Red meat and dairy retail volumes up on pre-pandemic Christmas

Friday, 14 January 2022

Once again, Christmas provided a positive lift for grocery sales, reaching £11.7 billion over the month of December according to Kantar.

Spend was down just 0.2% on record 2020 sales. Despite fewer restrictions than last year, many people still chose to celebrate at home due to increasing coronavirus cases.

Shoppers indulged more this Christmas with mince pies and chocolates seeing boosts on last year. Premium own-label was a real winner as sales increased 6.8% this Christmas (Kantar, 4 w/e 26 December 2021). Alongside Christmas treating, rising prices also pushed up shopping budgets. Grocery price inflation reached 3.5% in December, adding an average £15 to shoppers’ monthly grocery bills.

Despite reports of stock shortages and early panic buying, the busiest grocery shopping day of the year remained the 23 December. The driver of bumper sales on 23 December was in-store shopping, as we saw the largest number of visits since March 2020. Despite many online stores having sold out delivery slots weeks in advance, online sales fell in December by 3.7% against 2020 and accounted for 12.2% of sales.

Meat, fish and poultry

Total meat, fish and poultry (MFP) saw declines in both value and volume in comparison to last Christmas, but both are up on 2019 levels. During December, 98% of households purchased MFP, resulting in huge retail value of £1.9bn (Kantar, 4 w/e 26 December 2021). This Christmas, foodservice outlets were open resulting in some consumers switching part of their spend and volume in to the eating out market, which had an impact on most grocery food categories as well as the levels of meat purchased through retail.

Positively for the red meat category spend on roasting joints was up 2.2% year-on-year in the 4 weeks ending 26 December 2021, compared to a slight spend decline for total grocery. This growth was driven by increases in average price through the premium tier, as overall volumes saw a decline year-on-year.

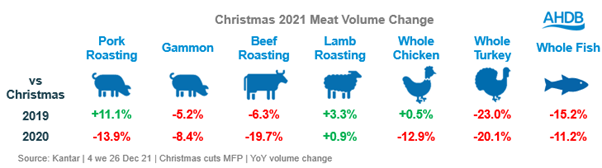

Most proteins saw roasting joints or whole cut volume declines on the heights of 2020 with lamb being the exception, up 0.9% on last Christmas.

Both pork and lamb roasting joints saw volume growth this December in comparison to Christmas 2019. Pork saw shopper numbers increase by 13.3% compared to 2019, with the main driver of growth coming from new shoppers to pork roasting joints. For lamb, volume growth was driven by repeat shoppers increasing the amount they bought.

Beef roasting joints had a particularly strong Christmas 2020 but was unable to reach the same heights this year. However, total beef was in growth in comparison to 2019 with growth coming from more everyday cuts such as mince and burgers.

Dairy

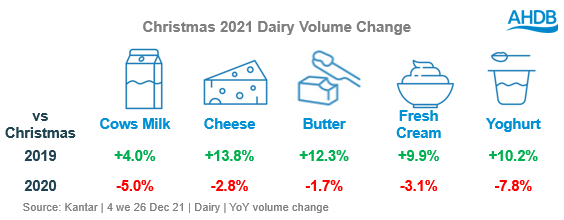

Retail sales of cow’s dairy reached £900m in December, with 99% of households buying dairy products (Kantar, 4 w/e 26 December 2021). Volumes were down 5% from the heights of 2020 but remained up 5% on 2019 levels.

Cheese saw the strongest volume increase on 2019 levels. Growth versus pre-pandemic was driven by shoppers buying more cheeses such as cheddar, paneer and mozzarella. Year-on-year there was growth for extra mature and vintage cheddars and Red Leicester, however other cheeses struggled, particularly soft continentals and mild cheddar.

Cream is always a Christmas favourite, with December accounting for 13% of all cream sales in 2021. However, despite growth in Christmas desserts such as mince pies, fresh cream volumes were down 3.1% year-on-year. However, aerosol and alcoholic creams saw growth. Compared to Christmas 2019, volumes of cream were up as existing shoppers bought larger quantities.

For a more detailed view of dairy performance over the last year, please see our dairy retail dashboard.

We are now doing a full analysis of Christmas sales and we will publish a full Christmas review in early February.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: