Behind the headlines of Meat-free

Friday, 8 September 2017

As the media intensifies coverage on the growth of diets featuring less meat which has given rise to the term flexitarian, has this impacted the meat category as much as it may have first been thought? Although 40% of evening meals contain no meat or meat substitute, it is important to note than 91% of GB households still bought fresh or frozen meat in the past year, according to Kantar Worldpanel, showing all may not be what it seems. Although more people are buying into a meat-free or substitute diets, actually only 0.2% of buyers left the meat, fish and poultry category this year, showing that the majority of these consumers are purchasing both meat and meat-free products.

The role of health

28% of UK consumers consciously reduced or limited the amount of meat or poultry in their diets in the six months to March 2017, according to Mintel. With health being at the forefront of modern day lifestyles, it is unsurprising to note that health is the primary reason for consumers wanting to reduce their meat intake, following a multitude of studies assessing the health implications of excessive meat consumption. Other factors which have been shown to contribute to a rise in meat-free diet are animal welfare and environmental concerns.

Despite concerns about the role of meat in a healthy diet, many still believe that meat provides the essential nutritional benefits needed in our everyday diets, with 36% of consumers being more likely to choose meat because it is more natural and unprocessed than its meat-free alternatives, according to Kantar Worldpanel.

While some consumers are unaware of the health credentials associated with meat, those that do can often have different health views depending on the type of meat. Although research suggests that consumers may be moving away from red meat due to health concerns, according to the AHDB/YouGov tracker, 20% of consumers still see beef as being ‘good for you’, with pork and lamb just behind at 17%. Additionally, over 40% also see beef, lamb and pork as a ‘good source of protein’.

Six in 10 adults believe that meat/poultry is the best source of many essential vitamins and minerals

Industry uptake

As the amount of consumers reducing meat in their diets increases, some supermarkets and food service businesses have increased their meat-free offerings with substitutes for fresh, cooked and processed meats including steaks, sausage rolls, bacon and chicken kievs. According to the Grocer magazine, supermarket giant Sainsbury’s are trialling new in-store formats by placing vegetarian alternative products next to meat products in aisle, as well as handing out meat-free recipes, reward vouchers and loyalty points to customers who choose vegetarian products. Popular coffee shop Pret A Manger have also followed suit by transforming two of its stores into a new ‘Veggie Pret’ resulting from a successful temporary pop-up shop in Soho last year.

Branded vs own-label

Mintel’s meat-free foods report suggests that the meat-free category in the UK is made up of both branded and own-label products, with own label comprising of 74% of chilled meat-free sales in 2016/17, compared to the leading brand, Quorn, with 12% of the volume sales in the chilled meat-free category. The most popular meat-free chilled snacks are ready meals, pastry-based products, snacks and sausages, with ready meals and sausages also being amongst the most popular frozen meat alternatives.

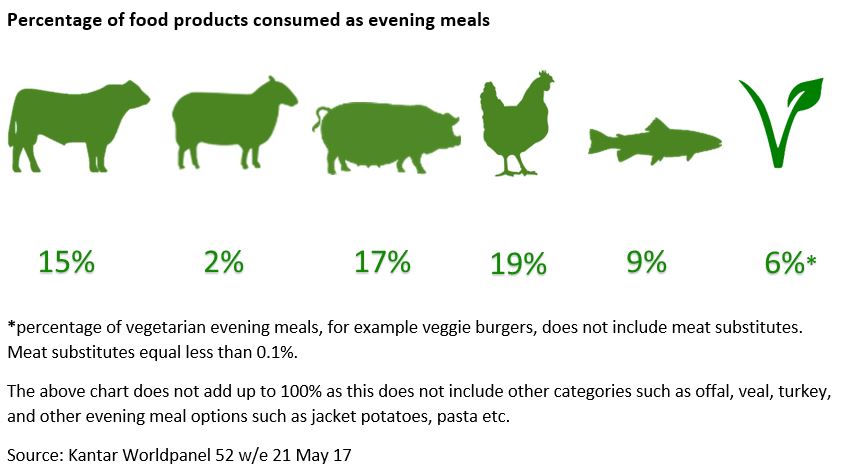

Meat substitutes are still an incredibly small player on the plates of our evening meals, at less than 0.1%; meat still being the favourite, with chicken topping the list at 19%, pork and beef following closely behind as leaders of the evening meal. Also it has been suggested that as part of the ‘flexitarian’ trend some consumers mixed or swapped meat with meat substitutes, it still proves to be a very small market and not one which will rival the main proteins any time soon.

Meat is still valuable to the consumer

Mintel shows that 50% of adults think that meat substitutes lack flavour and only a minority associate meat-free foods with versatility, compared to the 46% of people who see beef as versatile and 60% on chicken. According to the AHDB/Tracker, some 55% perceive beef and poultry as ‘tasty’, while over 40% stated the same about pork and lamb, this is where meat has the edge over its substitutes. It is also suggested that there are public concerns over the ingredients and production processes used in order to create these products, restoring faith in meat production with 6 in 10 adults believing that meat and poultry are the best source of many essential vitamins and minerals.

The meat, fish and poultry sector remains a major category in the grocery market, worth almost £18bn according to Kantar Worldpanel. While the threat from the meat free sector is currently quite small, it should not be under-estimated. In the face of this trend, the meat industry needs to make more of its strengths which include; its health benefits, the fact that primary red meat is a natural/non-processed product, the versatility of meat and its ability to deliver when it comes to that all important driver of satisfaction - taste.

Topics:

Sectors:

Tags: