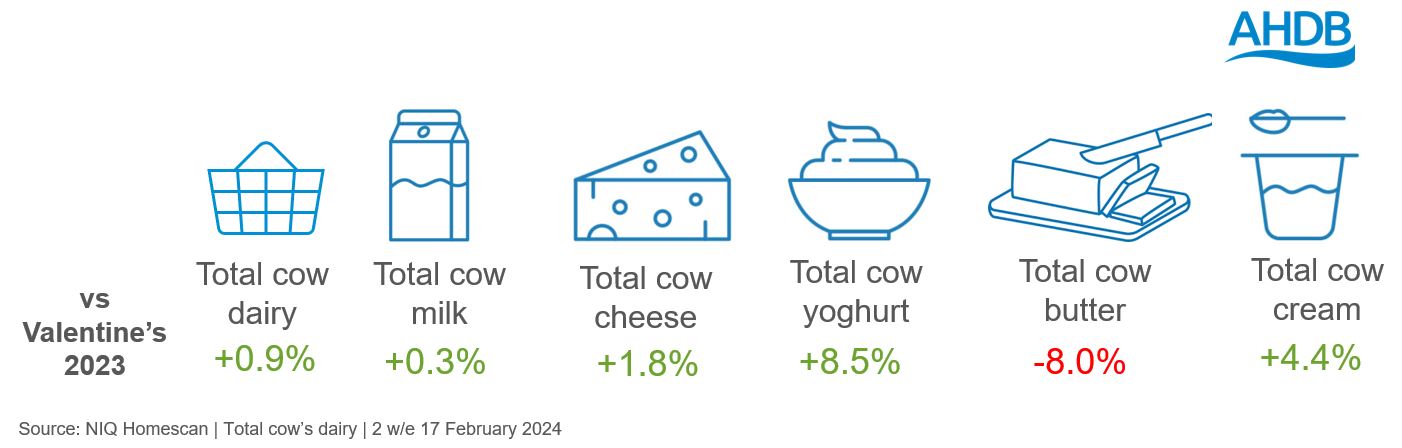

Dairy performance

Overall, cow dairy products performed well this Valentine’s Day, with an additional 1.97 million kg (+0.9%) purchased in the 2 weeks leading up to the loved-up holiday, and most products in volume growth (NIQ Homescan Panel, 2 w/e 17 February 2024).

Valentine’s Day 2024 cow dairy performance year-on-year

Last Valentine’s Day, cheeseboard type cheeses took a back seat as shoppers rationalised their spend. However, this year cheese was back on the menu, with cheese selections featuring in many retailers’ meal deal offerings. Volumes of cheddar, British regionals, and ‘other’ cow cheeses (including reduced fat and soft white cheeses) drove volume increases, as shoppers made use of promotional activity, and new shoppers were also attracted in to purchasing British regionals (NIQ Homescan panel, 2w/e 17 February 2024).

Cream also saw improved performance year-on-year. Volumes purchased of double, aerosol and crème fraiche increased on last year and were the key drivers for the overall performance of the cream category (NIQ Homescan panel, 2w/e 17 February 2024). These are all classically used as accompaniments to desserts, and fresh desserts saw pack volumes purchased increase by 0.8% year-on-year (NIQ Scantrack, Valentine’s food and drink, Total coverage inc Discounters, 2w/e 17 February 2024). With Pancake Day falling the day before Valentine’s, this may have benefitted aerosol cream sales as it can work well as a pancake topping, as well as an accompaniment to romantic meal desserts.

Yoghurt and cow’s milk continued on from their positive performance seen at Christmas, as while not normally associated with Valentine’s Day, volumes purchased in the 2 w/e 17 February 2024 increased by 8.5% and 0.3% respectively (NIQ Homescan panel, 2w/e 17 February 2024).They may have also benefited from pancake day falling so closely.

Impact of Pancake Day

Valentine’s day fell the day after Pancake Day (13 February 2024), which one in ten households planned to celebrate this year (NIQ Homescan survey, November 2023). Both events also coincided with school half term holidays for many areas, and this could have been a contributing factor to the additional £14 million spent on ‘Pancake Day categories’* versus last year (NIQ Scantrack, Total coverage inc Discounters, Pancake Day categories*, 2w/e 17 February 2024).

However, the combination of two celebratory events a day apart may have also had a negative impact on Valentine’s Day performance. Particularly for cost conscious consumers, choices may have had to have been made as to which of the two occasions they would celebrate. Equally, display space in stores is at a premium, and while there is cross over between some categories which may benefit sales, there will have been competition between the two celebrations for display space in store. This can have a significant impact on what shoppers’ purchase, as a quarter of Brits report seeking inspiration for Valentine’s gifts and celebrations from in-store advertising and activations (YouGov, January 2024).

Opportunities for Valentine’s Day 2025

- Look at how cuts and proteins outside of classically associated beef and steaks could be positioned for romantic meals at home, such as lamb. Ensure that promotional materials reflect these meals to help influence shoppers to pick up an ‘untraditional’ treat

- Valentine’s day will fall on a Friday in 2025, which may encourage celebration to roll over into romantic weekends, particularly breakfasts. This could be an opportunity for pork products, such as sausages and bacon, for use in breakfast sandwiches and full English breakfasts

- Next year, Valentine’s Day will fall separately to Pancake Day, so retailers can dedicate more space to Valentine’s promotions. This may have a knock-on negative impact for some dairy categories which benefitted from the dual-purpose nature of their purchase. However, due to the importance that marketing and displays play in how shoppers choose to celebrate, the increased display areas for purely Valentine’s products may increase the choices shoppers make and increase volumes and spend for MFP and dairy products

- Valentine’s Day doesn’t have to be seen as just a romantic event, and by broadening out appeal to cover ‘Palentine’s’ or ‘Galentine’s’ day, this opens celebration opportunities to wider demographics

*Pancake day categories include: Eggs, Milk, Flour, Golden and Maple Syrup, Butter, Icing Sugar, premade Pancakes, Lemon, Granulated sugar, Chocolate Spread, Berries

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: