Cheese and continental meats thrive this Valentine’s

Thursday, 31 March 2022

A lockdown-free Valentine’s Day in 2022 resulted in grocery retail sales being unable to maintain recorded-breaking highs seen last year as consumers had the option to venture back out-of-home (OOH). In-home, however, consumers indulged in cheese and continental meat boards to celebrate. And while consumers are willing to pay more for romantic occasions promotional support will be vital next year to encourage celebrations which will fall mid-week.

For Valentine’s 2022 consumers had the option to treat themselves and their loved one to a meal out. Restaurants and pubs were open unlike last year when the nation was in lockdown due to the COVID-19 pandemic. The special day fell on a Monday this year meaning the weekend prior benefitted, as the last time it fell like this in 2011, Friday and Saturday saw the largest boost in sales.

Following the biggest ever Valentine’s for food retail in 2021, sales were unable to maintain this year with total grocery volumes down 10% year-on-year but up 1% versus the pre-COVID Valentine’s in 2020 (Kantar 2 w/e 20 Feb 2022). While this suggests more volume through the OOH market, the number of households that visited restaurants, pubs and bars in the two weeks around Valentine’s Day still fell behind pre-COVID levels according to Kantar. This implies some consumers may have opted to not celebrate this year, potentially due to money concerns, or chosen cheaper alternatives to dining out such as takeaways and deliveries.

How did dairy fare this Valentine’s in retail?

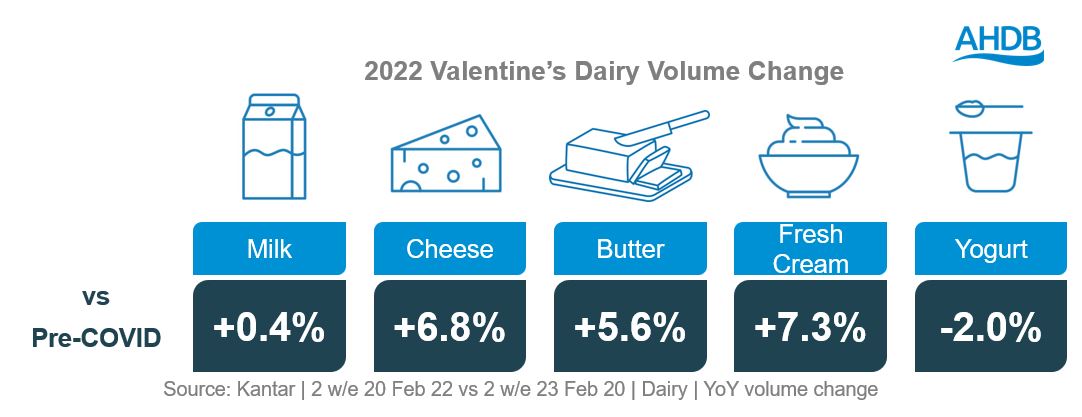

After seeing strong growth last year dairy continued to perform well this Valentine’s with volumes in the two weeks leading up to the event being up +0.8% versus the comparable time period in 2020 (Kantar, 2 w/e 20 Feb 22). A number of dairy categories are driving this, with volumes still significantly inflated versus a pre-COVID level.

Contributing most significantly was cheese with an extra 1.2m kg sold this Valentine’s versus 2020. Consumers wanting to treat themselves, coupled with strong retail advertising presence on cheese NPD and sharing boards, will have supported this performance. Cheddar accounted for 25% of volume increases, Speciality and Continental 24% and British Regionals 23%.

There were also volume increases in fresh cream, up 7.3% versus 2020, as consumers indulged in desserts.

How did meat fare this Valentine’s in retail?

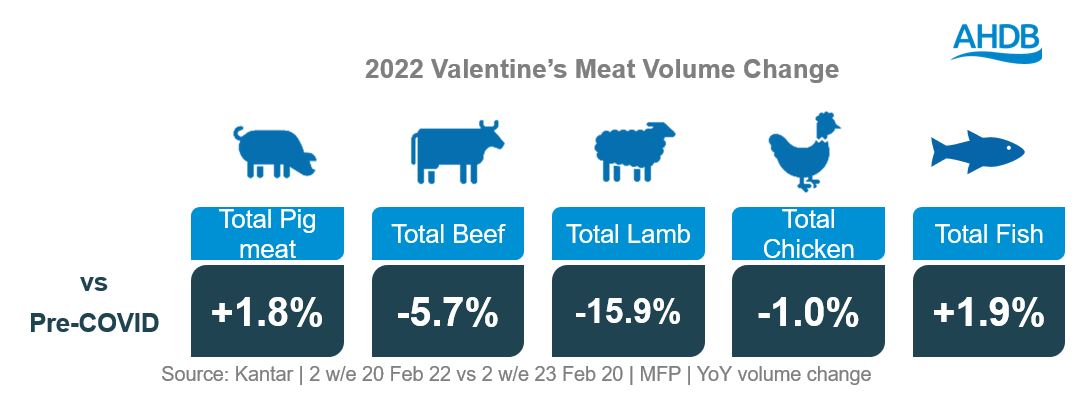

Like a lot of categories, 2021 saw the biggest ever Valentine’s for meat fish and poultry (MFP). In 2022, MFP in the 2 weeks leading up to Valentine’s were unable to maintain volumes, down 12.4% year-on-year and 1.8% on pre-COVID levels (Kantar, 2 w/e 20 Feb 22). What is concerning is the usual seasonal uplift we see for MFP at Valentine’s was not achieved in 2022. The event typically has the second highest average plate cost (behind Christmas), and shoppers spend on average 74p more on MFP during the period compared to rest of the year (Kantar 2 w/e 20 Feb 22). Therefore, declining MFP volumes will have a negative impact on the overall basket value for retailers.

What differed this year for MFP is a drop in promotional support resulting in an increase in average price at a time when purses are squeezed. For Valentine’s 2022 only 22.3% of MFP volumes were sold on promotion (Kantar, 2 w/e 20 Feb 22), compared to 29.8% for a pre-COVID Valentine’s (Kantar, 2 w/e 23 Feb 20). This meant that volume gains of +8.7% from non-promoted MFP sales were outweighed by significant volume losses of -26.5% from promoted MFP sales. Promotions, particularly dine in meal deals, are extremely important for the MFP category at Valentine’s because they drive higher value. In the 2 weeks leading up to Valentine’s Day this year promoted MFP had an average price per kg of £7.10, compared to non-promoted at £6.46. This is because more expensive cuts over index during the Valentine’s period (like ready-to-cook, steaks and sliced cooked meat), and premium tiers feature heavily in offers.

Promotions are particularly important for beef steaks which typically see a seasonal uplift for Valentines, but this year saw volume declines of -8.2% versus 2020. However, contributing more significantly to declines were ready-to-cook, joints/whole birds/fish, mince and processed, potentially due to less breakfasts as it fell on a Monday.

While MFP volumes were down overall versus pre-COVID there were certain cuts that bucked this trend. Sliced cooked meats contributed an extra 313k more kg this Valentine’s (Kantar, 2 w/e 20 Feb 22 vs 20). As mentioned earlier a focus from retailers on grazing and sharing boards supported continental meat growth of +33% in volumes versus Valentine’s 2020. This was driven by an increase in shoppers from 14% of the GB population to 17.4% buying in to the category those 2 weeks. There were also volume increases seen for burgers and grills, up 6.7% versus 2020, and marinades, up 30%.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: