Are cost conscious consumers still reaching for ready meals?

Monday, 4 December 2023

While prepared meals¹ are an occasional choice for most, we see these meals play a role in 90% of consumers diets in 2023 (Mintel Ready Meals and Ready-to-Cook Foods report – UK, 2023). With 29% of consumers claiming they eat ready meals at least once per week (AHDB/YouGov, May 2023).

The lives of consumers have become busier than ever, and it is no surprise that the speed and ease of ready meals makes them particularly appealing. As such, convenience meals as a preparation method² have seen a growth in share across both lunch and dinner occasions over the last five years (Kantar Usage, 52 w/e 3 Sept 2023). At present, convenience meals account for 15.3% of evening meals, and 5.9% of lunch occasions. While this is slightly down on last year when evening occasions peaked, it is 1.3 percentage points (ppt) and 1.1ppt respectively above levels seen in 2019. This is despite scratch cooking remaining a cheaper option than purchasing these premade meals.

When we look at why consumers purchase convience meals, no one attribute appeals to all users. Familiar flavours are key for a third of everyday solo diners, and is also top of mind for family dinners on leisure occasions, while time saving is prioritised as a top reason for meals for two on leisure occasions. But overall, time saved by not cooking from scratch, and meals which provide a good source of nutrients (eg protein, vitamins) are key selling points for the category (Mintel, 2023).

Reseach from AHDB and YouGov found that almost a fifth of consumers did not feel confident in providing themselves and their households with nutritionally balanced meals on a daily basis (August 2023). This research also found that only 39% of consumers enjoy cooking and are confident in cooking a wide variety of dishes (May, 2023). We have also seen a movement for consumers to replace out of home meal occasions with in home ones, often as a way to save money. Ready meals can provide this treaty, out-of-home experience at a lower price point, hence their appeal. All of these factors, in combination with busy lifestyles, may have resulted in the widespread use of ready meals within consumers meal repetoirs.

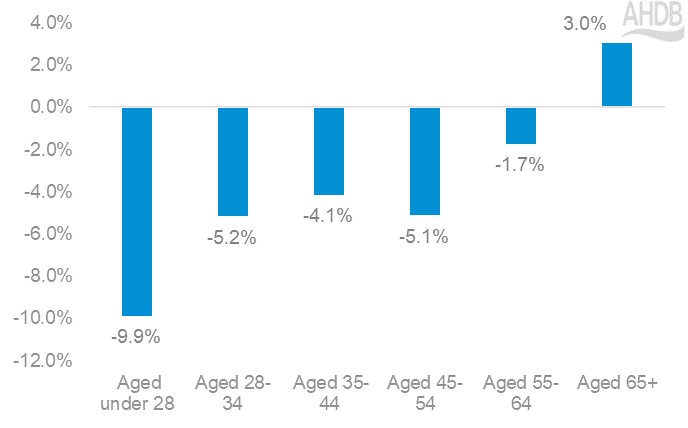

However, we started to see overall ready meal purchases decline in 2022, and this is a trend which has continued into this year (Kantar, 52w/e 29 October 2023). This has been driven by a reduction in shoppers across the majority of age demographics, with all but those aged 65+ reducing the volumes of pre-prepared meals including beef, pork, lamb and chicken that they are purchasing.

Volume changes of ready meals purchased by demographic

Source: Kantar | Demographics | Total volumes purchased | 52 w/e 29 October 2023 vs 30 October 2022

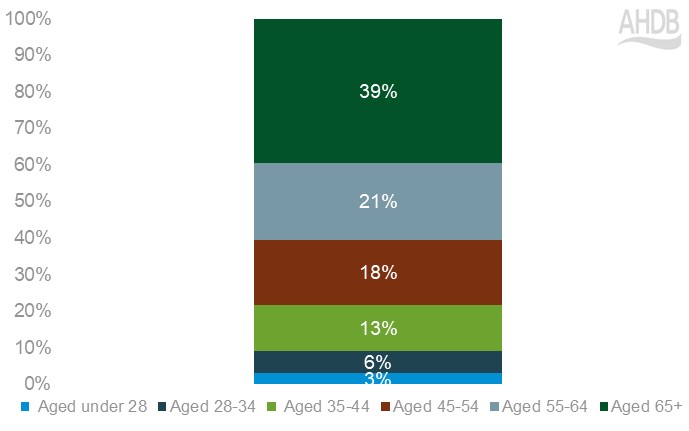

There were shopper volume declines across the age groups with the exception of over 65’s. This segment accounts for the largest volume share of sales, and despite volumes rises within the segment, total volumes purchased declined by 1.4%, only slightly above the volume declines seen by the total MFP category in this same period (Kantar, 52w/e 29 October 2023).

Volume share of ready meals purchased by demographic

Source: Kantar | Demographics | Total volume purchased| 52 w/e 29 October 2023 vs 30 October 2022

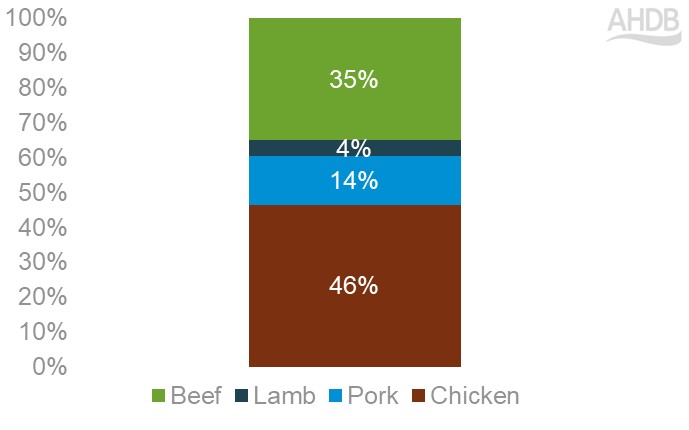

Meat in ready meals

Beef accounts for the largest actual volumes of the red meats, holding a 35.0% share of the market. However, chicken holds the overall largest share, accounting for 46.4% of all ready meals purchased.

Volume share of red meat and chicken in ready meals sold

Source: Kantar | Total volumes purchased | 52 w/e 29 October 2023

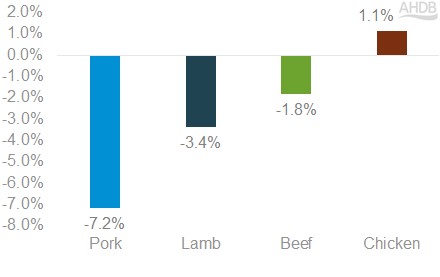

All of the red meats saw ready meal volumes decline year-on-year. Pork saw the greatest decline, both in terms of actual volumes purchased and percentage change, as it saw a reduction of 7.2% year-on-year. In the same period, beef and lamb ready meals were down 1.8% and 3.4% respectively, despite beef seeing an uplift in frozen ready meals purchased (Kantar, 52 w/e 29 October 2023). Chicken was the only protein to see growth with volumes up 1.1% on the same period last year.

Red meat and chicken ready meals volume sales change year-on-year

Source: Kantar | Volume change | 52 w/e 29 October 2023 vs 30 October 2022

Losses for pork have come from all types of ready meals. However chilled main meal accompaniments (e.g. the pork and sauce part of casserole where the side dishes of carbohydrate and vegetables are sold separately) saw the greatest loss of share, down 11.9% y-o-y, while frozen saw the smallest loss in volumes, back 4.2% (Kantar, 52w/e 29 October 2023). When looking at wider red meat purchasing trends during the last few years, we have seen consumers trading down tiers and switching between proteins as a means to save money. Price is likely influential in the slower decline of frozen pork ready meals as they command the lowest average price at £5.40/kg, while chilled main meal accompaniments command the highest at £8.29/kg (Kantar, 52w/e 29 October 2023).

It is likely that shoppers’ finances will continue to be squeezed over the next year, therefore prepared meals may have to justify their higher price point to consumers. However, there are some opportunities for the category, particularly when the dishes contains red meat:

- It is important to retain the core red meat ready meal demographics, so catering to their preferences for traditional tastes and flavours is important. However, to win share of in-home meal occasions which are replacing the out of home ones, take inspiration from emerging food trends in foodservice, or add a twist to well-loved classics to help consumers feel comfortable in engaging with the products

- Time is at a premium to consumers, so highlighting any time which they can save by not cooking from scratch is a key selling point. Calling out quantifiable time savings that can be made by purchasing the readymade version, or even the number of pots and pans saved from needing to be washed up may be appealing to consumers

- Costs remain important to consumers, but perceived value for money is also an important selling points of ready meals. Position the treatiness and potential for offering an out of home dining experience at a cheaper cost

- Consumers are finding it harder to follow a nutritionally complete diets amid money concerns, so use messaging highlighting any health benefits and nutritional credentials of meals wherever possible

¹Prepared meals include ready meals and ready to cook foods. Ready meals were defined to respondents as prepared pre-cooked meals that just need to be heated (e.g. lasagne) and ‘ready-to-cook foods’ as prepared foods that require no further preparation but require cooking (e.g. Sainsbury's Just Cook range). Chilled, frozen, and ambient variants were included.

²Convenience meals as a preparation method includes ready meals and frozen pizzas

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.