Dairy alternative sales weaken this Veganuary

Tuesday, 14 February 2023

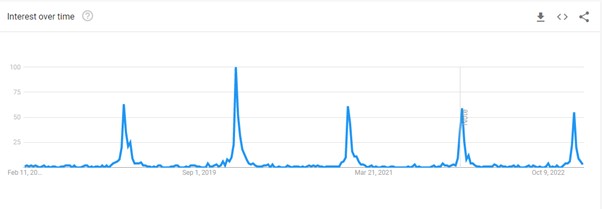

As British consumers buckle under the weight of increased economic pressures, minds seem to be less open to experimenting with different ways of eating. Interest in Veganuary as measured by Google trends, which measures search, has nearly halved since “peak-vegan” in 2019. Since then the annual peak in interest has gradually dropped off with people now more interested in terms such as “dry January”.

Research from IGD suggests 7% of shoppers started taking part in Veganuary at the start of January. This uplift in vegan shoppers appears to be short lived, with seven out of 10 returning to their normal diets by the two-week mark. Of those who stopped, 40% said it was due to alternatives being too expensive, while a further 40% couldn’t find food or drink they enjoyed.

Impact on dairy alternatives

Decreased interest meant that in the Veganuary period, there was a decrease in alternatives volume sales, both in meat ) and dairy. According to Kantar, the volume sold of dairy alternative products in the first three weeks of January 2023 reduced -2.6%. This was driven by a decrease in penetration, or the number of households buying a dairy alternative product which reduced -3.8%, or 281,000 British households, since Veganuary 2022.

Dairy alternatives in 2022

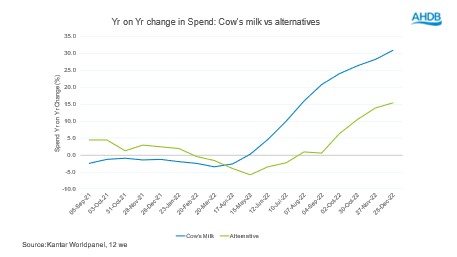

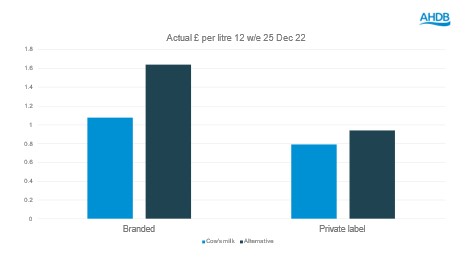

Growth in demand for milk alternatives has softened over the past 12 months, even moving into a period of volume decline from January to October 2022, although returning to moderate growth (+6.1%) thereafter. Alternatives remain a more expensive option than cow’s milk which is causing some lighter shoppers to turn away, with total dairy alternatives seeing penetration losses of -1.9%pts over the 12 we to 25 Dec 2022. Growth is therefore coming from existing, more committed, shoppers buying more. Value growth for alternative milk has also returned from October but to a lesser extent than cow’s milk, which has experienced significantly higher levels of inflation over the past year.

Within alternatives, there has been a lot of switching away from more expensive branded products into cheaper own-label as the financial situation accelerates the move towards commoditisation in the alternatives category. According to Kantar, in the 12 we 25 December 2022, private label alternatives grew by 25% whilst more lucrative branded products lost 7% of volume.

Dairy itself has seen some volume losses over the same period as shoppers have sought to manage their overall household expenditure. Penetration losses over the last year have been very modest (only -0.3% for milk and -0.2% for cheese for example) suggesting that people are buying less volume, less often rather than dropping those categories. More detail is available on the retail dashboards.

The outlook moving forward

Cost is growing as a reason for dairy reduction, although is considerably less influential than in the meat category. Consumers continue to be motivated by concerns around health, the environment and animal welfare. While dairy alternatives are being actively promoted as satisfying some of those demands, whilst consumers are very price sensitive it is doubtful that they will regain the same growth trajectory as they have enjoyed in the past.

Read more about the outlook for dairy for 2023.

Sign up for regular updates

You can subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.