Is there a market to export more UK red meat and dairy to Switzerland?

Wednesday, 27 March 2024

Switzerland is a net importer of food. Agriculture in the country is relatively small-scale, with farms generally being family-run. As such, agriculture only accounts for 0.6% of GDP, according to the OECD.

In February 2023, the Swiss Federal Council approved discussions to develop the 2019 trade agreement between Switzerland and the UK. This was created following the UK leaving the EU.

According to the UK government, in 2022 trade with Switzerland totalled £52.8bn. Switzerland is the tenth-largest trading partner of the UK. The UK has opportunities to grow its agricultural exports through reducing or removing tariff rate quotas (TRQs). Currently, TRQs are very strict and expensive for red meat and dairy.

A large proportion (45%) of farm income in Switzerland comes from farm support payments (OECD, 2023). However, over time these payments have been reducing and so has agricultural production. When coupled with rising production costs over the last few years, this is threatening specialised domestic production of red meat and dairy. This is especially the case for numbers of dairy producers, which have fallen by more than half over the last 25 years. Dairy farms are disappearing at double the rate of other food producers.

This comes as larger supermarkets continue to make profits on dairy products, despite rising energy costs, as their prices do not cover the increasing milk-production costs.

Consumer demand

Despite the small scale of agriculture, Schweizer Bauern reports that approximately 80% of Swiss meat consumption comes from domestic production. Additionally, according to The New York Times, nearly two-thirds of all cheese consumption is from local cheese.

Consumers place high importance on domestically produced meat and cheese, despite its higher price, due to the perceived quality of local produce.

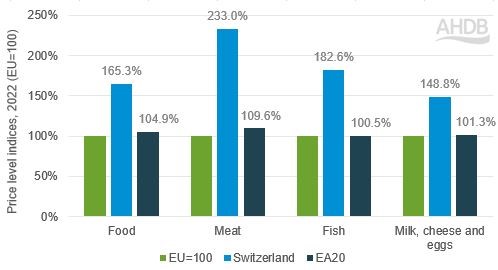

Swiss consumers have one of the highest disposable incomes globally. However, food in Switzerland is the most expensive in Europe. Meat comes in at 133% more expensive than the European average, while milk, cheese and eggs cost 48.8% more (Eurostat).

Figure 1. Price level indices of Swiss meat and dairy products

Source: Eurostat 2023, Comparative price levels for food, beverages and tobacco

According to the USDA, Swiss consumers spent $4,313 per person on food in 2021 – the highest amount globally.

While the small-scale, specialised production of meat and dairy within Switzerland results in high prices, importing these products is also costly. Swiss imports are regulated by strict TRQs, which provide market price support, according to a 2023 OECD report on Switzerland.

Despite their high income, these high prices mean Swiss consumers eat less meat than their European neighbours. OECD forecasts that by 2029:

- Beef and pork consumption per capita are both expected to reduce by 1.1%

- Sheep meat consumption is expected to dip by 0.8%

- Poultry consumption is expected to rise (+3.8%) as it is the cheapest protein

Swiss shoppers have also been impacted by the cost-of-living crisis. This has led to a growth in demand for private label products, and discounters have gained share as a result (IGD).

According to IGD’s country report on Switzerland, there has been an increase in the importance of ease and convenience when shopping. Consumers have been purchasing more on-the-go items and ready meals − perhaps as an alternative to eating out, i.e. to save money.

Coming onto retail channels, IGD forecasts grocery market sales to grow by 11.2% between 2022 and 2027. By 2027, IGD forecasts that supermarkets will remain the largest grocery channel, accounting for 37.1% of all sales. This is a small decline on its market share in 2022.

Convenience stores are predicted to overtake the traditional channel (independents/street vendors/kiosks and food markets) to become the second-largest retail channel. This is due to growing consumer demand for food-to-go and other convenience meals. Discount stores are also forecast to be one of the fastest-growing channels, opening more stores as value and affordability is expected to remain key for consumers.

When looking at cheese demand specifically, Swiss consumers have been eating more cheese (Swiss info, 2023). However, this is in the form of cheaper, imported varieties. According to The New York Times, the percentage of total cheese consumption made up of local cheese has fallen to just under two-thirds. This has been helped by the increasing selection of cheese, especially for lower prices. Additionally, the strengthening of the Swiss franc has made food exports more expensive but imports cheaper.

