Beef: modelling the impact of a UK-New Zealand trade deal

Thursday, 11 August 2022

For beef, the impact of the UK-New Zealand trade deal was examined looking at the changes expected after the deal comes into force. This aspect of the modelling work assumes all other circumstances remain the same. We also looked at the potential impact if, in the future, China banned imports of beef from China.

Key points for beef sector:

- The model suggests that New Zealand beef exports to the UK will increase by around 6,300 tonnes (an increase of 740% in percentage terms on the baseline used within the model)

- Total UK imports are expected to increase by around 2%, or 5,000 tonnes, with the increase from New Zealand partially offset by reduced imports from the EU

- The model predicts that changes to production and price will be relatively small (less than 1%) and New Zealand farmers will see marginal benefits, whereas UK farmers will be negatively impacted, albeit by a small amount

These results assume that China/New Zealand trade relations stay the same. If the relationship was to break down, and China imposed tariffs on New Zealand beef imports, or banned them altogether, there would be much more beef on the global marketplace looking for a home. We have modelled these scenarios, and results show New Zealand exports to the UK rising by around 6,600 tonnes (779%) if China imposed a 25% tariff on New Zealand beef imports and 7,000 tonnes (830%) if there was an outright ban.

The chosen network for beef consists of the UK, New Zealand, EU, USA and China. The EU and UK are key trading partners in beef, with most UK beef imports originating from the EU. The US is a major global beef exporter and New Zealand’s main beef export market is China.

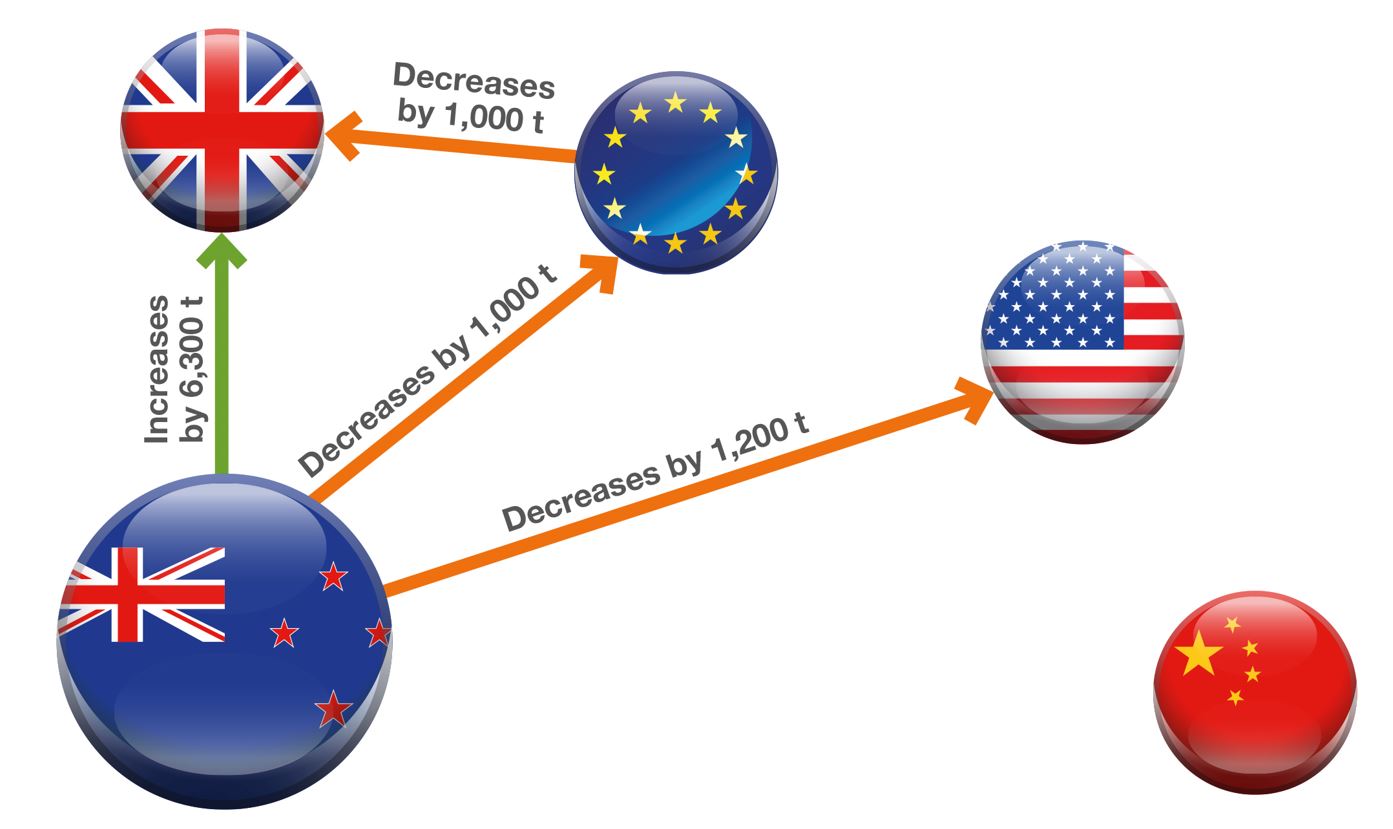

Figure 1 shows how beef trade within the network could change. The model predicts that UK beef imports from New Zealand will increase by 6,300 t (740%), whereas imports from the EU will drop by 1,000 t (-0.4%). Overall, UK beef imports will increase by 2%.

According to the model, in order to send more beef to the UK, New Zealand will increase output, and reduce the amount of beef it sends to the EU and USA. Exports to China would also fall, but not by as much.

Beef cattle numbers in New Zealand have been rising steadily in recent years, as mentioned in the section on New Zealand production systems, with the dairy herd playing a key role in maintaining production levels.

It is also worth noting that New Zealand has negotiated an FTA with the EU. Once this deal comes into force, New Zealand will be able to export up to 10,000 tonnes of beef, at a reduced tariff rate to the EU. As a result, there is potential for New Zealand to send more beef to the EU in the future than suggested in Figure 1.

Figure 1. Network showing main changes in beef trade flows

Source: AHDB/Harper Adams University

The predicted impact of the UK-New Zealand trade deal on UK farmgate prices is small (<1%) with a even smaller drop in production in percentage terms. The New Zealand farming sector, however, is predicted to see a slight increase in production (0.7%) and prices, with the price paid to farmers just under 1% higher.

Table 1 shows the effect of the UK-New Zealand trade deal on domestic production, prices and the total amount of beef available in both countries.

Table 1. Detailed results for beef

| UK | New Zealand | |

|---|---|---|

|

Domestic production |

<-0.1% (-540 t) |

+0.7% (3,700 t) |

|

Price paid to producers |

<-0.1% |

+ 0.9% |

|

Total beef sold in the domestic market (incl imports) |

+0.4% (4,600 t) |

<-0.1% (-80 t) |

|

Retail price |

-0.4% |

<+0.1% |

Source: AHDB/Harper Adams University

Further considerations

There are still a number of caveats to these results. Like other economic models, the trade network model is not a prediction or forecast and assumes all other things remain equal.

For example, the model assumes that New Zealand retains its current preferential trading arrangements with China. If these were to change, we would expect the New Zealand product currently traded with China to be diverted elsewhere in the global marketplace, including the UK.

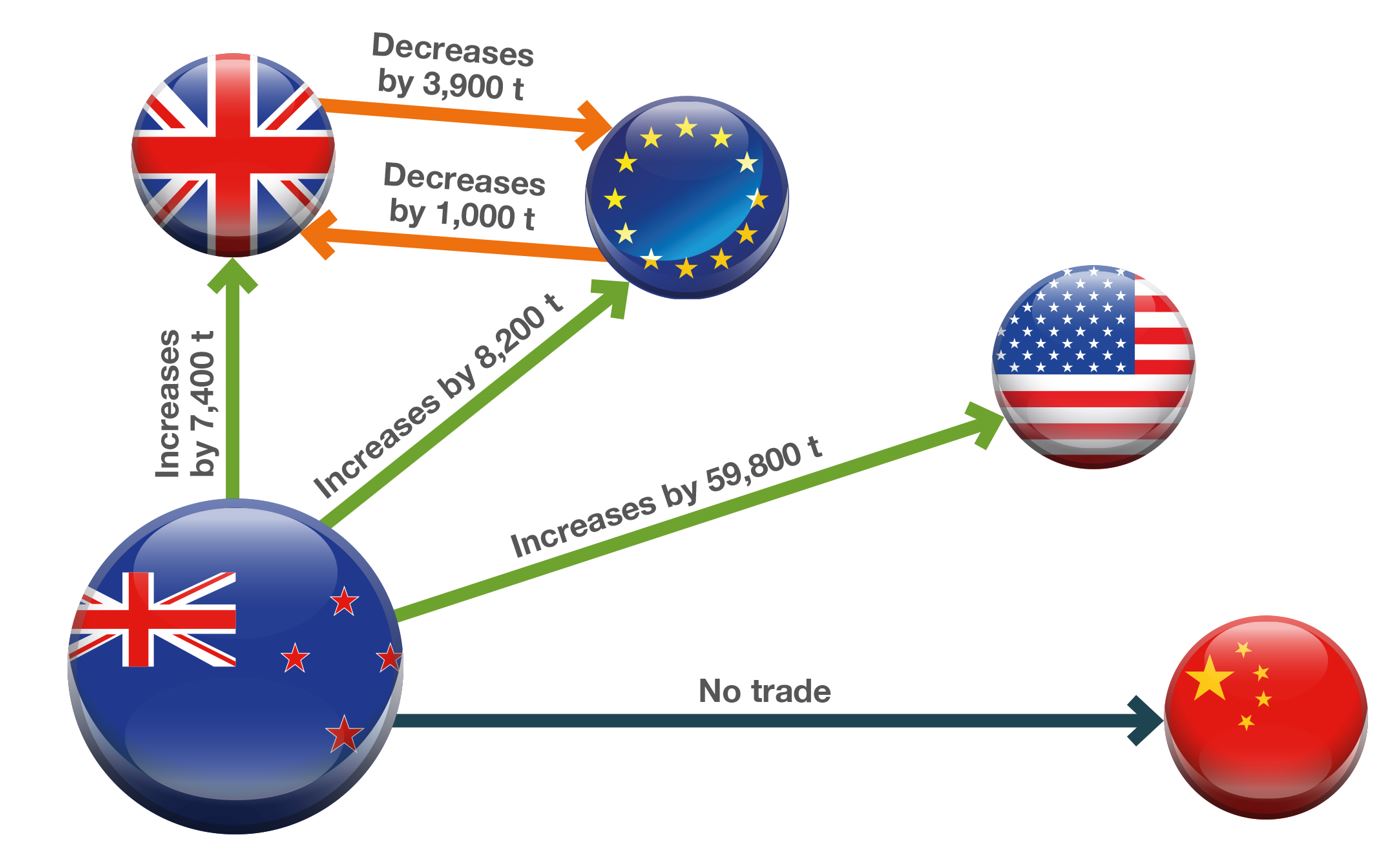

In a scenario where China imposes a 25% tariff on New Zealand beef imports the model predicts that its exports to the UK would increase by 6,600 tonnes (779%) rather than the 6,200 tonnes (740%) discussed above. If China decided to ban New Zealand beef imports altogether, the model predicts that New Zealand beef exports to the UK would increase by 7,400 tonnes (830%).

In both of these scenarios, New Zealand diverts more beef to the US and, to a lesser extent, the EU. The model views the USA as a more attractive option due to a combination of factors including higher farmgate prices making US intermediaries less competitive. It also has the highest retail imported price and the largest market size with respect to the UK and EU.

While exports to the UK increase, the percentage increases in New Zealand beef exports to the EU and USA are higher. An indirect effect of New Zealand exporting more beef to the EU is that it increases competition for UK beef exports into the EU. As a result, UK beef exports to the EU fall by 1,200 tonnes (-1%) under the 25% tariff scenario and around 2,800 tonnes (-3%) under the total ban scenario.

As mentioned earlier, there is greater potential for New Zealand to send more beef to the EU once the negotiated FTA between the countries comes into force.

Figure 2. Main changes in trade flows within network if China banned all New Zealand beef imports

Source: AHDB/Harper Adams University

UK beef production falls by 1.6% to 900,000 tonnes under this scenario with the price paid to farmers declining by less than 1%.

Like other economic models, the trade network model treats all products in a category as homogenous. In reality, we know that there are differing levels of demand for different cuts of beef in different markets. The model treats all cuts as the same and therefore the impact of carcase balance must be considered alongside the results. As such, our interpretation considers the modelling results within the context of the other analysis and findings.