Christmas 2023: Udderly amazing cow dairy sales this Christmas

Monday, 29 January 2024

This year saw a record-breaking Christmas week for sales with £4.8bn spent on total grocery, an increase of 4% year-on-year (w/e 23 December 2023, NIQ Homescan Panel). As predicted in our ‘save or splurge’ article, inflation remained a key driver of growth, and we saw that shoppers economised on some items to be able to spend on indulgences, and retailers turned to promotions to combat price intensity. As a result, total grocery saw volume growth in the two weeks of Christmas (w/e 23 and 30 December 2023).

Dairy category performance

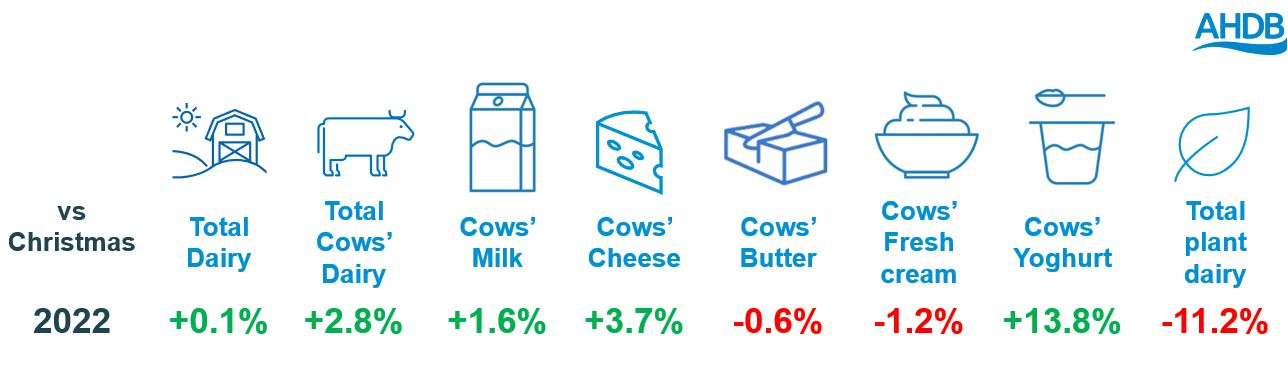

In the two weeks leading up to Christmas, shoppers spent more than £593 million on total dairy products (including cows’, plant and other animal) – a 2% increase in spend year-on-year. While price inflation has been a hot topic for shoppers and a key driver for increased retail expenditure throughout the year, cows’ dairy did see volume growth match value growth this Christmas – up 3% on 2022. Cows’ dairy also equated to 94% of total dairy volume sales – a two-percentage point increase on the previous year (2w/e 23 December 2023, NIQ Homescan Panel).

Christmas 2023 cows’, plant and total dairy retail volume changes

Source: NIQ Homescan Panel| Total GB| 2w/e 23 December 2023 vs year ago, volume change

Cheese

Overall, cows’ cheese saw an almost 4% increase in volume purchased this Christmas (2w/e 23 December 2023, NIQ Homescan Panel). In spite of this, and in line with our pre-Christmas predictions, there was an indication that shoppers were cutting back in some areas perhaps perceived as non-essential, such as cheeseboards and convenience products. Volumes purchased of cheeseboard classics such as Stilton and British regionals (including Wensleydale and double Gloucester) were in decline, as were snacking and convenience cheeses (such as sliced/grated cheeses).

Despite seeing greater promotional activity year-on-year for these, retailers failed to entice more shoppers than last year, and there was a decrease in the average cheese volumes purchased per shopper in the Christmas period for all but Cheddar, processed, and speciality and continental cheeses. The strong volume growth for these cheeses (+3%, +9% and +5%, respectively) was, however, enough to offset the declines of the other varieties.

Cream

Cream is a staple accompaniment to many shoppers’ desserts at Christmas time, with meringue and yule logs being popular cream vessels, and this year was no different. There was a 7% increase in flavoured cream volumes purchased, driven primarily by an increase in the number of households who purchased some compared with Christmas 2022 (2w/e 23 December 2023, NIQ Homescan Panel). We also saw greater volumes being purchased on promotion this year, which perhaps tempted the increase in households which picked up a pot this year.

Overall cow cream performance was down 1% on Christmas 2022. However, the two-week volume sales still accounted for 10% of total cream sales for the year (52 w/e 30 December 2023), matching that of 2022. While most creams saw a reduction in volumes purchased year-on-year, double cream and crème fraiche performed well. Both benefited from a reduction in average price paid and saw an increase in the volumes purchased per shopping trip, likely influenced by the increased promotional activity for these products. This good performance was not seen to the same extent with the other cream varieties, and, as a result, they all saw volumes decline to some extent.

Yogurt

While yogurt is not normally a product associated with strong performance around the festive period, this year it saw the volumes purchased increase by almost 14% (2w/e 23 December 2023). Almost 1 million more households purchased yogurt in the two weeks running up to Christmas, which, coupled with an increase in the frequency of purchase, resulted in the strong volume growth year-on-year. Treat categories were an area where shoppers looked to control their spending this Christmas, with 29% of consumers reporting to spend less on desserts (IGD, 2024). Yogurts may have been substituted in by shoppers as a way of providing a pudding element to their meal without blowing the budget, as an average pack price of yogurts cost just £1.38 (2w/e 23 December 20023).

Dairy alternatives

In the two weeks before Christmas, there were decreases in both the value (-8%) and volumes (-11%) of plant-based dairy products purchased. All plant-based dairy alternatives, aside from cream, saw volumes decline in this period (2w/e 23 December 2023, NIQ Homescan Panel). Overall, there was a reduction in average volumes purchased by shoppers, as well as a drop off in the number of shoppers who were purchasing plant-based dairy products.

Average prices for plant-based dairy products increased above that of cows’ dairy, and promotional activity was lower over the Christmas period than the rest of the year. This may have influenced consumers who do not need to purchase alternatives due to health or dietary needs to instead purchase the cows’ dairy version of the product. Cows’ dairy during the Christmas period commanded 4% lower average price point than plant-based dairy; therefore, cost-conscious shoppers may have been swayed with what they were including in their shopping basket.

Tiers

As the second Christmas in this cost-of-living crisis, and after almost two years of shoppers displaying trading-down behaviours, it had been anticipated that premium, more expensive products would be negatively impacted in preference to cheaper options to save money.

However, this year all tiers saw volume growth, with premium seeing the largest increase at almost 7% (4w/e 30 Dec 2023, NIQ Homescan Panel). As in previous years, premium-tier cows’ dairy took a bigger share of sales in December compared with the rest of the year. And while last December-branded dairy lost out, this year it saw the second-largest increase in volume sales, benefiting from shoppers swapping in from economy, standard and premium tiers.

Prices will have impacted this, with standard and economy seeing price decreases year-on-year, and premium and branded products only experienced slight increases year-on-year (+4% and +2%, respectively).

Retailer performance

As predicted, at a total grocery level, discounters and premium retailers benefited this December. Retailers did well when they played to their strengths, with discounters visited for more basic items and premium retailers chosen for more luxury items. Most shoppers opted to shop at their regular retailer and were more likely to complete one main shop for their Christmas groceries than to shop around. This saw shoppers more likely to use the traditional Big 4 retailers for the bulk of Christmas shops than other retailers (IGD, 2024).

As a result, the 4w/e 30 December 2023 saw an improvement in the volume sales of cows’ dairy products for the traditional Big 4 retailers – up 3% on the previous year. Premium retailers also saw growth, up 5%, albeit from a smaller base. Despite discount retailers gaining value share of the market and increasing volumes sold over the year, they saw a decrease in volumes purchased this December compared with the previous year (4w/e 30 December 2023, NIQ Homescan Panel).

For more insight on what AHDB believes the next 12 months could look like, our predictions for 2024 and how this will influence retail sales of cows’ dairy products will be updated in February as part of our Agri Market Outlook.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: