Meat and dairy outperform their plant-based alternatives in January

Wednesday, 6 March 2024

Plant-based products were less of a hit with consumers in January, as meat-free volume declines outpaced their animal-product counterparts. Dairy volumes grew year-on-year (YoY) in January while dairy-free products experienced less demand compared to last year. It seems food trends during January are changing, with greater opportunities for red meat and dairy to be eaten by consumers as more of a health-conscious start to the year.

In January 2023, we saw poor performance for both meat-free and dairy-free products compared to January 2022. This resulted in some retailers attempting to position plant-based products with health-focused messaging within stores this year, rather than promoting Veganuary 2024 as an occasion in its own right, according to IGD. This aligns with our marketing campaign Let’s Eat Balanced, showcasing the nutritional benefits of British meat and dairy and their role as part of a balanced diet. Moreover, fewer plant-based products were stocked in retailers this year, with reduced shelf space due to slower sales, according to The Grocer.

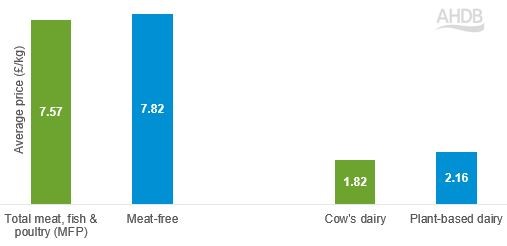

While this limited promotion and product availability will have impacted sales of plant-based products to some extent, the cost-of-living crisis can also be attributed to a large proportion of the 12.8% and 3.8% YoY volume decline for meat- and dairy-free products, respectively (Kantar, 3 w/e 21 Jan 2024; Nielsen, 4 w/e 27 Jan 2024). This is because meat- and dairy-free products are 3.3% and 18.4% more expensive than their animal product competitors respectively. This continues the YoY volume decline seen throughout 2023, and was further highlighted during January with some consumers switching from meat-free products into red meat (Kantar).

Meat and dairy are cheaper than their plant-based alternatives

Source: Kantar, 3 w/e 21 Jan 2024; Nielsen, 4 w/e 27 Jan 2024

Meat-free performance subdued

Despite high inflation, spend on meat-free items dropped by 6.6% YoY (Kantar, 3 w/e 21 Jan 2024) due to the fall in volumes of both branded and unbranded products. This decline outpaced that of total meat, fish and poultry (MFP) (-1.9%) and came as many shoppers left the meat-free category due to its high price point at £7.82/kg compared to the average for total MFP (£7.57/kg). As a result, some shoppers also switched to buying primary MFP products.

Compared to the average 3-week period within the 52 weeks ending 24 December 2023, meat-free volumes increased by 25.9%. However, this was to be expected as retailers always try and drum up interest in meat-free products and are health focussed in January, e.g. through in-store displays and advertisements. This may be to counter the trend that the proportion of food chosen for health reasons is not typically at its highest in January, contrary to popular belief.

Looking at promotions more closely, 43.2% of meat-free products were on promotion during the 3 w/e 21 January 2024; this is a slight increase (+1.5 percentage points) compared to the rest of the year. Yet retailers’ efforts to try and increase the pick-up of meat-free products during this health-focused month weren't very successful, as the percentage of baskets with meat-free products fell 0.4 percentage points YoY, to 4.1%. This indicates that consumers’ interest in meat-free products is waning, despite attempts to market them as healthy following the indulgent Christmas period.

This trend is also apparent when we look at the number of people buying meat-free products, which has been falling since 2021. Linked to this, demand for meat-free products has been declining recently, as people turn to carbohydrates and cheese to create tasty meatless meals at a lower cost (Kantar).

Therefore, while we see this peak in interest for meat-free items in January, only 28% of shoppers who attempt Veganuary actually complete it (The Grocer), and most are unlikely to continue purchasing meat-free products for the rest of the year. This suggests consumers have a fleeting interest in a meat-free lifestyle, and meat-free products are not a big threat to the MFP category at this point in time.

Dairy-free products in decline

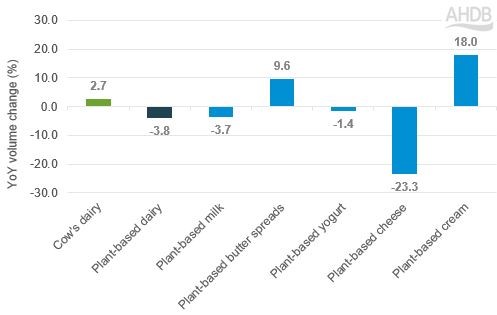

Due to rising prices, cow’s dairy volumes have seen a YoY decline (-1.0%) for the 52 w/e 27 January 2024; this continues a trend we have observed for the last couple of years. However, volumes grew in January (+2.7% YoY for the 4 w/e 27 January 2024), driven largely by a growth in milk, cheese and yogurt volumes.

In comparison, dairy-free products saw volumes decline in January, which surprisingly was due to a decline in own-label sales; this contrasts the strong performance of own-label products seen across grocery during 2023. Meanwhile, branded volumes of dairy-free products increased, as the average price for plant-based products declined by 3.8% YoY due to increased volumes sold on promotion (+2.8 percentage points YoY).

The overall decline for dairy-free alternatives boils down to fewer trips per shopper for these products, indicating interest is falling, especially for the cheaper, own-label products.

As expected, due to retailers focusing on health messaging, volumes for all plant-based products were up for the 4 weeks of January 2024 (+6.4%) compared to an average 4-week period for the 52 w/e 27 January 2024 (Nielsen). However, compared to January 2023, plant-based cheese (-23.3%), milk (-3.7%) and yogurt (-1.4%) all saw volumes decline this year.

YoY volume change for cow’s dairy versus plant-based dairy and specific products

Source: Nielsen, 4 w/e 27 Jan 2024

Much like cow’s milk, its plant-based counterpart accounts for the majority of dairy-free sales volumes (89.5%). As a result, the drop in plant-based milk volumes drove the decline of plant-based dairy. In January 2023, plant-based yogurt was the only product to see volumes fall compared to the same month in 2022, but with more products now following suit in 2024, this suggests plant-based products are losing their appeal.

Plant-based butter spreads (+9.6%) and cream (+18.0%) were the only products to see volumes increase YoY due to shoppers buying greater volumes on promotion in January 2024.

Opportunities

Media coverage has recently focused on the negative nutritional values of ultra-processed foods, which is putting many consumers off eating them (Mintel). This, alongside slowing inflation and the potential for real wages to grow in 2024, means health is becoming more of a priority for consumers. This provides the opportunity to promote the health benefits of meat and dairy in January, to align with consumer values. We are promoting red meat and dairy as part of a healthy, balanced diet in our ‘Let’s Eat Balanced’ and ‘Love Pork’ campaigns.

With 96.4% of households buying MFP in January (Kantar, 3 w/e 21 January 2024), compared to 99.0% for the rest of the year (52 w/e 24 December 2023), there is a slight drop off in consumers purchasing red meat at the start of the year. Therefore, alongside promoting the health benefits of red meat and dairy, retailers could provide meal inspiration, both on-pack and in-store, to help encourage consumers to buy these items in the big post-Christmas shop.

With a small proportion of UK adults completing Veganuary (The Grocer) and volume sales of meat- and dairy-free products suffering, it is likely that new plant-based product development will be limited, but meat and dairy may still face competition from cheap staple alternative products.

For more information on how consumer demand may evolve in 2024, take a look at our Agri Market Outlooks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: