Flexitarian trends: Shifting diets and changing preferences

Thursday, 22 May 2025

Dietary preferences are forever evolving and are influenced by many external factors, such as cost, health, media, family and friends, and the environment. So, with all these factors influencing today’s consumer, what are flexitarians choosing to eat in 2025?

Growth in meat eaters and decline in plant-based diets

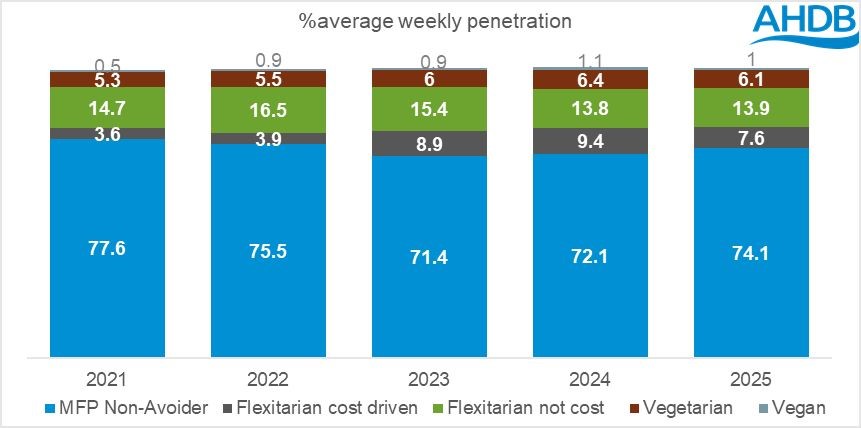

In terms of the latest movements within the GB population, the number of consumers eating meat, fish or poultry (MFP Non-Avoider) has risen 2 ppt from 72.1% to 74.1% year-on-year.

Conversely, the number of consumers identifying as flexitarians* (cost and not-cost reasons combined) has decreased from 23.2% in 2024 to 21.5%, while the number of vegan and vegetarian consumers have declined slightly to 1% and 6.1% share respectively (Kantar Usage, 52w/e 23 February 2025).

*Flexitarians are consumers who have expressed they are reducing their red meat consumption.

Source: Kantar Usage, Total main meal occasions, 52 w/e 23 February 2025 versus previous four years

Despite these declines, the flexitarian diet remains a popular choice for those who desire a balanced approach to nutrition, including a mix of both meat and plant-based meals.

Approximately 20% of main meals consumed by flexitarians now include red meat, a clear indicator that its nutritional and culinary value remains high. AHDB’s Let’s Eat Balanced campaign highlights the health benefits red meat can provide when eaten in moderation.

Red meat continues to be an excellent source of essential nutrients such as iron, zinc, and vitamin B12, which are harder to obtain in sufficient quantities from plant-based foods alone.

Diverging flexitarian motivations and red meat preferences

Kantar Usage data reveals two distinct types of flexitarian consumers: those driven by health and lifestyle and those guided by financial concerns.

-

Flexitarians not-cost (13.9%) tend to be more affluent, older and more focused on a natural and healthy, balanced diet. While they do reduce their meat consumption, they are more likely to consume fish, chicken breasts and dairy products such as cheese, butter and yoghurt. As cost is a lower priority, they incorporate these products into their meals on a regular basis

- Flexitarians cost driven (7.6%) are often from lower-income households or families managing busy schedules, are more likely to rely on red meat as a familiar, versatile and satisfying component of meals. This group favours value-for-money cuts such as mince, sausages and burgers, which are quick and easy to cook while still delivering on protein and flavour

Meaty meals and changing preferences

According to Kantar, the number of meals eaten within the home have declined by -1% year-on-year (Kantar Usage, 52 w/e 29 December 2024), as consumers are potentially working from home more often. Within in-home meal consumption, share of meals not containing meat have risen slightly from 43% to 43.3% year-on-year, with vegetarian meals accounting for 24% and vegan meals making up 19.3% (Kantar Usage, Total main meal occasions, 52 w/e 23 February 2025).

The majority of meals without meat are naturally so, rather than a conscious decision, for instance, beans on toast, salad, soup and eggs.

This rise is being driven primarily by lunch occasions, where simple and lighter options are consumed. Meals such as soups, salads and sandwiches naturally lend themselves to options without meat, with 55.6% of lunches now not containing meat, up from 54.6% last year.

Meals without meat, such as Italian dishes and baked potatoes, are growing in popularity as they are cheaper than the traditional sandwich and are quick and easy to prepare (Kantar Usage, Total main meal lunch occasions, 52 w/e 23 February 2025).

However, the proportion of evening meals not containing meat has remained constant at 34.4%, suggesting that consumers continue to value red meat and other proteins at dinner time when they are looking for variety, heartiness and satiety (Kantar Usage, Total main meal evening meal occasions, 52 w/e 23 February 2025).

Cost comparison of a main meal

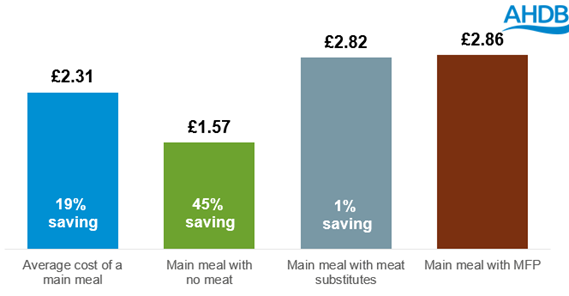

Source: Kantar Usage, Total In-Home & Carried Out of Home main meals, Average saving per meal versus main meal with MFP, 52 w/e 23 February 2025

Affordability drives meatless meal choices

Affordability remains a significant driver in meal decisions at this time. With meals without meat averaging £1.57 versus £2.86 for those with meat, fish or poultry (MFP), this provides a 45% saving per meal. When meat is substituted with a plant-based alternative, the price averages £2.82 – only four pence cheaper than MFP, narrowing the financial argument for meat substitutes (Kantar Usage, Total main meal occasions, 52 w/e 23 February 2025).

This subtle difference may be contributing to the decline in meat-substitute popularity, with their share of meat-free meals dropping from 5.8% to 4.7% in February 2025 (Kantar Usage, Total main meal occasions, 52 w/e 23 February 2025).

It suggests that while consumers are mindful of budgets, they are becoming more discerning – opting either for naturally meat-free dishes or returning to traditional meat-based meals that they view as more natural, satisfying and nutrient dense.

Opportunities for red meat and dairy

As the food landscape shifts, retailers and processors must adapt to these diverse consumer preferences, offering a wide range of affordable, convenient and health-conscious meat and dairy options to meet the growing demand.

Lunchtime – Italian dishes, soups and baked potatoes are all popular options that are quick to prepare. By adding beef or pork mince, ham, cheese or butter to these meals, these options become more filling, tastier and more enjoyable at a minimal cost.

Evening meal – Italian meals continue to be the most popular choice which provides the opportunity to use mince, bacon, cheese and milk. Roast dinners are also a popular option which provide a healthy meal with all the accompaniments which can often provide surplus to be used for an additional mealtime.

A balanced future is the way ahead

Whether driven by health, convenience, sustainability or cost, many flexitarians are finding space in their diets for red meat without seeing it as a contradiction to their goals.

Higher costs have been a considerable influence in the rise of flexitarians over the last two years, but as financial pressures start to ease, more flexitarians will be able to achieve the best of both worlds: a diet that is affordable, balanced, healthy, sustainable and, most importantly, tasty!

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: