- Home

- Knowledge library

- Consumer insights: Optimising red meat labelling

Consumer insights: Optimising red meat labelling

This research was undertaken in collaboration with Basis Research with the aim to understand how we can optimise red-meat packaging and labelling. Our analysis examines opportunities to optimise meat labelling to improve shopper purchase intent for red meat, as well as improve long-term perceptions of the industry.

What are the opportunities?

While spend has increased over the last few years, volumes of red meat purchased have declined year-on-year since peaking in 2020. AHDB has previously undertaken analysis of shopper data, which has shown that there is a need to re-engage shoppers with the red meat category, both in store and online. With this research we wish to understand how we can optimise meat packaging and labelling to help consumers re-engage with the red meat category when at fixture.

Who is this analysis for?

This research aims to help supply retailers and processors with evidence as to what shoppers are looking for on food packaging that could influence their purchase intent and, in turn, protect and grow red meat sales. It may also be of interest to British farmers, helping them understand how AHDB is looking to promote and protect the long-term reputation of red meat to consumers in the retail environment.

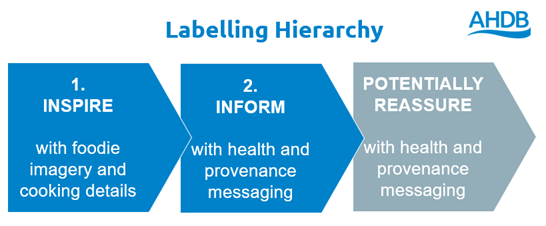

The hierarchy

There was a clear preference to the hierarchy of what should be included on pack, regardless of the protein or cut. These could be split into three categories:

1. Inspire

Inspiration was the biggest driver of purchase intent. Shoppers were drawn to images of tasty dishes; therefore, having strong foodie imagery on pack is essential. Consumers also found that having information on cooking times gave them more confidence – particularly for less familiar cuts such as lamb. Read the full research:

2. Inform on health and provenance

Health and provenance information was liked by shoppers to help them make an informed decision about their purchase. Health is a driver of purchase, particularly low in fat and vitamin and mineral content. Highlighting British origin, farming methods such as grass-fed or free-range as well as any assurance schemes. Read the full research:

3. Reassure on environment and farming

Information on farming and sustainability credentials was liked by lighter meat shoppers and those who were cutting back on their meat consumption. In previous research looking at the meat aisle, we found that these messages were most effective on point of sale at fixture. Read the full research:

Labelling format

There were also thoughts on how the label should look. QR codes and stickers were two ways of being able to include additional messaging outside of the label itself. Read the full research:

Key findings

- Labels which utilise strong food imagery were best liked by shoppers and increased intent to purchase across all cuts and proteins

- The most compelling inspiration and taste messages on pack focused on ‘How to cook the perfect…’ product, quality guaranteed messaging and fat and flavour statements

- Cooking information on pack gives shoppers confidence in purchasing red meat, especially for cuts of proteins they are less familiar cooking with

- Packs should highlight the multiple benefits of red meat with tangible consumer benefits, particularly for low fat and B12, making sure it is clear that these are naturally occurring and not artificially added

- Shoppers like provenience and housing credentials highlighted and logos for assurance schemes to be on packs where possible

- Don’t over-crowd labels with too many messages as this makes it harder for shoppers to navigate. The ideal was using one longer message, plus a couple of simpler points

- Shoppers didn’t like labels and stickers which covered too much of the product in the pack nor peel-and-stick stickers, as seeing one which had obviously been peeled would result in them being less likely to pick up the pack

Examples of optimised meat labels

Watch the video summary

Volume growth in fresh red meat has been challenging for many years. Over time, there has been growth in chicken and, in some instances, meat alternatives at the expense of red meat. This has been largely due to price, ease of meal cooking and negative health perceptions. In particular, the drive for convenient meal options has put increased pressure on primary red meat products to meet evolving consumer needs.

Analysis provided by Kantar has also identified that unconscious reducing is the biggest threat to red meat. This ‘unconscious reduction’ is from shoppers who do not actively follow a meat reduction diet, yet they are behind the majority of category losses that were taking place prior to the coronavirus pandemic.

AHDB has previously undertaken research to understand how to capture shoppers both online and in store, including how best to re-engage shoppers with the meat aisle in store. A key takeaway from this research was that there are communication opportunities through the inclusion of inspirational imagery and health messaging on meat packaging.

This latest research now examines how we can optimise meat packaging and labelling across a range of different proteins and cuts to help increase shoppers’ intent to purchase when at fixture.

Utilising a three-stage mixed methodology*, the research set out to answer the following objectives:

- Identify which concepts and messages on pack will drive behaviour changes at point of purchase within the red meat category and improve perceptions towards the industry in the longer term

- Be able to showcase optimised concepts to deliver ideal meat labelling across a range of cuts and product tiers (e.g. mince versus steaks, premium versus standard)

- Influence processors and retailers in the industry to initiate changes to meat labelling

For this project, we utilised a three-stage mixed methodology. This allowed us to fully test which concepts and messages on pack drive behaviour changes at point of purchase within the red meat category.

We used a sample who were jointly or solely responsible for grocery shopping and classified themselves as either a stable meat eater, or as cutting back. Meat rejectors were not included in this research, but otherwise the sample was nationally representative.

Stage one

We used an online quantitative survey of 624 meat eaters, split evenly between stable meat eaters and those cutting down. The survey included a Max Diff to test the hierarchy of key packaging messages we wanted to test.

Stage two

We utilised an online qualitative community to explore key information, messages, images, logos and where these should be included on pack. The community consisted of 10 stable meat eaters and 10 who are cutting back on their meat consumption.

Stage three

We used a 20-minute online quantitative survey exploring the optimised designs which we created from the results of the first two stages. These designs were tested on 1514 meat eaters, split evenly between meat eaters and those cutting down on their meat consumption.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: