Meat alternative sales decline this Veganuary

Monday, 13 February 2023

Volume sales for meat-free* products have declined this Veganuary, with initial data for the first three weeks of January showing a fall in shoppers in the meat-free category.

More than a million fewer households bought meat-free products this January compared to last year with only 13.7% of households buying one (AHDB/Kantar, 3 w/e 22 January 2023). This compares to 96.4% of households buying meat, fish or poultry (MFP) in the first three weeks of the year.

Research from IGD suggests 7% of shoppers started taking part in Veganuary at the start of January. However, this uplift appears to have been short lived, with seven out of 10 failing to make it past the two-week mark. Of those who stopped, 40% said it was due to alternatives being too expensive, while a further 40% claimed they couldn’t find food or drink they enjoyed. Decreased interest has meant that in the Veganuary period, there was a decrease in alternatives volume sales, both in meat and dairy.

This shows despite new product development and heavy promotions from retailers, the taste and price of meat-free products are still the major barriers for shoppers.

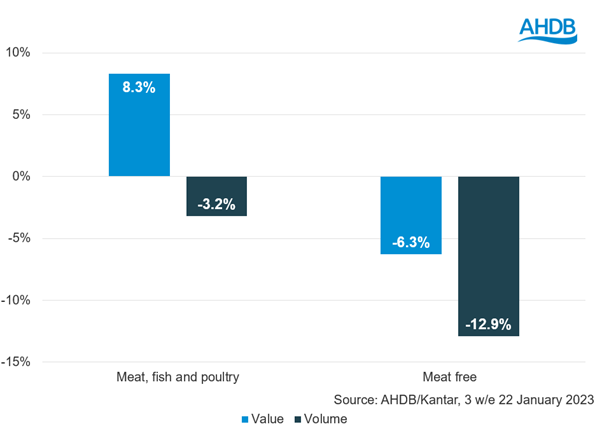

Meat-free remains a small part of the market, maintaining the 2% volume share it has seen over the last four years. This decline in shoppers means overall value and volume for meat-free has declined with volumes down 12.9% and value down 6.3% compared to MFP, which declined by 3.2% in volume but saw value growth of 8.3% due to price increases.

Despite declines, Veganuary provided a boost for meat-free products with a sales uplift of 36% in the last three weeks versus the average three weeks in 2022 (excluding Veganuary and Christmas).

Meat-free products have seen average prices rise 8.9% year-on-year, slower than their meat counterparts at 11.9%. This increase for MFP meant the gap in price between the two categories narrowed with meat-free being only £0.13/kg more expensive.

January is a time when shoppers try to eat healthily in general, not exclusively reduce meat. Therefore there is an opportunity to promote healthy meat options, highlighting those high in vitamins and minerals as well as lean cuts. We also see the impact of Dry January in the data, as no and low alcohol beer volumes were up 3% on last year’s levels (Kantar). £10 million less was spent on chocolate deals this January compared with last year, partially as a result of the new health regulations as well as a drop in promotions.

Meat-free trends in 2022

In 2022, volumes of meat-free declined by 3.4% while value grew by 2.2% according to AHDB and Kantar (52 w/e 25 December 2022), as a result of shoppers cutting back as well as some leaving the category. Trends across total meat-free are replicated within specific meat alternatives and vegetarian and vegan range products. Meat-free products performed better than total MFP, which saw volumes decline by 7.1%.

Average price per kilogram in meat-free increased by 5.7%, slower than MFP at 8.2%. However, meat-free was a more expensive product at £7.59/kg on average, which is £0.74/kg more than MFP.

Shoppers have been dropping meat-free brands with volumes down 5.9%, in favour of private label offerings which grew by 4.2%. This move has been even more pronounced in the last 12 weeks, as the cost-of-living crisis started to hit shoppers’ budgets harder.

Opportunities for meat

- Shoppers are more health conscious in January, so remind shoppers of the health benefits of meat. AHDB is actively promoting the health benefits of meat and dairy during January through its We Eat Balanced marketing campaign.

- Over 96% of households bought meat in January and remains a huge category – worth over £1.3bn in the first three weeks of 2023. Retailers can cater to these shoppers through innovation and inspiration at point of purchase. See our research of how to inspire shoppers in the meat aisle.

- With the economic outlook, shoppers may be more wary of new products and return to tried and trusted meat cuts. However, the price difference between meat and alternatives is one to watch going forward, as more retailers launch cheaper own brand ranges. Some shoppers may swap from meat to alternatives if meat-free products become cheaper.

- Read more about the outlook for meat in our Agri-market outlook for 2023

* Meat-free definition defined by AHDB (includes meat alternatives and selected vegetarian/vegan ranges. Excludes pizzas).

Sign up for regular updates

You can subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: