Strong retail performance for meat and dairy during Valentine’s 2021

Thursday, 25 March 2021

The Covid-19 pandemic and resulting national lockdowns created an unprecedented challenge for consumers who would usually eat-out on Valentine’s Day. Forcing consumers to look for new or different ways to celebrate the romantic occasion.

But did we celebrate?

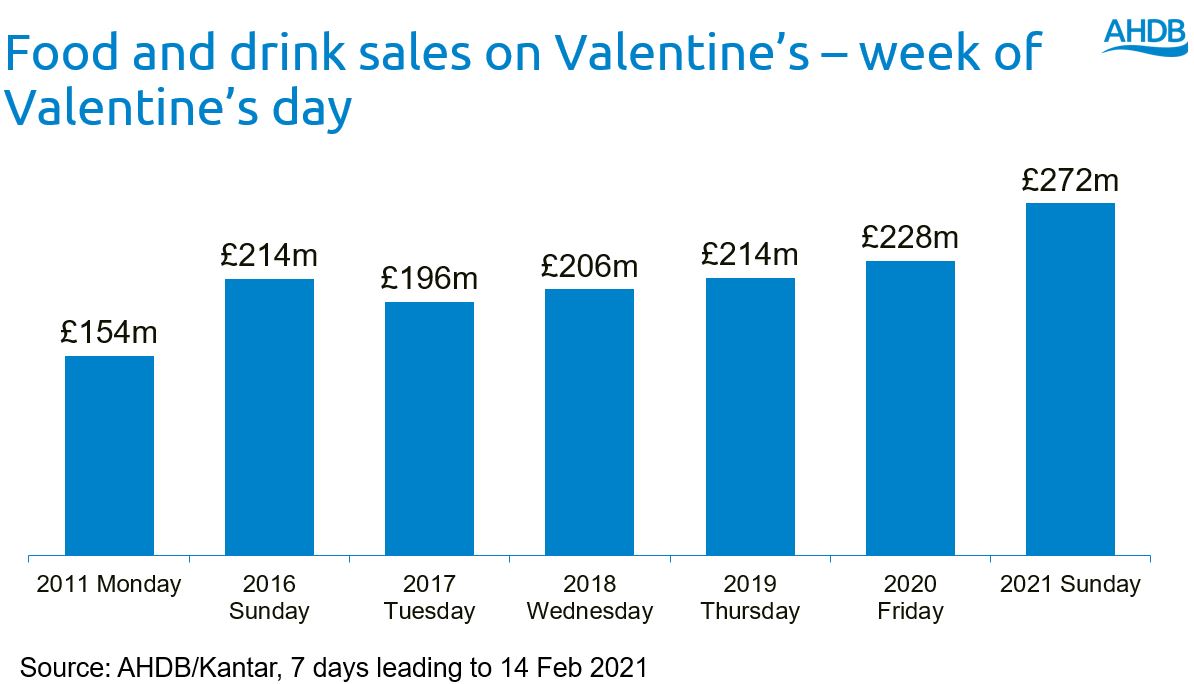

The Covid-19 pandemic did not stop us from celebrating, 2021 was the biggest ever Valentine’s for food retail, with total Valentine’s food and drink sales up £85m compared with 2020 (Kantar 2 w/e 14 Feb 2021).

Steak felt the love in lockdown

2021 saw the biggest ever Valentine’s for meat fish and poultry (MFP), with an extra 16m kg sold versus 2020. In the two weeks leading up to Valentine’s Day compared with the average 50 weeks of the year, beef steaks performed exceptionally, with a retail volume uplift of 26%, ahead of total MFP at +4%.¹ This is slightly higher than the uplift we saw for the same period last year of +25%.²

All cuts of beef steak saw volume uplift in the two weeks leading up to the date, with fillet (+29%), ribeye (+29%), and sirloin (+34%) seeing the largest volume uplifts.¹ This shows consumers were willing to pay more for a ‘treat’ to celebrate the romantic occasion.

Takeaways proved a popular option

Takeaways proved an attractive option for consumers this Valentine’s, with an uplift in value of 112% in the week ending 14 Feb 2021, which is significantly higher than the uplift caused by Covid-19 throughout the rest of the year at +75%.³

Chilled potatoes were the perfect pairing

In the two weeks leading up to Valentine’s Day compared to an average two weeks of the year, retail volumes of chilled and fresh potatoes saw an uplift of +42% and +9% respectively. The stronger growth for chilled potatoes showed signs that consumers are more likely to purchase chilled potatoes for a treat at special occasions.¹

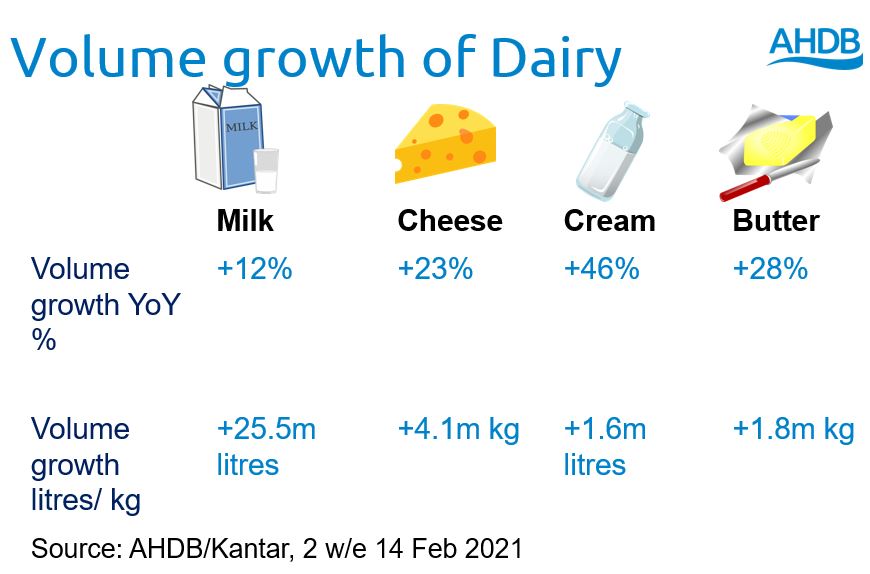

Dairy did well

Dairy performed well this Valentine’s with many categories seeing year-on-year volume growth. Consumers treated themselves to cheese, with volume growth of +23%, compared with the two weeks to Valentine’s Day last year.⁴ This accounts for an extra +4.1m kg of cheese sold. Cheddar (+22%), speciality and continental (+40%), and soft white cheese (+37%) drove this growth in volume, as consumers looked for taste and variety in the Covid-19 pandemic. Butter volumes increased by 28%, accounting for an extra 1.8m kg sold, following the increased trend for scratch cooking, and baking as a result of the Covid-19 pandemic. There were also volume increases in fresh cream sales, up 46%, as consumers indulged in puddings.

What can the weekday tell us?

The closer Valentine’s is to the weekend, the higher the value of the event week. Valentine’s 2022 will fall on a Monday, the last time Valentine’s Day fell on a Monday, in 2011, daily Valentine’s category sales dropped significantly on the Sunday before the event. A result of reduced retailer trading hours, impacting last minute Valentine’s purchases. In 2011, the two largest days for Valentine’s sales were the Friday and Saturday, therefore, it would be advisable for retailers to be mindful of stock levels of Valentine’s offerings in-store and online on these key dates for Valentine’s 2022.

Seasonal events 2021

Governmental restrictions placed on consumers have significantly impacted the dynamics of key events such as Valentine’s, where previously consumers could have eaten-out. AHDB’s eventing report highlights the importance of key events for food consumption habits.

We will continue to monitor and report on key events throughout 2021, following the government’s roadmap to lifting lockdown. Currently Easter, a key time for family and friends to gather for a meal, could see an easement in government restrictions, allowing a maximum of two households or six people to mix outdoors. If family and friends are not allowed to mix indoors, this could have a significant impact on products which rely on the seasonal event such as lamb.

Further information on how Easter performed during the first lockdown

¹ Kantar 2 w/e 14 Feb 2021 vs. Year Average: 50 w/e 31 Jan 2021

² Kantar 2 w/e 16 Feb 2020 vs. Year Average 50 w/e 2 Feb 2020

³ Kantar 1 w/e 14 Feb 2021 vs. Year Average: 51 w/e 21 Feb 2021

⁴ Kantar 2 w/e 14 Feb 2021 vs. 2 w/e 16 Feb 2020

Related Content

Topics:

Sectors: