Added Value’s relevance for meat is apparent but opportunities remain

Monday, 28 June 2021

Convenience products, an evolving market where the main aim is to make life easier for the consumer, have been increasing their presence on supermarket shelves for many years. For meat this includes marinades, sous vide and ready-to-cook products, for example in a foil tray or bag. However, with the COVID-19 pandemic, have Added Value (AV) ranges maintained their relevance?

In short, yes, because despite many consumers enjoying more time at home to scratch cook, over half (54%) of meals in the last year have still been driven by convenience needs (Kantar Usage, 52 w/e 21st March 2021). So what are the opportunities going forward?

How did Added Value perform pre-pandemic?

For meat, fish & poultry (MFP) pre-pandemic AV was a growth driver, with spend reaching £874m in 2019, rising by 20% over five years (Kantar, 52 w/e 26 Jan 2020). This was against a backdrop of only 3% spend growth for total MFP and declines in value and volume for primary red meat.

In the year leading up to COVID-19, AV was actually one of the only categories to see volume growth for pork, beef and lamb, along with mince for all and diced/cubed/stewing for lamb, again all lending themselves to more convenient meal solutions. However, it needs to be remembered that AV only accounts for 4% of total red meat volumes and therefore gains were unable to compensate for other cut losses.

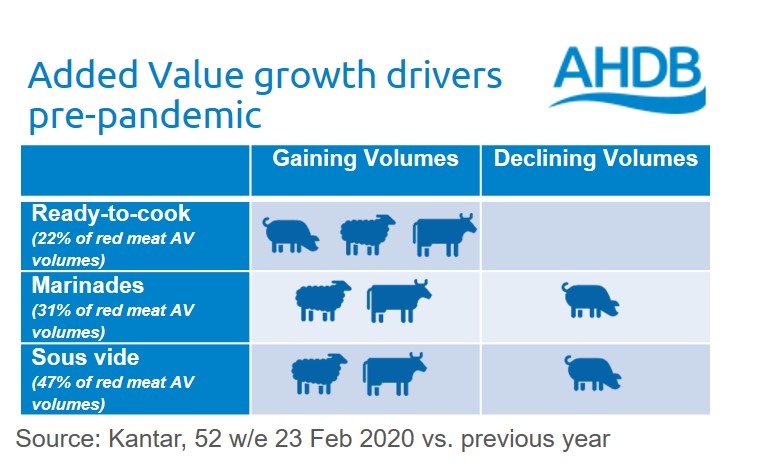

Within this red meat AV growth, prior to the pandemic, there was a mixed performance for the individual categories. Overall AV growth was driven purely by ready-to-cook products, across all meats, but particularly pork. These ready-to-cook gains outweighed losses for marinades and sous vide which were impacted by a poor performance for pork as beef and lamb grew in these two categories (Kantar, 52 w/e 23 Feb 2020).

How has Added Value performed recently?

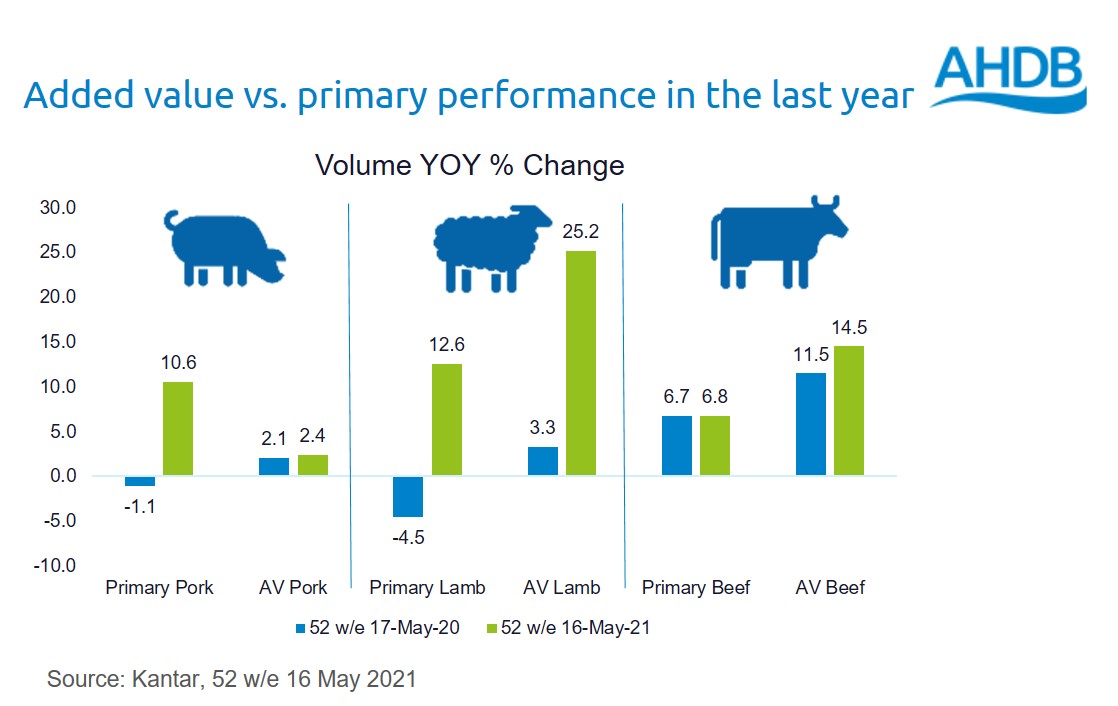

The pandemic has triggered growth in retail meat sales, benefitting a range of cuts. Looking at the last year we can see that AV has fared differently across the red meats but overall is in volume growth of +9% and value growth of +20%, the latter a faster growth than primary (Kantar, 52 w/e 16 May 2021). AV beef and lamb have accelerated their already strong growth year-on-year, whereas pork only maintains, despite the COVID boom.

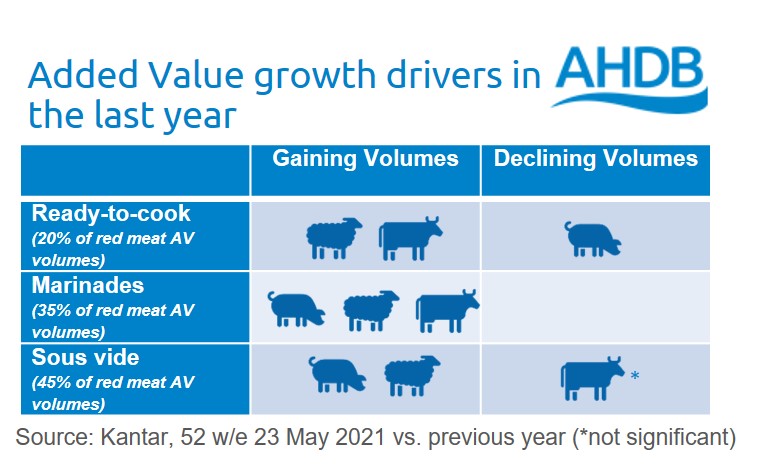

Unlike pre-pandemic, 96% of the growth seen for AV in the last year has been driven by marinades and sous vide which have seen an exceptional recovery. However, like pre-pandemic, lamb performs well across all AV products and pork is a key area to address with ready-to-cook.

For marinades, all red meats have contributed to the positive AV performance with double digit growth year-on-year. The biggest volume contributor has been beef steaks, particularly with butters and flavourings, and BBQ ranges. While traditional flavour pairings, such as peppercorn with steak and mint with lamb, still dominate there are innovation opportunities to excite the category, as well as consider pack sizes for different occasions. This is particularly important as we predict more treating meals and social gatherings at home post COVID.

For sous vide, lamb and pork are growing year-on-year. Beef has seen slight declines highlighting an opportunity to push further. Key for sous vide is tactical support. Around a third of sous vide volumes are sold on promotion (Kantar, 52 w/e 21 Feb 2021). During the pandemic, meal deal promotions were scaled back but Y for £X deals remained just as important for the category as previous years.

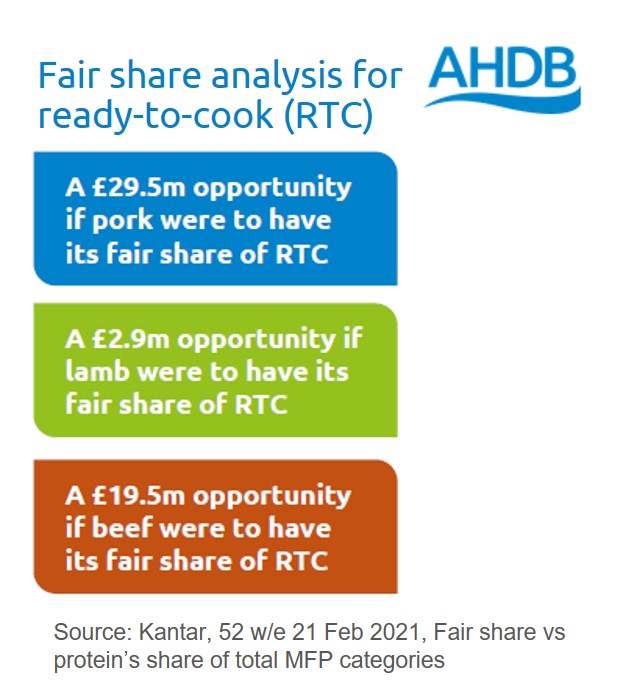

For ready-to-cook the strong growth seen for pork pre-pandemic has not been maintained and pork ready-to-cook has seen volume losses since October last year. These losses have limited category growth, with beef and lamb only just being able to compensate, resulting in relatively flat volumes year-on-year. Currently the ready-to-cook market is dominated by chicken (approximately three quarters of sales) highlighting an opportunity to reinvigorate meat. A good gammon offering is key for pork but there is scope for more indulgent meat products. Innovation in the market recently includes beef wellingtons and fakeaway products such as lamb kebabs and meat topped dirty fries.

Opportunities for the Added Value category

- From previous consumer research we know AV products need to dial up taste credentials and reassure on quality, consider the role of sourcing

- Health is an area of concern so consider addressing through ranges or serving suggestions

- Legacy COVID behaviours mean more in-home meal opportunities, play on the treating element of the category

- Innovation in flavourings, particularly world cuisines, and different sizing options for socialising and celebrations

- AV is typically an unplanned purchase so stand out in store is key. Think of the whole plate and inspire the accompaniments

- Tactical support is essential to increase penetration of the category