Meal deal promotions boosted the love for meat this Valentine’s Day

Friday, 31 March 2023

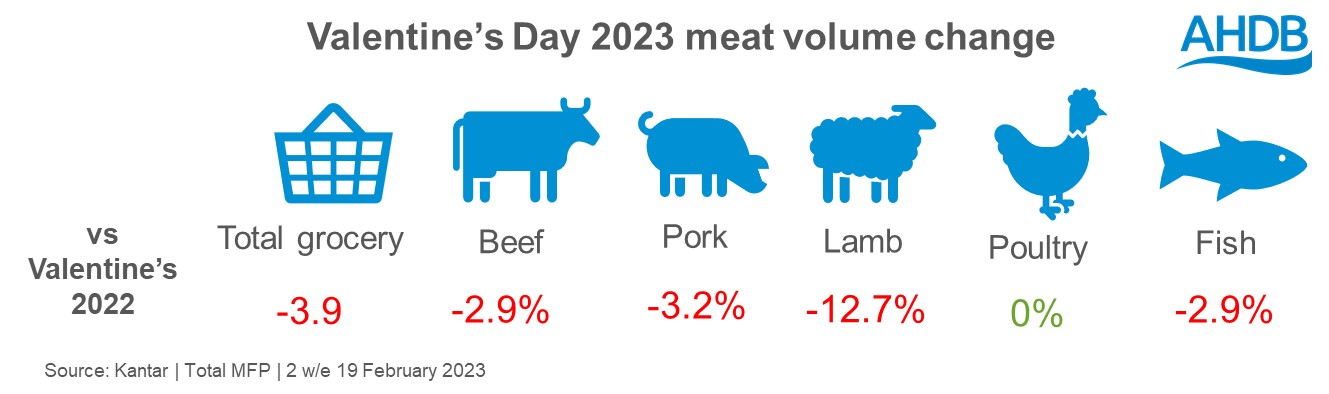

Meat, fish, and poultry performance

Meat, fish, and poultry (MFP) saw its lowest performance of the last five years in the two weeks over Valentine’s Day according to Kantar World Panel. However, all proteins apart from lamb performed better than total grocery, reaffirming its importance at this time.

Despite volume declines, shoppers spent £2.70 more on MFP during this loved-up period (Kantar, 2 weeks ending 19 February). This highlights MFP’s status as ‘treat’ products. Some people, though, appear to have been priced out of this category with inflation driving up average price per kilo by 78p. Consequently, the number of households buying these foods has dropped 0.2 percentage points (ppts), according to Kantar, two weeks ending 19 February 2023.

All protein volume sales declined aside from chicken which remained flat on last year. Again, price was likely influential, as chicken averaged £5.88/ kg, making it the cheapest protein in the category. We also saw examples of other cost-of-living behaviours with economy and value tiers seeing the highest growth within the category. However, the premium tier still outperforms at Valentine’s Day, indicating that, whilst some are being influenced by price, others are still deciding to treat themselves.

Beef is particularly important for this special occasion and, whilst this year saw declines in volume sales of 2.9% compared with 2022, it is still the best performing red meat during the period. Chicken and fish also performed better than some proteins, with data from Kantar indicating that they experienced an increase in promotions during this period. This highlights the importance of promotional activity to help drive sales, particularly in red meat categories which command higher price points.

This year, the majority of promotional growth for MFP came from meal deals. Many of the major retailers were running promotional activity around dining in for two, and these contributed to 6.4% of promoted MFP sales this Valentine’s Day, versus only 2.2% for the rest of the year.

Steak is frequently associated with Valentines Day and is more likely to be eaten during February than any other time of year. This year was no different with shoppers 9% more likely to buy steaks for Valentine’s Day compared to the rest of the year. However, volumes reduced by 9.4%. This is unsurprising as it is a higher priced cut. Despite this, sirloin steaks saw volume increases of 17%, the only steak cut to see growth. They are higher priced than the average steak, but have seen the slowest price increase compared to steaks in general (+3.5% compared with +9%) which may have contributed to this growth.

Overall, steaks in the 52 weeks ending 19 February have seen a drop in household penetration, as have the volumes and frequency of purchases. Consumers are cutting back on more luxury products during the cost-of-living crisis and opting for cheaper cuts such as mince. Steak’s importance at this time shows consumers still want to treat themselves and are prepared to spend more on luxury items at celebratory events.

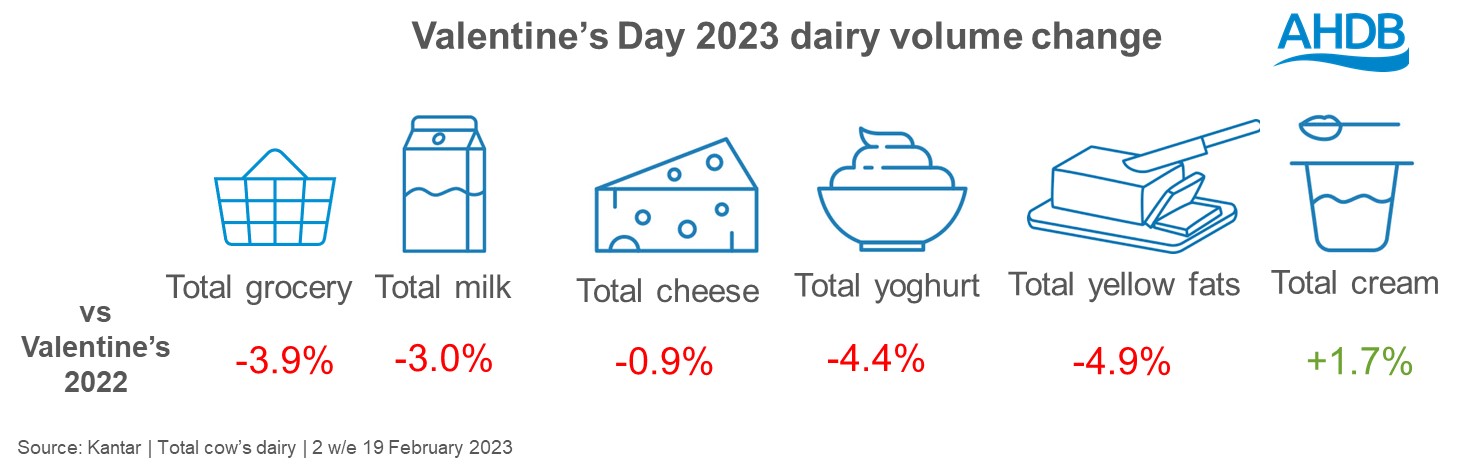

Dairy performance

Following two strong years, some dairy products seemed to struggle somewhat this Valentine’s Day compared to last year, in data according to Kantar World Panel. However, overall dairy performed well against total grocery.

Cream bucked the market trend and saw volume growth on last year, driven by double (+6.6%) and single cream (+12%). This suggests that consumers have been treating themselves to desserts this year, perhaps deciding to pick up some cream to go with the desserts offered in the promotional meal deals retailers were offering.

Last year, cheese performed particularly well showing growth both on previous years and pre-COVID. This year, cheese saw an overall volume decrease of 0.9% year on year, but again better than total grocery performance, with only cheddar and soft white cheese in growth (+2.3% and 2.5% respectively). This was due to standard promotional activity for these categories, rather than trends such as cheese boards, which have been present the last few years.

What is evident for both meat and dairy is the importance of promotional support around this key consumer period. With the economic recovery looking slow, this will be vital next year for the categories to see uplifts.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: