The UK Organic Market

Friday, 26 May 2017

Times are good for sales in the organic sector. A report published by the Soil Association reveals organics in their fifth year of growth and although share of total grocery sales is small, the sector is worth over £2 billion. What are the market conditions driving this growth?

Consumer trends and organic produce

Many aspects of organic produce are consistent with the needs of the wider consumer base. Increasingly UK shoppers are seeking food that is local and has an authentic and ethical story behind it. Consumers also would like food to be more natural and less processed. The driver of this is perceived health benefits, not just around calorie counting and losing weight but the idea that what you eat can have a positive effect on your overall health and wellbeing.

Home Delivery

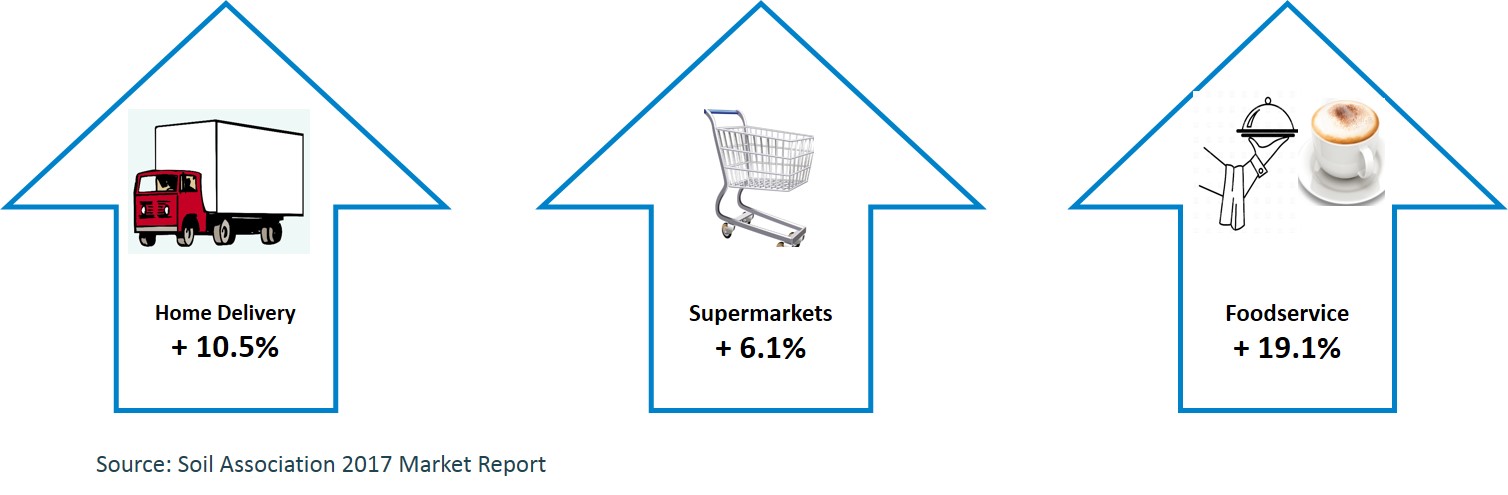

Online shopping grew strongly in 2016, according to IGD, with 42% of British shoppers purchasing groceries online in September 2016. The attribute of online most attractive to shoppers is convenience - 57% say that is the main reason they choose the online channel. Organic food shoppers are often professionals, typically from high social groups, they lead busy lives and consider themselves to be time-poor. This profile is consistent with that of the online shopper and is likely to have contributed to the sales value increase of 10.5% in 2016 for organics online.

Organic shoppers are interested in provenance and like to know more about the journey that food has made from the farm to the plate. The online channel gives shoppers time to do some research and find out more about what they are buying, so there is an opportunity for a meaningful story to be told and understood.

Supermarkets

According to The Soil Association, around 70% of organic sales are made through big retailers, so the 6.1% sales value increase through this channel has been influential on recent total organic market growth.

One of the initial responses made by bigger retailers to counter the competitive threat posed by Hard Discounters was line consolidation and organic produce was a victim of the reduced number of products carried in bigger supermarkets. During 2016, though, there was an uplift in lines stocked and organic produce became much more accessible through what remains the most popular shopping channel. IGD research shows 98% of shoppers use a large format store every month.

The Hard Discounters have influenced this as well, Lidl has its own organic brand ‘Meadow Fresh’ and Aldi stocks a range of organic lines including eggs, baby food and even wine. More than 40% of Soil Association members say ‘new listings in supermarkets’ were a key reason for their sales increase in 2016.

Foodservice

Foodservice experts, NPD CREST, estimate the value of the out-of-home food market to be more than £53 billion annually, growing by 2.8% in 2016. This makes it not only an important industry to the UK economy but an essential market for organic food and drink. Sales of organic produce made through this channel increased by 19.1% in 2016, growing way ahead of the total market.

The motivation for consumers to choose organic when eating out is essentially the same as for retail, food choices need to be fresh, natural and to have not been heavily processed. Eating out is often a treat or for a special occasion, therefore it is important to tell the organic story on the menu.

Summary

This research from the Soil Association shows that retailers are increasing their organic lines and the category is growing ahead of the total market.

Current consumer sentiment appears aligned with features of organic food. Some of these trends look to be embedded: localism and the food journey, ethics and authenticity, a preference for more natural and less processed food.

Farmers, growers and others in the food supply chain may consider conversion to organic methods in response to the growth in demand for organic products. Something to note though is that the fortunes of organic sales have in the past been matched to the economy and consumer confidence. Any downturn may affect sales in this sector. This emphasises how important it is to understand your customer and consumer trends.

AHDB’s Consumer Insight team have written a Consumer Focus report which examines the understanding of health through the eyes of the consumer and picks out the challenges and opportunities in meeting the health needs of the modern consumer. This report can be accessed here.