Trust in British agriculture and consumer perceptions on the environment

Friday, 1 December 2023

AHDB’s recent trust and transparency research conducted by Blue Marble in August 2023, found consumer trust in British agriculture remains strong and that the environment is important to 51% of consumers when choosing food. However, consumers are carefully balancing household finances due to the cost-of-living crisis, so while interest in the environment is strong, it sits alongside cost and quality in terms of priorities.

Perceptions of British farming

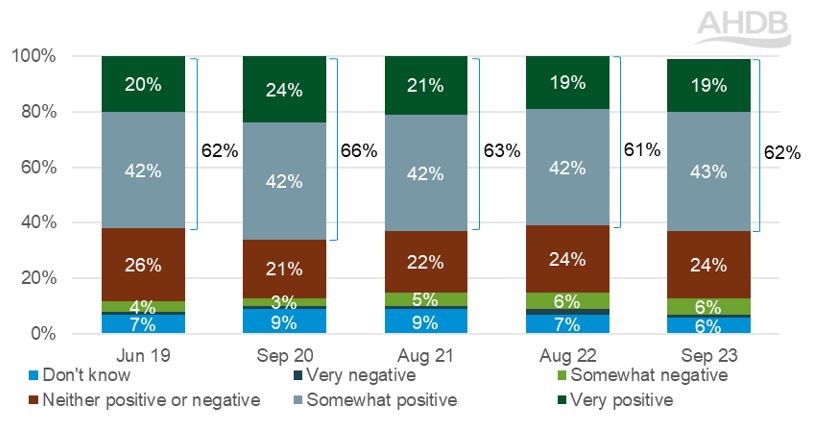

As part of AHDB’s continual focus on the reputation of British farming and agriculture, we have been tracking consumer trust and the effect on the environment since 2019. The latest results of our AHDB/Blue Marble study show that consumer perceptions of agriculture remain very positive with over 60% feeling very or somewhat positive towards British agriculture over the last 5 years. There was an increase in positivity in 2020, due to a greater consumer focus on the food supply chain as a result of Covid.

The majority of UK citizens feel positive towards British agriculture

Base: All respondents 2019(1500), 2020(1578), 2021(1501), 2022(1576), 2023(2085)

Source: AHDB/Blue Marble 2023. Q25 Please indicate your overall impression of British agriculture.

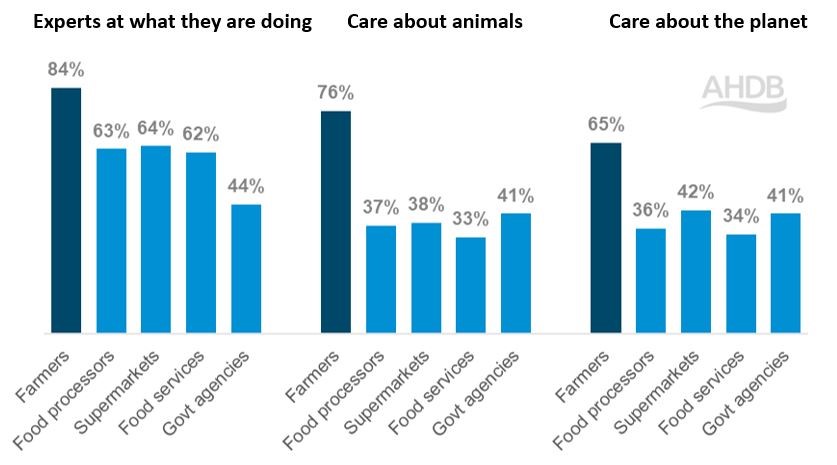

Farmers continue to be the most trusted sector of the food supply chain with 71% of consumers agreeing that farmers are ‘trustworthy’, compared with supermarkets and food processors scoring 50% & 41%. Consumers also rank famers significantly above other areas across the supply chain for their expertise, animal welfare and caring for the environment.

Percentage who strongly or tend to agree

Source: AHDB/Blue Marble 2023. Q24 Thinking about all elements of the food system, how much would you agree or disagree, where 1 is strongly agree and 5 is strongly disagree? Base all respondents 2023(2085)

Consumers are more concerned today about environmental issues but due to the cost of living, are increasingly having to change their lifestyle habits and choose factors such as price and quality over reputational topics such as health, sustainability, animal welfare and the environment.

Which environmental factors have the biggest influence on consumer views towards farming and the environment

The trust study carried out by AHDB went into further depth around consumer views across environmental factors. According to this research, the public are more concerned now about environmental issues than in 2020, with particular interest in water issues relating to water pollution (74%) and in addition, plastic in food packaging (76%) and rainforest and habitat destruction (75% and 76% respectively). (AHDB/Blue Marble, August 2023)

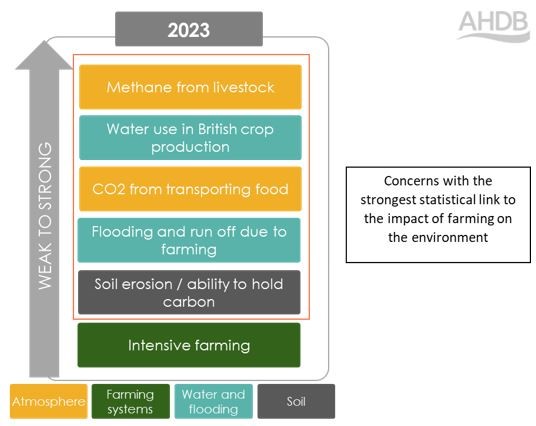

A key driver analysis was used as part of this research, to establish which of the stated concerns were most strongly statistically linked to the overall concerns of farming on the environment and its impact. The results showed that methane from livestock, water usage in British crop production and food miles were the major concerns for all respondents. (AHDB/Blue Marble, August 2023).

Key consumer concerns of the impact agriculture has on the environment

Source: AHDB/Blue Marble 2023. Q17: Agreement with statements - I am concerned about the effects of farming on the environment

When assessing specific demographics, meat reducers were most concerned about the methane from livestock, effects of insecticides and water use in British crop production, whereas Gen Zs were more concerned about plastic use on farms, loss of native UK species due to farming and water usage in imported crops.

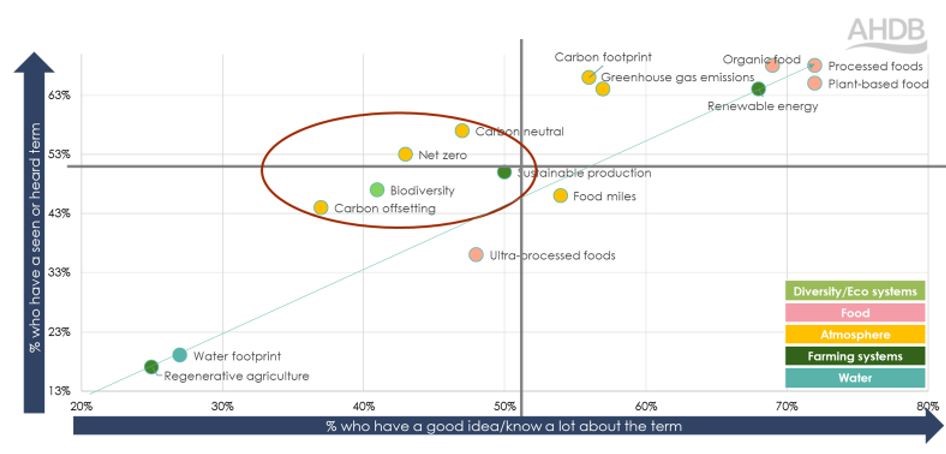

Consumer understanding of environmental buzz words are mixed

It’s widely recognised today that there are a vast array of agricultural and food production ‘buzzwords’, which our research highlights as having differing levels of consumer understanding. People are generally more familiar with food related terms, such as ‘organic food’ and ‘plant-based food’, but they may need further clarification on terms such as ‘net zero’, ‘carbon offsetting’ and ‘regenerative agriculture’, as these are less well-understood. (AHDB/Blue Marble, August 2023)

Environmental Buzzwords – Awareness vs. Understanding

Source: AHDB/Blue Marble August 2023. QW1 Which of these terms relating to the environment and food production have you seen or heard before today? QW2 Looking again at these terms, how well do you understand what each of them means? Base: Total (2085)

Environmental purchase trends

Despite the current cost-of-living crisis and consumers having to reassess their priorities, the proportion of people who claim that they are engaging in more environmentally friendly behaviours in 2023, such as buying loose food without packaging (37% vs.32%) and choosing sustainably produced food (21%vs. 16%), has risen since 2022. (AHDB/Blue Marble August 2023)

In addition, AHDB/YouGov’s Consumer tracker (August 2023), shows more people (68%) are considering the packaging of products and their levels of food waste (63%) than in May 2023. Reducing levels of food waste has two benefits; consumers using all available food in a variety of meals keeps costs down and also reduces their environmental impact by cutting greenhouse gas emissions.

For further information regarding the role of the environment in the consumer landscape, please see our latest webinar.

The current economic situation has forced many consumers to reconsider their purchasing behaviour to help reduce costs, so while the environment is on the minds of consumer, its often factors such as price, taste and value/quality which enters at point of purchase. In the longer-term, the environment is an important area that can offer key opportunities for the industry.

Key Opportunities

- Provide consumers with information to clarify the meaning of all environmental and agricultural terminology to improve understanding.

- Utilise the trust in British farming to communicate welfare, sustainability and environmental initiatives to support the meat and dairy industry.

- Provide transparency where possible around where and how British food is produced.

- Build on the knowledge that Gen Z’s have learnt about climate change through school and provide factual environmental reports via social media.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: