- Home

- News

- Cost of food still rising slightly – How are meat, dairy and substitute products performing?

Cost of food still rising slightly – How are meat, dairy and substitute products performing?

Monday, 30 September 2024

In the long-term, consumer confidence has been increasing over recent months although there are whispers of concern with news of the budget and rising energy prices (IGD ShopperVista). While consumers are still mindful of price, with wages growing and inflation much lower than previous levels, consumer budgets are being squeezed less. As a result, we’ve seen total grocery volumes return to marginal year-on-year (YoY) growth again for the latest two 12 week periods, 12 w/e 07 July (+0.1%) and 04 August 2024 (+0.7%), according to Kantar. So are plant-based meat and dairy volumes still struggling and how are meat and dairy performing in comparison?

Meat, fish and poultry (MFP) is purchased by almost 99% of all consumers (Kantar, 52 w/e 12 May 2024) with cow’s dairy purchased by 99.4% of all consumers (Nielsen, 52 w/e 13 July 2024). Therefore, meat and dairy are staples in consumer diets. In comparison, plant based dairy accounts for just a 5.1% share of total dairy volumes sold, with household penetration sitting at just 69.7% for the 52 w/e 13 July and with meat-free penetration dropping (-3.1ppt) to 40.7% (Kantar, 52 w/e 04 August 2024).

Whilst the cost-of-living constrained all food purchases including meat, dairy, and plant-based products, many consumers did not stop eating meat and dairy as penetrations have remained largely unchanged over the last couple years.

Recent performance

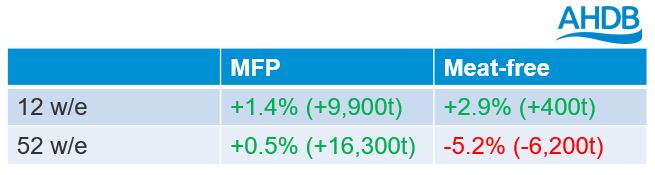

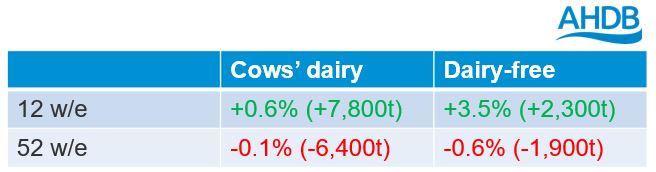

Whilst the YoY percentage increase in meat-free volumes and plant-based dairy is greater than that for total MFP (Kantar, 12 w/e 04 August 2024) and dairy (Nielsen, 12 w/e 13 July 2024), over the long-term meat and dairy has outperformed their substitute counterparts products in actual volume terms.

MFP performance versus meat-free volumes

Source: Kantar, w/e 04 August 2024

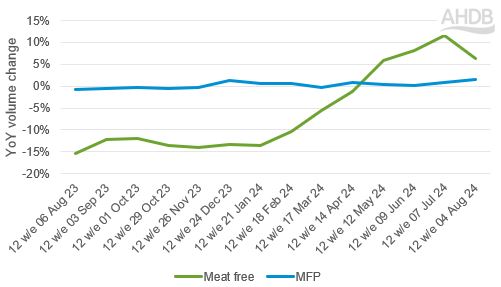

MFP versus meat-free trend volume performance

Source: Kantar, 12 w/e 04 August 2024

Much like at the start of the year including for the month of January, meat-free volumes have continued to fall since peaking in March 2022 (Kantar, 52 w/e 04 August 2024). This is in part due to meat-free products being on average 55p/kg more expensive than MFP despite MFP actually seeing a greater average price rise (+5.1% YoY) compared to meat-free (+3.6% YoY) for the 52 w/e 04 August 2024 (Kantar).

With consumer wallets being hit, we’ve seen the share of consumers adopting a flexitarian diet for cost reasons increase despite a decrease in consumers reporting to be flexitarian YoY. Linked to this, where consumers are looking to save money, they are more likely to drop MFP or meat-free products so will include less ingredients in their meals, rather than switch to meat-free from red meat. One cost saving strategy has been turning to carbohydrates and cheese to create tasty meatless meals at a lower cost (Kantar).

Recent dairy and dairy-free performance

Volumes of dairy-free products peaked at the start of 2023 and have been in a gradual decline since then (Nielsen, 52w/e 13 July 2024).

Cows’ dairy performance versus dairy-free volumes

Source: NIQ Homescan, w/e 13 July 2024

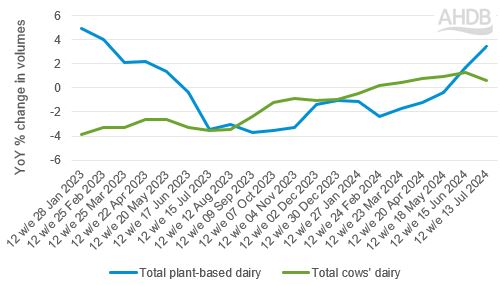

Cows’ dairy versus plant-based dairy YoY trended volumes

Source: NIQ Homescan, 12 w/e 13 July 2024

For the latest 52 week period cows’ dairy has seen an average price rise of 1.7% compared to 3.8% for plant-based. This larger price rise, coupled with the fact plant-based dairy is on average 63p/kg more expensive than cow’s dairy has seen cows’ dairy outperform its plant-based equivalent in the long-term (52 w/e 13 July 2024).

However, prices for both categories have begun to fall in the latest 12 weeks, and as a result we’ve seen demand for plant-based start to recover on the back of declines during the year.

Key drivers of MFP and dairy consumption

In comparison to plant-based products, MFP and cows’ dairy products are good value, especially when considering they are highly nutritious products high in protein and packed full of vitamins such as B12 and minerals. Also, with the current spotlight on ultra-processed foods, the naturalness of primary red meat cuts and milk in particular is a key selling point, which AHDB are educating consumers on through media campaigns such as Let’s Eat Balance, Milk Every Moment and Love Pork.

MFP is also more likely to be requested by family members and eaten for enjoyment and taste reasons, as well as naturalness (Kantar Usage, 52 w/e 12 May 2024). With price remaining a key motivating factor for meat consumption, along with health returning as a focus, it is unsurprising that demand for meat substitutes is anticipated to be muted for 2024 and 2025, and volume growth is not likely to be seen until 2026 (Mintel, Meat Substitutes UK report, 30 January 2024.

Moving forward

Whilst they are still topical areas of interest for consumers who purchase meat and dairy, as well as meat-free products, with consumer confidence recovering, reputational topics such as health, animal welfare and the environment are likely to rise up the priority list. One way we can address reputational issues is on red meat labelling, as research by AHDB found that including messaging on pack around health benefits and provenance of products would help shoppers to make informed decisions on their purchase and shoppers like seeing farming and sustainability credentials at the point of sale. We continue to do work to promote the benefits of British meat and dairy.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: