Christmas sees red meat roasting growing faster than total grocery

Monday, 7 February 2022

Christmas provided a positive lift for total food and drink sales in retail and foodservice, reaching £15.3 billion over the month of December according to Kantar. Spend through retail was £11.7 over the 4 weeks to the 26 December 2021 as covered in our earlier Christmas article.

In December 2021, there were more occasions with guests than last year, 75 million, but this is still down from 125 million in 2019. However, the increase in guests didn’t result in more time cooking. As we predicted in December, convenience returned. Many consumers turned back to shortcuts and assisted products rather than preparing from scratch. Therefore, the average prep time for a Christmas dinner fell by 15 minutes. Party food also didn’t see a resurgence with volumes down on 2020 and 2019.

Grocery

Over December, the average household spent £412 on take home groceries, which is £66 more than the average month in 2021. However, the of the ‘big Christmas shop’ was down £3.31 on last year to £73.84. Despite this, as detailed in our previous article, premium own label was the only tier to see growth showing some consumers were looking for something extra special. The number of shopping trips was up on last year and this Christmas saw switching gains for supermarkets, with shoppers moving away from online and high street stores. The hard discounters and premium stores were the only ones to see growth on last year as shoppers expanded the number of stores they visited and shopped around for deals and luxuries.

Foodservice

Christmas gave a welcome boost to the foodservice market, with an extra 715 million occasions out of the home this December (Kantar Out of home). Spend in foodservice was up 40.5% on last year but down 7.8% on a pre-pandemic Christmas. Roast dinners overperformed the market with spend up 166% and occasions up 78% for December to 2.8 million occasions vs 2020. The average spend when buying a roast when eating out was £25.10 per person per meal.

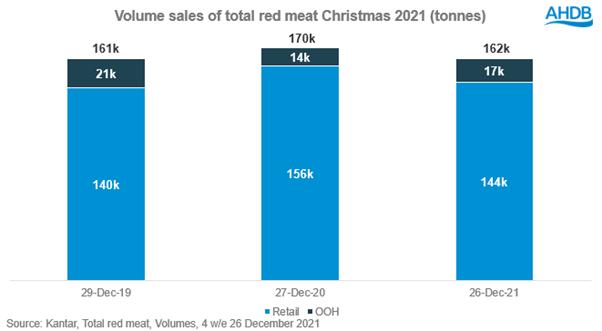

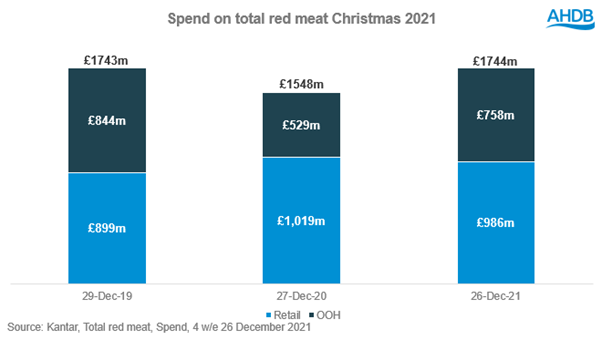

Red meat total market

Looking at the total red meat market at Christmas (retail and foodservice) the impact of eating-out restrictions in 2020 was apparent on market value despite volumes booming through retail. Christmas 2021 showed signs of a return to pre-pandemic levels with shoppers still buying more red meat volume through retail compared to Christmas 2019 but now only compensating for foodservice losses rather than exceeding like in 2020.

Meat, fish and poultry in retail

Total meat, fish and poultry (MFP) saw declines in both value and volume in comparison to last Christmas, but both are up on 2019 levels. During December, 98% of households purchased MFP, resulting in huge retail value of £1.9bn (Kantar, 4 w/e 26 December 2021).

Positively for the red meat category spend on roasting joints were up 2.2% year-on-year in the 4 weeks ending 26 December 2021, compared to a slight spend decline for total grocery. We had 107 million roast dinners in Britain during December, but this was down from 118 million in 2019. However, our roasts did feature more people this year with 38% of occasions being for 4 or more people.

