Harnessing consumer buying behaviour for British exports

Wednesday, 9 March 2022

Exports are the engine which drives economic growth. Every year, the UK exports around £1.5 billion worth of red meat around the globe, with more than 550,000 tonnes of sheep meat, beef, and pig meat shipped in 2021 (AHDB analysis of trade data from IHS Maritime & Trade – Global Trade Atlas® - HMRC).

New trade markets are imperative to adding value to the supply chain and maximising returns, while maintaining existing markets helps to further grow overseas trade, strengthen relationships, and react to changes in the marketplace. A key role of AHDB is working with government and industry to create new opportunities for the UK’s red meat exports by accessing new markets and supporting businesses to help strengthen trade in existing markets.

To help with this, AHDB commissioned a study with consumer research agency Two Ears One Mouth to gain valuable insight into the buying behaviours of consumers across three continents: the European Union, North America, and South-East Asia, in order to better understand the context behind where British products fit into current consumer purchase habits. More than 25,000 consumers across 17 markets in the EU, North America, and South-East Asia took part in an online quantitative survey. All respondents had to be the main shopper within the household, eat meat, and show interest in purchasing British products. This in-depth analysis into new and growing trends in multiple countries allowed us to pull out key consumer opportunities and considerations for UK red meat exporters.

The first stage of the research formed part of our Exploring EU report and builds on past research on International Buying Behaviour and Exploring Asia reports. Our latest research looks at consumer buying behaviours towards red meat in North America and South-East Asia and will form part of a new Horizon report later this year. Here, in this article, we look at the topline findings from this valuable research to help our exporters and levy payers maximise on the potential opportunities these markets present.

Global buying behaviours

Globally, consumer buying behaviour is influenced by three overarching factors: quality, price, and taste. These factors rank in different orders of importance for consumers in different continents, countries and cities. For instance, in China the key factors are food safety, quality and health, whereas in Mexico the key factors are quality, taste and price.

Quality is the most influential factor behind consumer buying behaviour in all areas of our study. However, what a consumer considers as ‘quality’ is unique to the individual and can encompass further factors such as product taste. Taste and price sit in second and third position for Europe and North America. Whereas food safety rises up the consumer radar and ranks in second place for South-East Asia. This is understandably so, as food safety has consistently been a top concern for consumers in many Asian countries, especially those without trusted food-safety systems. Food safety scares throughout Asia such as the 2008 Melamine milk scandal, led to a great deal of consumer mistrust in domestic products.

Quality is key – but how do consumers assess?

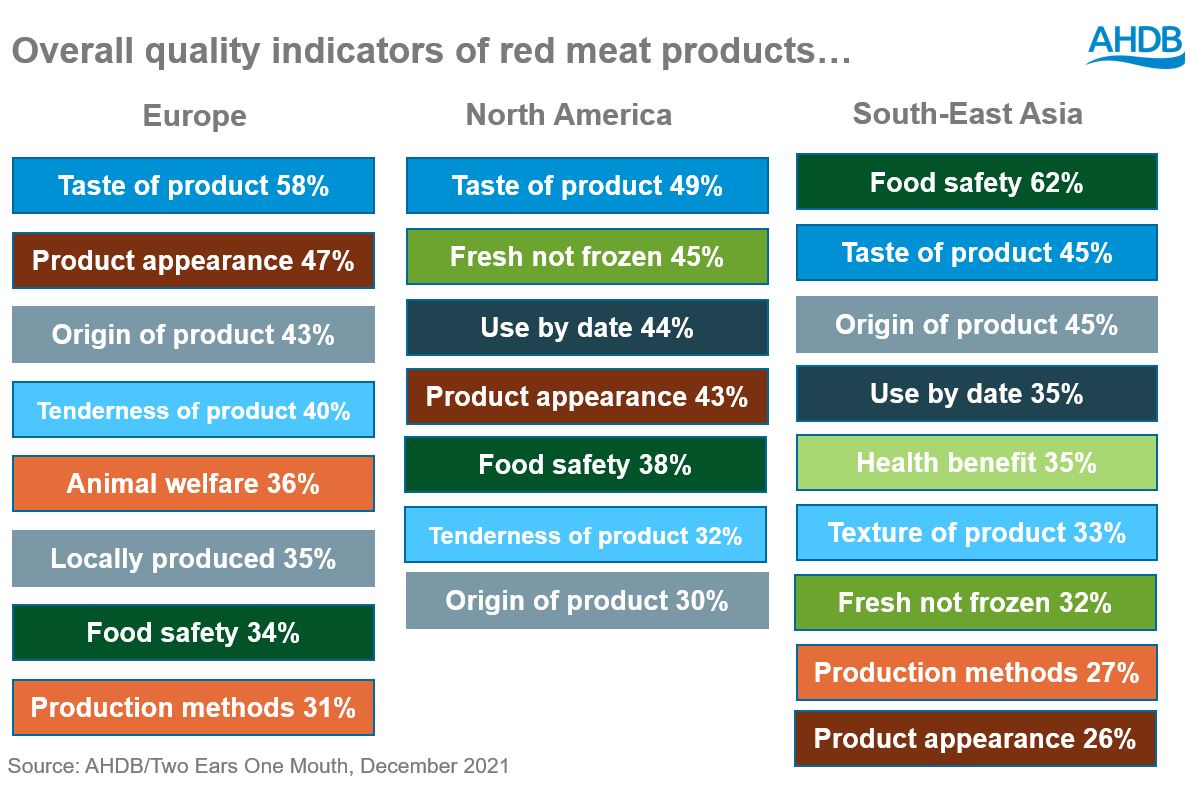

The infographic below shows the indicators which represent quality to consumers when judging the quality of a red meat product. As highlighted, quality means very different things to consumers from different areas of the globe. However, there are key overarching themes across all markets such as taste, production standards, food safety and product appearance/texture.

For example, a consumer in South-East Asia would predominantly look for food safety as the main indicator of quality red meat. Whereas for a consumer in Europe, food safety is an assumed aspect of red meat products, so sits lower down the list of quality indicators, with factors such as animal welfare, product appearance and taste being greater indicators of quality.

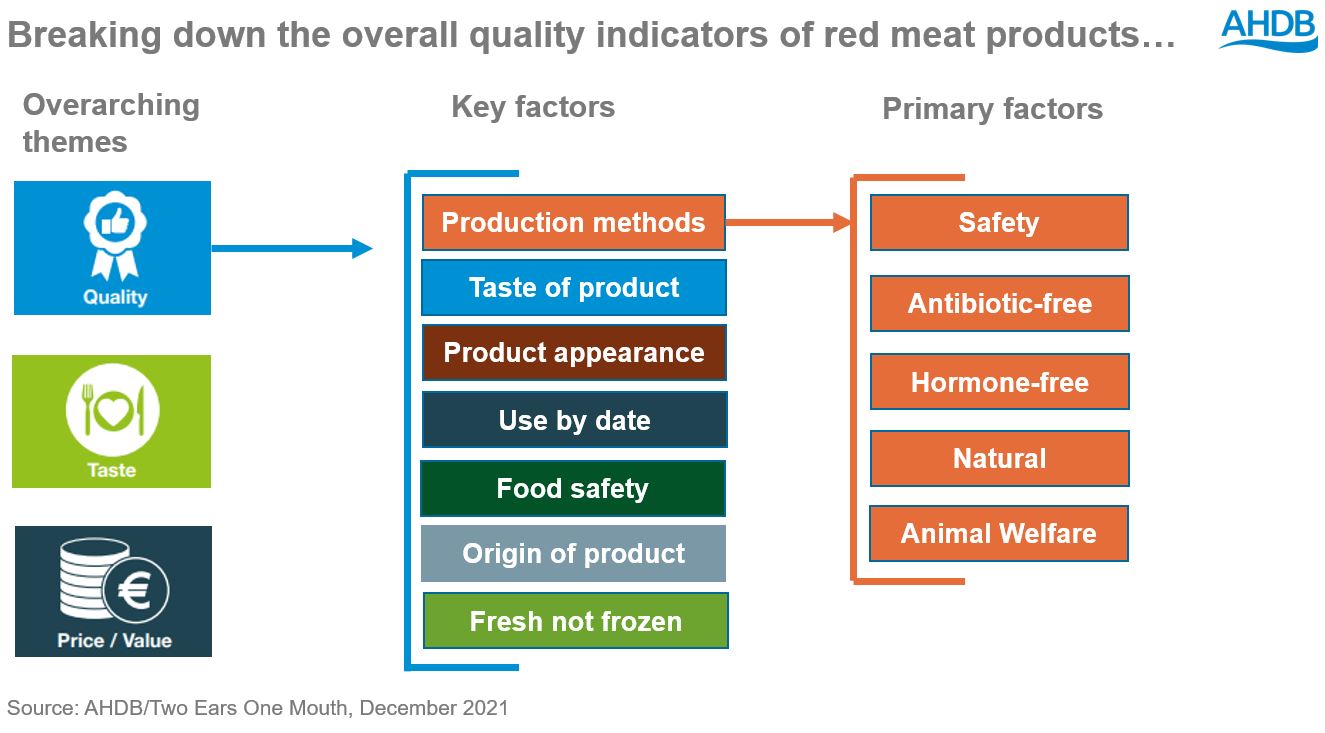

To understand the complexity of consumer buying behaviour, not only can the three overarching themes be broken down into key factors, but each of those can also have multiple primary factors which sit beneath them.

For instance, in North America and South-East Asia ‘production method,’ can be broken down further into four primary factors: safety, antibiotic-free, hormone-free and natural. Whereas European consumers consider animal welfare and hormone-free as the primary factors in relation to production method. This provides UK meat exporters with a great opportunity to promote British products as safe and natural as well as hormone and antibiotic free.

The same goes for food safety. In both North America and South-East Asia, food safety is broken down into two primary factors: how it was processed (e.g., to sanitary standards), and additive free, (meaning there are no added antibiotics, hormones, or preservatives).

The role of British for international consumers

The current reality is that British food products remain relatively niche in export markets. This was highlighted in a previous AHDB study which looked at International Consumer Buying Behaviour and explored consumer perceptions toward British food. The study found that most consumers had not had direct exposure to British food products and therefore had not developed a view of the quality of British foods. The latest consumer research covering Europe, North America, and South-East Asia looks to build on this in more detail.

Purchase Intent

The study revealed the number of consumers who consciously purchase British food products on a regular basis varies quite significantly. In the EU consumers claiming to purchase British food ‘quite’ or ‘very frequently’ ranged from 11% to 22%. In North America, this was even less substantial with the claimed purchase of British food ranging between 9% to 18%. Whereas, in South-East Asia it is much more substantial ranging between 5% and 52%, with consumers from China claiming to consciously buy British products the most.

Europe

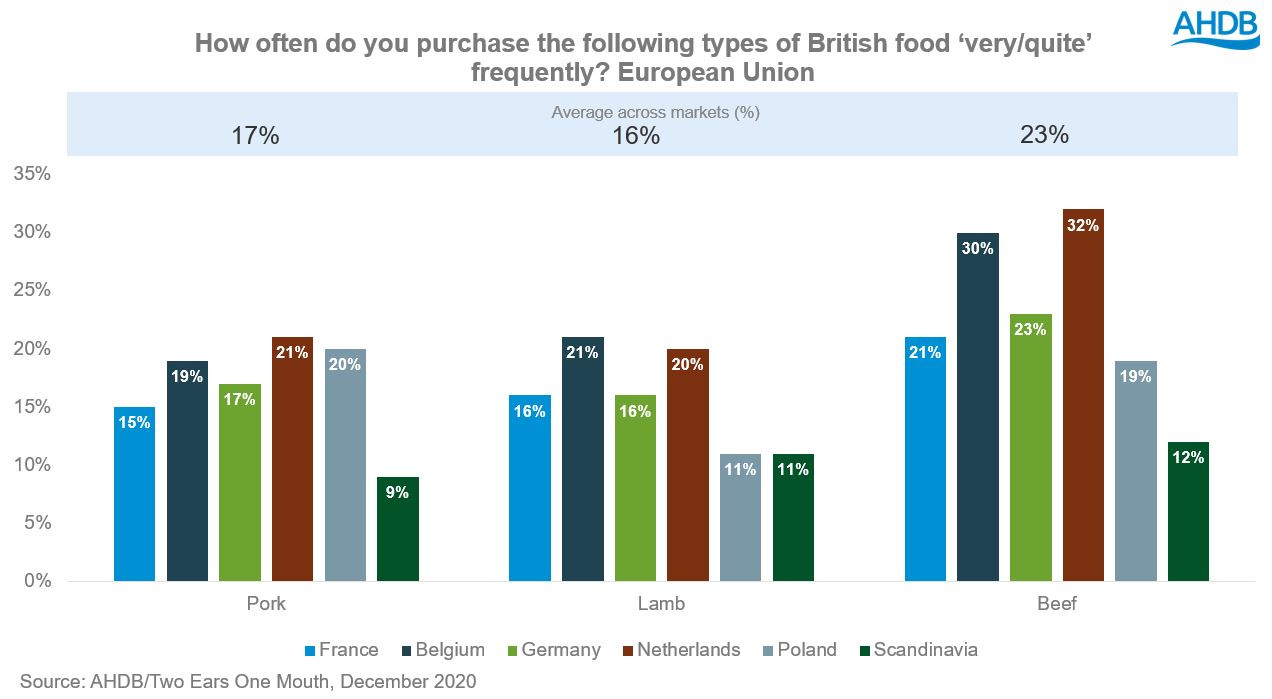

On average, 16% of EU consumers claim to consciously purchase British food ‘very/quite’ regularly across all food groups. Looking specifically at the red meat category, beef performs above average at 23%, whilst above average this does suggest that British is still fairly niche. Additionally, EU consumers stated a preference for domestic red meat. However, up until 31 December 2020, UK red meat was often labelled as ‘EU origin’, therefore it had previously been difficult for European consumers to identify and develop a judgement on the quality of British red meat.

North America

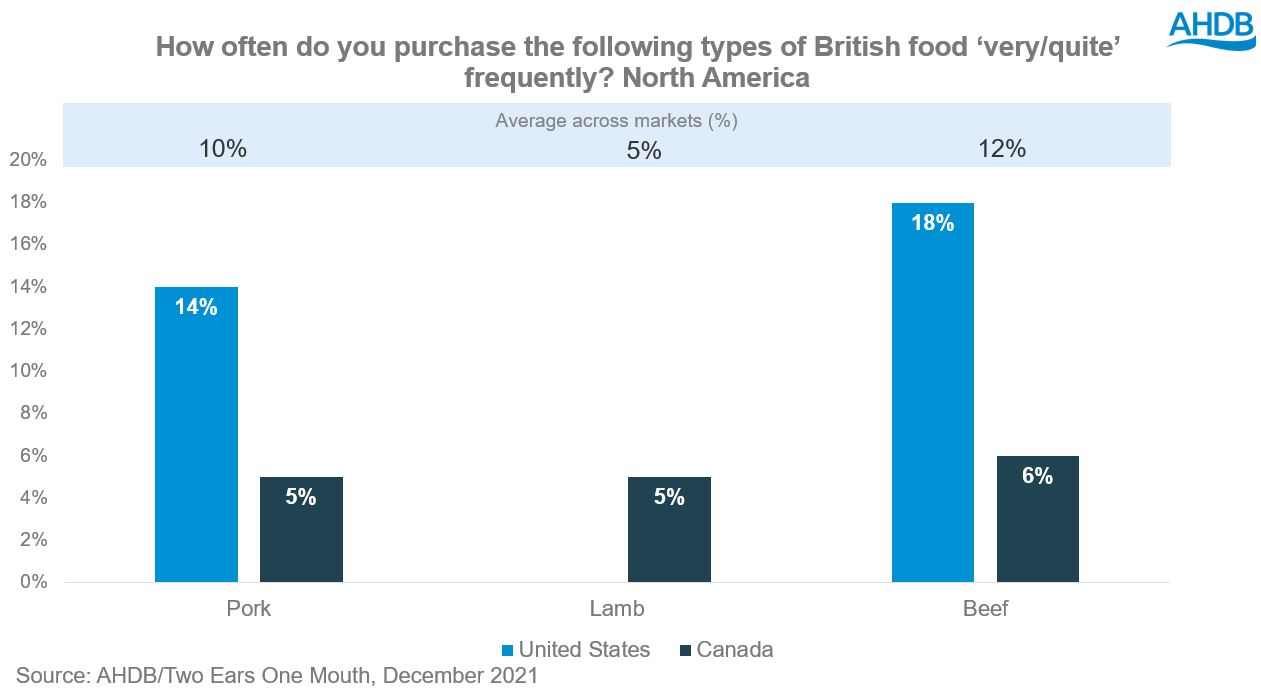

On average, 14% of North American consumers claim to consciously purchase British food ‘very/quite’ regularly across all food groups, with Canadian consumers purchasing least often (9%), and US consumers purchasing most often (18%). Similar to France, Canadian consumers champion domestic and local red meat.

Looking specifically at the red meat category, on average 9% of North American consumers claim to consciously purchase British Red Meat ‘very/quite’ regularly (12% beef, 10% pork, 5% lamb). When we break this down by type of red meat purchased ‘very/quite’ frequently we can see that British pork and beef performs above average in the US.

*Please note those countries which do not currently import red meat from the UK, have been excluded from the bar chart, but are part of ongoing market access dialogue.

South-East Asia

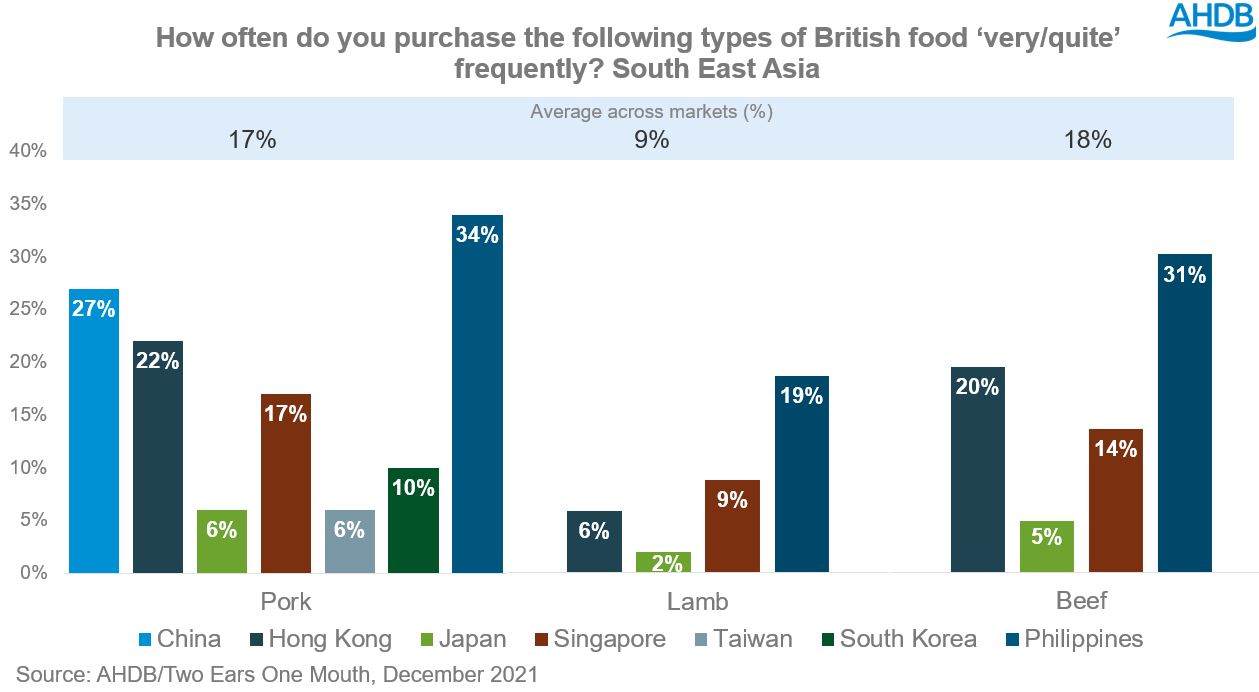

On average, 24% of South-East Asian consumers claim to consciously purchase British food ‘very/quite’ regularly across all food groups. Looking specifically at the red meat category, on average 15% of South-East Asian consumers claim to consciously purchase British Red Meat ‘very/quite’ regularly (18% beef, 17% pork, 9% lamb).

*Please note those countries which do not currently import red meat from the UK, have been excluded from the bar chart, but are part of ongoing market access dialogue.

When we break this down by type of red meat purchased ’very/quite’ frequently we can see that British pork performs above average in China, Hong Kong and the Philippines', British lamb performs the same as or above average in Singapore and the Philippines' and British beef performs above average in Hong Kong and the Philippines’. It is interesting to note that British red meat performs poorly in the Japanese market, and this is likely linked to consumers favouring domestic product and domestic premium cuts, such as Wagyu beef.

Strengths of British meat exports

It’s important for British red meat exporters to harness the strengths of red meat in their target markets and find the right messages to amplify the products. To help identify these, the study looked contextually at how British red meat is perceived in comparison to domestic product – but further focused in on drivers that are of high priority when making purchases.

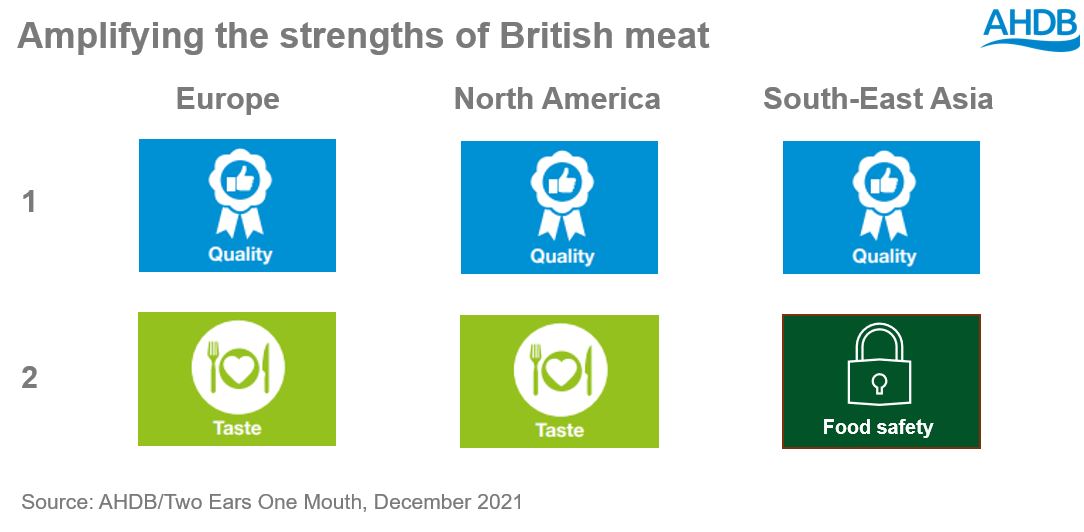

The study shows the consistency and importance of quality, taste and food safety across the regions. This further highlights the importance of tailoring quality messages to consumers in specific target markets.

Opportunities and challenges for British meat exports

While there are many opportunities for British meat exports, exporters still face challenges in accessing the markets, which will be discussed below. It is crucial that certain areas are amplified and addressed within each market to develop greater export opportunity.

Across the study, few consumers are consciously purchasing British red meat and domestic product is typically favoured. However, there is good openness to the idea of buying British red meat in many markets. Some markets do present a challenge, for instance Canada show a strong desire for local red meat, whilst Japan notably do not regard British products as highly as domestic. Therefore, we need to utilise the current predisposition to British red meat – making the most of where there is already openness whilst addressing perceptions in those markets that are less likely to consider British red meat. Price is the primary barrier to overcome across all markets, therefore we need to ensure that communication seeks to justify a price premium, whilst getting across messaging on the key purchase drivers within given regions.

Currently there is good consistency of key purchase drivers across the markets: quality, price, taste, food safety. This enables British red meat exports to provide a consistent core approach to the marketing and messaging of British red meat. To go one step further, messaging could be tailored to different countries, but this is not essential to impact consumer perception.

With quality in mind, the key drivers are taste, tenderness/texture, and freshness, therefore showcasing delicious looking product is key here, whilst also reassuring consumers on freshness perceptions – something which is perceived as a feature of locally produced meat.

Amplifying the message of British red meat to consumers globally

There are key overarching themes across the globe when it comes to consumer buying behaviour. Quality, price, and taste remain the top three purchase drivers of food and drink products. British food products are renowned for holding a price premium, but targeted messaging highlighting the quality, taste, food safety and production factors of British red meat could help to justify the increased cost compared to domestic product and offer consumers good value. However, there is the ability to differentiate British red meat products from the rest of the crowd by expanding on the factors which sit under the key overarching themes, for instance the different factors which sit behind a market perception of ‘quality’ such as taste, production methods/standards, food safety and appearance. Therefore, it is important British exporters consider targeted marketing and adapt their offering to local markets.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.