Trade

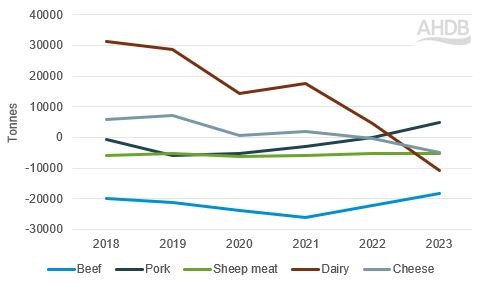

Figure 2. Full-year trade balance for red meat and dairy

Source: HMRC, via Trade Data Monitor LLC

Red meat

Data from Trade Data Monitor LLC shows that beef and lamb imports far outweighed exports in 2023. However, imports have been declining over the last couple of years, potentially due to reduced demand from price pressures.

For pork, the UK only supplies a minimal amount to Switzerland. Full-year Swiss pork imports have also been reducing, a trend seen since 2018, with the country now a net exporter.

Imports of UK beef

In 2019, Swiss imports of UK beef dropped by 46% year-on-year, and the pandemic negatively impacted trade further as imports remain even lower than 2019 levels.

This further drop came as UK exports were mainly going into foodservice. The DW news service explained that lower-priced, imported meat is typically used in foodservice to try and save money. Swiss restaurants are more expensive than those of all other EU member states (Eurostat, 2023).

Some of this drop-off in UK exports has been picked up by other major exporters, which has helped counteract some of the recent demand declines.

Imports of UK sheep meat

While total Swiss imports are in decline, Switzerland is increasingly reliant on imports from the UK. These have increased over the last couple of years and now make up around 22% of total sheep meat imports. Can the UK continue to capitalise on this and increase exports further?

Dairy

Switzerland is now a net importer of dairy, and import volumes have increased compared to pre-pandemic levels. Both imports and exports did fall year-on-year in 2022, perhaps due to cost-of-living pressures reducing demand. This decline was more pronounced for exports, which continued in 2023. By contrast, imports have grown. This reflects the shifting trade balance towards Switzerland being a net importer – prior to 2022, exports outweighed imports.

Cheese has followed a similar trend, and makes up around 58% of dairy imports. Imports have generally been increasing, with the exception of 2022. In 2023 imports were in growth compared with the five-year average. Meanwhile, exports have been on a downward trajectory since 2021 (HMRC, Trade Data Monitor LLC).

Currently, the UK is only a small player in the Swiss dairy market. Year-to-date, dairy and cheese imports from the UK only account for 0.9% and 1.6% of total imports, respectively.

But with the cost-of-living crisis continuing across the continent and discounters gaining share of the Swiss retail market, could we see more UK red meat and dairy exported to Switzerland and purchased through retail? This could present an opportunity for the UK.

Opportunities for UK exports

Compared with the high price point of Swiss-produced meat and dairy, the lower cost of production of UK products makes domestic red meat and dairy competitive on the export market − especially with the Swiss exchange rate favouring imports. As a result, price remains one of the key selling points for UK exports to Switzerland as its shoppers look to save money.

Although the high price of restaurant meals may be limiting out-of-home consumption, consumers are returning to pre-pandemic trends. With this, we could see consumers look for cheaper meals containing meat and dairy. This provides an opportunity for UK exports to Switzerland. Affordable UK products can help meet this demand without compromising on quality and price.

Yet price is not the only selling point of UK meat and dairy. British red meat and dairy is among the most sustainable in the world; strong messaging around this could improve Swiss consumers' perception of imported UK products. This kind of messaging features in our domestic marketing campaigns, such as Let's Eat Balanced. IGD report that sustainability is becoming increasingly important to Swiss shoppers. As shoppers become more eco-conscious and retailers expand their sustainability ranges, UK meat and dairy is well placed to meet demand.

Linked to this, while the price of organic products remains a concern, increasing demand has positively impacted sales of these products. In the UK, organic red meat and dairy sales volumes are suffering, due to its high price point. However, Swiss consumers already expect to pay a high price for meat and dairy. This could provide an opportunity for increased exports to Switzerland to meet this demand at a reasonable price.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: