- Home

- Knowledge library

- Consumer insights: Optimising butchers and supermarket meat counters

Consumer insights: Optimising butchers and supermarket meat counters

Independent butcher shops and supermarket meat counters make up a small but important part of the retail market for red meat purchases. This analysis examines opportunities for protecting and growing retail performance at these retailers by understanding the messages shoppers are looking for, and the format that they should take, with the aim to drive conversion to purchase red meat.

What are the opportunities?

Currently, loose packaged meat and poultry accounts for 7% of the total market, equivalent to almost 183 million kilos (Kantar, 52 w/e 20 April 2025).

We know that shoppers like interacting with the meat counter and that these counters play an important role within red meat in retail. However, retail data has shown that at a total market level, loose package red meat and poultry is in a 3.2% decline and underperforming compared with prepackaged which has seen a 0.7% growth in the same period (Kantar, 52 w/e 20 April 2025).

So how can we reengage shoppers with the meat counter and inspire them to purchase their red meat in a loose packaged format?

Who is this analysis for?

We aim to help butchers’ counters at both independent retailers and supermarkets to increase demand and volumes of red meat being purchased. This benefits levy payers by increasing demand for red meat in the market.

Key findings

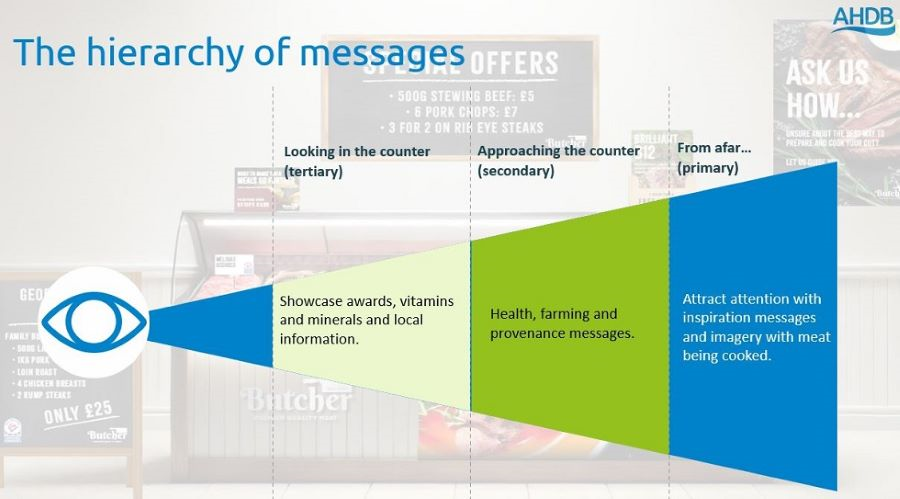

The research found that there is a hierarchy of messages needed at different stages of a shopper journey to a counter: from afar, on the approach, and when looking at the counter.

An example of how a meat counter could look when implementing the research insights

Source: AHDB/Linney re-thinking butcher research 2025

From afar

- The theme of inspirational communication is standout in attracting people to the meat counter. Utilise foodie imagery and informative messaging (such as guidance on how to prepare and cook a piece of meat) to get shoppers thinking about the different tasty meals they can make with meat purchased from the counter

- Larger assets such as posters, chalk boards and A-frames are good formats to use for inspiration messages and attract the greatest attention

- Aesthetics are just as important as the images used. Utilise images of cooking or cooked meat, warm colours such as red, brown and yellow, and avoid abstract images, or those linking the animal back to the meat on display

On the approach

- Leaflets and recipe cards are seen as important by shoppers when they are approaching the counter to provide inspiration, as well as a range of messaging themes to reassure shoppers of concerns regarding health, farming and provenance

- Messages highlighting British farming expertise, local, welfare schemes or the health benefits of vitamins and minerals such as B12 strongly appeal

Looking at the counter

- Showcase awards, vitamins and minerals and local information for the red meat.

- Utilise meat flags for these messages. While the smallest format we tested for displaying information, they are the second most influential for increasing purchase intent

- Also, the role of the butcher should not be underestimated. Consumers like interacting with the butcher, the personalisation of the service and the knowledge that the butcher can offer them. This shows that the human element of a meat counter is really important to consumers, and gives them confidence in their purchases made from the counter

Video: Watch the full insights

AHDB has a number marketing resources, including recipe cards, leaflets, stickers and posters available to order for free from the website, and delivered directly to your door. Equally, for those interested in creating their own resources, AHDB has a number of high quality images of beef, lamb and pork recipes which are available for use. Please contact the Retail and consumer insight team for more details.

Methodology

For this project, we used an online questionnaire of 1,204 respondents. The questionnaire was split into three sections:

- Section one: we used a Max Diff to test the types of messages consumers liked best. We tested 30 different messages ranging from inspiration, health, environment and sustainability and farming and provenance which were then ranked in order of preference. Once we had this ranking, we used TURF analysis (Total Unduplicated Reach and Frequency) which is a statistical research technique that gauges appeal and reach within a market for a combination of messages. This help to maximise the number of consumers you can connect to with the fewest messages

- Section two: Next, we investigated how different point of sale assets are received by format through in situ testing

- Section three: A secondary Max Diff was used to understand what aesthetics best appeal to consumers. We tested 30 different colour pallets and imagery types to best understand what a consumer likes to look at when thinking about purchasing meat

By combining these three stages, this approach has allowed us to understand the messages, formats and aesthetics which could be used to increase purchase intent at meat counters.

Key graphics

It was found there was a clear hierarchy of messages which should be used, and each come at specific points of the shopper approach to the counter.

Source: AHDB/Linney re-thinking butcher research 2025

Each stage of the hierarchy lends itself to different formats for conveying the messages, and works best when the preferred visual aesthetics are adhered to.

Source: AHDB/Linney re-thinking butcher research 2025

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: