Christmas boost for cheese and cream

Monday, 7 February 2022

Christmas provided a positive lift for total food and drink sales in retail and foodservice, reaching £15.3 billion over the month of December according to Kantar. Spend through retail was £11.7 over the 4 weeks to the 26 December 2021 as covered in our earlier Christmas article.

In December 2021, there were more occasions with guests than last year, 75 million, but this is still down from 125 million in 2019. However, the increase in guests didn’t result in more time cooking. As we predicted in December, convenience returned. Many consumers turned back to shortcuts and assisted products rather than preparing from scratch. Therefore, the average prep time for a Christmas dinner fell by 15 minutes. Party food also didn’t see a resurgence with volumes down on 2020 and 2019.

Grocery

Over December, the average household spent £412 on take home groceries, which is £66 more than the average month in 2021. However, the of the ‘big Christmas shop’ was down £3.31 on last year to £73.84. Despite this, as detailed in our previous article, premium own label was the only tier to see growth showing some consumers were looking for something extra special. The number of shopping trips was up on last year and this Christmas saw switching gains for supermarkets, with shoppers moving away from online and high street stores. The hard discounters and premium stores were the only ones to see growth on last year as shoppers expanded the number of stores they visited and shopped around for deals and luxuries.

Foodservice

Christmas gave a welcome boost to the foodservice market, with an extra 715 million occasions out of the home this December (Kantar Out of home). Spend in foodservice was up 40.5% on last year but down 7.8% on a pre-pandemic Christmas. Roast dinners overperformed the market with spend up 166% and occasions up 78% for December to 2.8 million occasions vs 2020. The average spend when buying a roast when eating out was £25.10 per person per meal.

Dairy in retail

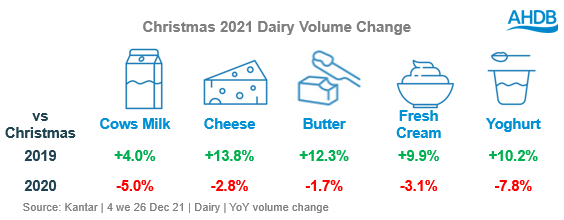

Sales of cow’s dairy reached £900m in December, with 99% of households buying dairy products (Kantar, 4 w/e 26 December 2021). Volumes were down 5% from the heights of 2020 but remained up 5% on 2019 levels.

Increased numbers of guests this Christmas boosted the dairy market as tea, coffee and cake saw the biggest uplift in share of guest servings. Snacking also grew during December with dairy drinks and coffee increasing their share of this day part.

Cheese saw the strongest volume increase on 2019 levels. Growth versus pre-pandemic was driven by shoppers buying more cheeses such as cheddar, paneer and mozzarella. Year-on-year there was growth for extra mature and vintage cheddars and Red Leicester.

During December, there is normally an uplift in pre-packed cheese boards and gifts as well as cheeses which would normally feature here. This year, 65% of cheese gifts and boards were sold in December, showing the importance of these products during the festive period. Christmas sales are critical for some cheeses where a large proportion of their sales are at this time. Stilton has the highest share of sales at Christmas with 23% of all stilton volumes sold in December. Christmas is also very important for Wensleydale and other British blue cheeses.

Cream is always a Christmas favourite, with December accounting for 13% of all cream sales in 2021. However, despite growth in Christmas desserts such as mince pies, fresh cream volumes were down 3.1% year-on-year but aerosol and alcoholic creams saw growth. Compared to Christmas 2019, volumes of cream were up as existing shoppers bought larger quantities.

Opportunities for next Christmas

- Next year Christmas day will fall on a Sunday, so we expect Friday the 23rd to be the biggest shopping day

- AHDB categories need a strong presence both online and in store

- Inflation and budgets are likely to play a large role, so understanding how your shopper is being impacted is crucial for the right product offering

- Cheese and cream shoppers are interested in new products, so highlighting Christmas innovation is vital

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.