New Zealand farming production systems – Beef and Sheep

Monday, 8 August 2022

In this section, we look at how beef and sheep farming in New Zealand compares with that in the UK.

Introduction

Beef cattle and sheep farming in New Zealand is extensive with hardly any supplementary feeding and housing. New Zealand’s climate and soil conditions make it suitable to graze beef and sheep all year round, whereas in the UK many soil conditions and the weather result in the need to house stock indoors which adds cost.

A typical highly productive beef and sheep farm in New Zealand is around 200 ha in size on average. In the mountainous regions of South Island such farms can be over 1,500 ha.

Beef and sheep farms are the dominant farm type in New Zealand and deer may also be reared on these farms.

The 2019/20 Beef + Lamb New Zealand (B+LNZ) Sheep and Beef Farm survey of commercial sheep and beef farms showed that North Island Hill Country farms were predominant. Most of the livestock is sold in store or prime condition. Details of the other beef and sheep farm classes are available on the B+L NZ website.

South Island Finishing Breeding farms comprised the second-largest farm type according to the 2019/20 B+LNZ Sheep and Beef Farm survey and are the dominant farm class in South Island and are on lower land. These are typically more extensive finishing farms and may include cash crops. Dryland farms have 6-11 stock units per hectare whereas wetter or irrigated farms have 12 stock units per hectare.

Sheep

New Zealand sheep numbers have fallen by over 60% since the 1980s to a headcount of around 26 million in 2020. A reduction in land available for sheep and beef farming is one of the reasons behind this trend, with urbanisation, plantation forestry, an increase in public and private conservation land, and an increase in the area of vineyards all contributing. Dairy farming in New Zealand, which has become more profitable than sheep and beef farming, has also had a negative impact on the number of sheep.

However, despite declining sheep numbers, New Zealand’s sheep meat exports reached record levels in 2020 – ‘average carcase weights for lambs slaughtered for export have increased dramatically over the last 15 years from 14 kg to 18kg’ (B+LNZ 2012). This is due to productivity improvements, with many flocks involved in genetic improvement and composite breeding.

Beef

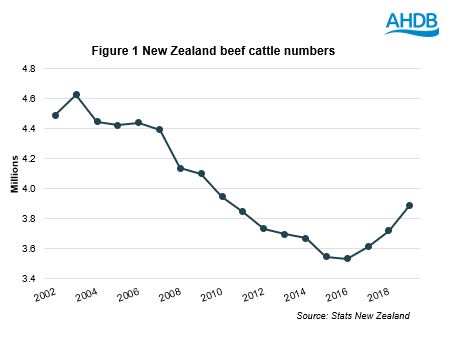

New Zealand’s beef cattle numbers were also following a similar downwards trajectory to that of sheep since the start of this century but have recently started to make some recovery (Figure 1). Increasing beef prices and higher exports to China and the US are cited to be behind the upturn.

Most of beef breeding and finishing in New Zealand occurs on the North Island. The warmest and wettest parts of the North Island create favourable conditions for pasture growth and cattle improve the condition of the pasture for sheep.

A considerable proportion of New Zealand’s beef cattle herd comprises cattle bred in the dairy sector and the dairy herd plays a key role in making sure that the national beef herd is large enough to maintain production levels.

In New Zealand, there are two main beef cattle farming systems; beef breeding cows and growing/finishing beef cattle. Beef breeding herds are usually found in the hill country farms in the North Island, while growing and finishing tends to occur on lowland farms with high quality pasture. Although supplementary feed such as hay, silage, forage may be used in challenging circumstances, most beef cattle have a predominantly pasture based diet.

The average altitude of the North Island (average elevation of 170m) is lower than that of the South Island, where a considerable proportion of land is 600m above sea level and similar to the average elevation of the Scottish Highlands.

Costs of production – international benchmarking

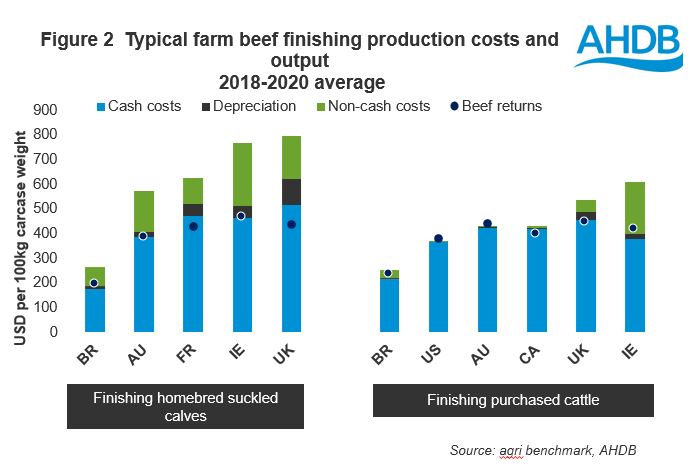

AHDB is a member of the international agri benchmark beef and sheep network, a global, non-profit network of agricultural economists, advisors, producers and specialists in key agricultural sectors. In previous Horizon reports looking at the UK/Australia trade deal and potential UK/US trade deal, agri benchmark data has been used to compare costs of production for beef and sheep farms in different countries within the network. New Zealand was a member of the agri benchmark network until 2017. As a result, we cannot use the latest agri benchmark data to compare New Zealand cost of production data with other countries (such as the UK) in this analysis. We can, however, use the latest data for Australia as a proxy. Figure 2 shows that typical beef finishing costs in Australia were lower compared with the UK (2018-20 average).

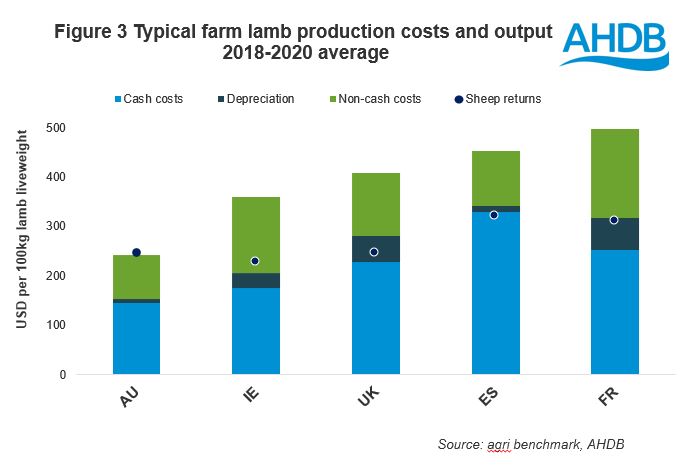

Typical lamb production costs (Figure 3) were also lower. While similar data for New Zealand is not available over this time period, we know that Australia’s production costs are likely to be higher due to additional costs incurred from dealing with drought. Furthermore, previous data has consistently shown that Australia’s production costs are higher than those in New Zealand due to additional costs around drought conditions, infrastructure, travel logistics and feeding.

However, it is important to note that it is difficult to compare Australia and New Zealand on a like-for-like basis as there are differences in geography, climate and production systems. New Zealand's freight costs are considerably higher due to its location and New Zealand does not have the same levels of shipping traffic which contributes to higher fertiliser costs. Furthermore, New Zealand farmers are also facing higher regulatory costs which are expected to increase as agricultural emissions are priced at an on-farm level.

The fact that the New Zealand beef and lamb has lower cost of production than the UK is no surprise; economies of scale due to larger farm sizes and a mainly pasture based system are key factors behind this. However, this does not mean that a trade deal between the UK and New Zealand will automatically lead to increased competition for British beef and lamb; New Zealand already has lucrative markets in Asia-Pacific and all things remaining equal, the fact that it has lower cost of production compared with the UK doesn’t act as a signal to target the UK. Nevertheless, it does mean that New Zealand beef and lamb is more competitive than British beef and lamb in the global export market.

Click below for:

New Zealand production systems - overview

New Zealand production systems - Dairy

New Zealand production systems - Pigs