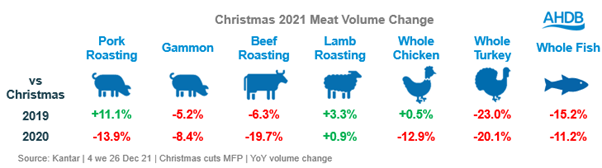

While it looks like less shoppers bought in to turkey this year, with news of shortages earlier in the year, we did see some panic buying of whole turkeys and crowns. For the 4 weeks ending 3 October 2021, sales of frozen whole turkeys and crowns were up 140% year-on-year, although from a small base. Overall, for the 16 weeks to Christmas, whole turkeys and crowns were down 9% year on year and 5% compared to pre-pandemic.

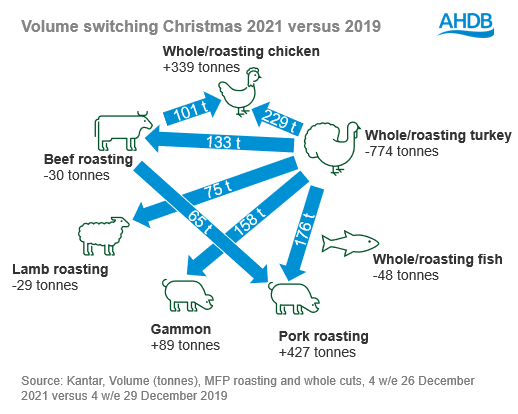

There was switching between the roasting cuts this Christmas. Compared to 2019, turkey lost to all proteins, in particular chicken as shoppers potentially scaled down their Christmas in both size and spend. Although beef saw large gains from turkey, overall volumes were lost as 2019 beef shoppers switched to chicken and pork.

Lamb is the only roasting cut to see growth year-on year. Leg roasting joints were driving this growth with leg volumes up 5.7% compared to 2019 but shoulder roasting is in decline. Lamb roasting growth came through an increase in volumes sold on promotion with temporary price reductions being the main mechanic used by retailers. Although it is a very small part of the market, it was frozen lamb which drove most of the growth in lamb roasting. As lamb lost volumes to switching, it was loyal lamb shoppers buying more which drove growth, therefore young families and empty nesters. This boost for lamb and the decline of turkey caused lambs share of roast dinners to increase to 11% in December 2021 compared to only 2% for Christmases in 2020 and 2019.

Pork was in growth compared to pre-pandemic. Shoulder and loin joints proved popular whereas leg roasting joints struggled. An increase in shoppers was the main driver of growth with pork roasting shopper numbers up 13.3% compared to 2019. A reason pork may be attracting so many new shoppers is its competitive price point. Shoppers are currently very price conscious and budgets are being squeezed. Grocery price inflation reached 3.5% in December, adding nearly £15 to shoppers’ average monthly grocery bill. Pork is nearly half the price of beef per kilo and even cheaper in comparison to lamb.

Pigs in blankets have struggled this year with volumes down 3.5% compared to 2019 but with sausages and bacon up individually, it could have been an issue of availability rather than shoppers turning away from the Christmas staple.

Beef roasting joints had a particularly strong Christmas 2020 and was unable to reach the same heights this year with a decline on 2019 and 2020. However, roasting was the only beef cut to decline compared to pre-pandemic in December. Burgers were one of the strongest performing cuts for beef showing the trend for fakeaways or recreating restaurant dishes at home is still popular in the Christmas month. Ready meals, pies and pastries also saw a strong performance as we see consumers need for convenient food starts returning.

Sales of total meat and poultry through butchers was up 1.5% compared to Christmas 2019 but volume sales were down 12.4% year-on-year. Growth on 2019 was driven by red meats while total poultry struggled to find growth this year. Butchers have failed to retain a lot of the new shoppers they gained during the first year of the pandemic as many return to previous shopping habits. Loyal butcher shoppers however have been buying more which is driving the growth on 2019, so keeping these shoppers engaged is essential.

Meat free

Meat free under indexes at Christmas and is in decline compared to last Christmas. Volumes were up 3.3% year-on-year for December, but were down in the last quarter of 2021. Growth came from both younger and older consumers. Meat free managed to attract new shoppers this December and gained in switching from a range of proteins in particular, chicken. However, all growth in meat free came from new shoppers as established meat free shoppers bought less than they did last year.

Opportunities for next Christmas

- Next year Christmas day will fall on a Sunday, so we expect Friday the 23rd to be the biggest shopping day

- AHDB categories need a strong presence both online and in store

- Inflation and budgets are likely to play a large role, so understanding how your shopper is being impacted is crucial for the right product offering

- As people look to return to a more traditional Christmas, reminding consumers of the great taste of red meat will help maintain momentum

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.