New Zealand’s Free Trade Agreements

Monday, 8 August 2022

New Zealand has completed 12 Free Trade Agreements, including bilateral agreements, with China and Malaysia, as well as well as with larger trading blocs, such as the Association of South East Asian Nations (ASEAN). FTAs with the UK and EU have been concluded but are awaiting ratification. Negotiations for an FTA with the Gulf Cooperation Council (GCC) and India are currently underway.

In this section, we delve into some of the FTAs New Zealand already has in place as well and compare/contrast these with the UK-New Zealand FTA.

New Zealand – China FTA

The New Zealand – China FTA has been in force since 2008. China is New Zealand’s most important trading partner. From an agrifood perspective, New Zealand’s key exports to China are dairy, meat and preparations of cereals, flour and starch.

Currently, there are no tariffs on 97% of all New Zealand goods exported to China. For dairy, there are some products which are still subject to tariffs as well as safeguards which are due to be phased out by 2024.

|

Date for removal of tariffs |

Year of FTA in which tariffs removed |

% of NZ exports in 2008 |

Key export products |

|

2012/2013 |

4/5 |

31.2 |

Infant milk formula, yoghurt, casein, frozen fish fillets, methanol, animal fats and oils, apples and wine |

|

2016 |

8 |

4 |

Edible offal, oranges, orange juice, milking machines, sheep and beef meat, kiwi fruit, sheepskins |

|

2017 |

9 |

2.5 |

Butter, cheese and liquid milk |

|

2019 |

11 |

15.2 |

Skim and whole milk powders |

At the time the FTA was negotiated, dairy produce was the top New Zealand export to China in value terms (NZ$363 million, 2006-08 average).

As part of the FTA, China has access to a temporary safeguard measure for dairy, which is applicable for the period over which tariffs are phased out (2008-2018) and for a further five years after tariffs have been removed (as mentioned above). It allows China to impose World Trade Organisation (WTO) most favoured nation (MFN) tariff rates on New Zealand dairy products if Chinese imports of New Zealand dairy products exceed certain amounts. These ‘trigger levels’ are either at or above current imported amounts.

Milk powder is a key New Zealand export which remains subject to tariffs under the safeguard until it is removed on 1 January 2024. When the New Zealand – China FTA was negotiated, New Zealand had not expected that Chinese demand for milk powder would grow as much as it has done and, as a result, would have gained more export revenue had Chinese tariffs on milk powder been eliminated earlier.

Recently, New Zealand and China have concluded negotiations to ‘upgrade’ the original FTA with the aim to make it more up-to-date (e.g. cover e-commerce) and reduce barriers to trade even further.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

New Zealand is part of the CPTPP trade bloc which also includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, Peru, Singapore and Vietnam. New Zealand also has bilateral FTAs with Australia, Malaysia and Singapore .

For beef exports, as a member of the CPTPP, New Zealand is able to benefit from:

- Reduction in Japanese import tariffs from 38.5% to 9% over 16 years

- Removal of all Canadian tariffs and quotas over 6 years

- Removal of import tariffs for New Zealand beef entering Mexico and Peru within 10 and 11 years, respectively

For sheep meat, almost all import tariffs for other CPTPP members were eliminated as the FTA came into force. Preferential rates were negotiated for Canada over an eight-year period, but after that, there is trade liberalisation for sheep meat.

Tariffs on New Zealand offal and processed meat going into Japan will be removed over 13 years (from when the agreement came into force) following an immediate 50% reduction.

As a member of the CPTPP, key benefits for New Zealand dairy exports are:

- Removal of tariffs on most types of cheese exported to Japan over 16 years from when the FTA came into force

- Immediate removal of tariffs on milk powder exports going to Canada and Mexico

- Removal of tariffs on liquid milk exported to Malaysia over 16 years from when the FTA came into force. On top of this, there is a two million litre tariff free quota (TRQ) available for all CPTPP members for exports sent to Malaysia. This is in addition to other TRQs New Zealand has access to for exporting liquid milk to Malaysia, including the TRQs within the bilateral FTA between New Zealand and Malaysia.

There are also Rules of Origin (RoO) benefits as if New Zealand exports a product which comprises ingredients originating from other CPTPP countries, they will count as originating in New Zealand.

UK – New Zealand FTA: Agreement in Principle (AIP)

The UK – New Zealand trade negotiations have concluded and are now awaiting, ratification prior to the deal coming into force in late 2023. Once in force, imports tariffs on 99.5% of New Zealand goods coming into the UK (such as, wine, kiwi fruit, honey and a range of dairy products) will be removed. For beef and sheep meat, cheese, butter and apples, tariffs will be removed over a longer time period.

Sheep meat

Tariffs on NZ sheep meat imports into the UK will be removed 15 years after the UK – NZ FTA comes into force. Until then, there will be specific transitional quotas in place whereby imports will be tariff free if they come into the UK under the quota but will face WTO tariffs if they exceed the quota:

- Years 1 – 4: 35,000 tonnes

- Years 5 – 15: 50,000 tonnes

These quotas are in addition to the New Zealand specific WTO quota which allows up to 114,205 tonnes of sheep meat to enter the UK tariff-free. As noted in the New Zealand trade and production section, this quota has not been 100% utilised since 2008 and utilisation of the quota has averaged at around 40% (2017-21) . The UK – NZ FTA quotas can only be accessed in a given year, if the New Zealand specific WTO quota for that year has reached 90% utilisation. Therefore, based on current trade levels it is unlikely that the quota volumes outlined in the FTA will be anywhere near 100% utilised.

Beef

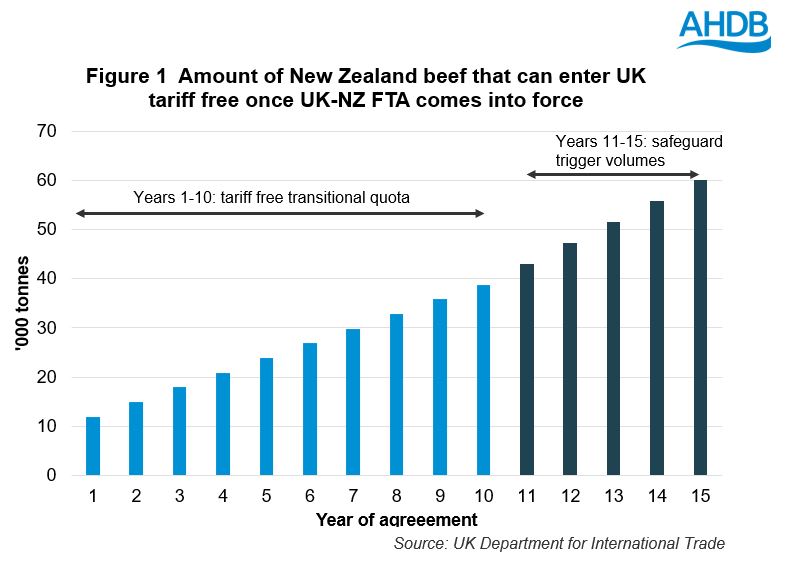

New Zealand beef will be able to enter the UK tariff-free 10 years after the UK – NZ FTA comes into force. Unlike for lamb, however, the quota volume will increase in equal instalments from 12,000 tonnes in Year 1 to 38,820 tonnes in Year 10 (Figure 1). Furthermore, a safeguard will apply between Years 11 and 15; if the trigger volume for that year exceeds negotiated levels, a 20% tariff will apply to New Zealand beef which comes into the UK over the limit. This safeguard measure will be removed after Year 15 enabling full liberalisation of trade.

To put things into perspective, UK beef imports from New Zealand are currently under 1,000 tonnes (2017-21 average), so for beef, the quota does look rather generous. However, just because the quota is available, it doesn’t mean that it will be utilised to the maximum level. There are many factors which govern international trade, as covered in other sections of the UK -NZ FTA analysis, such as supply and demand, non-tariff measures and existing lucrative markets. Gaining tariff-free access for one particular market, in isolation, is not a signal for a country to export all of its produce there. However, the value of the goods exported could exert more of an influence rather than the quantity. If, for example, New Zealand exported more high-value beef cuts to the UK under the FTA, then this could have a considerable effect on demand for domestic beef used in food service.

Dairy

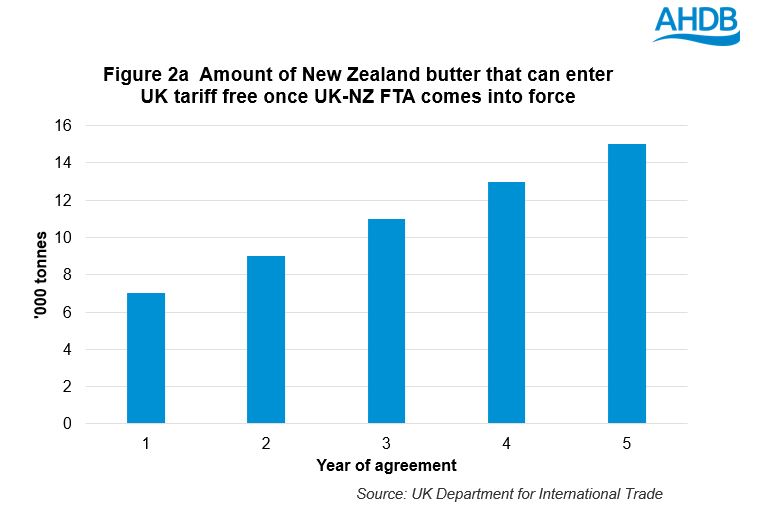

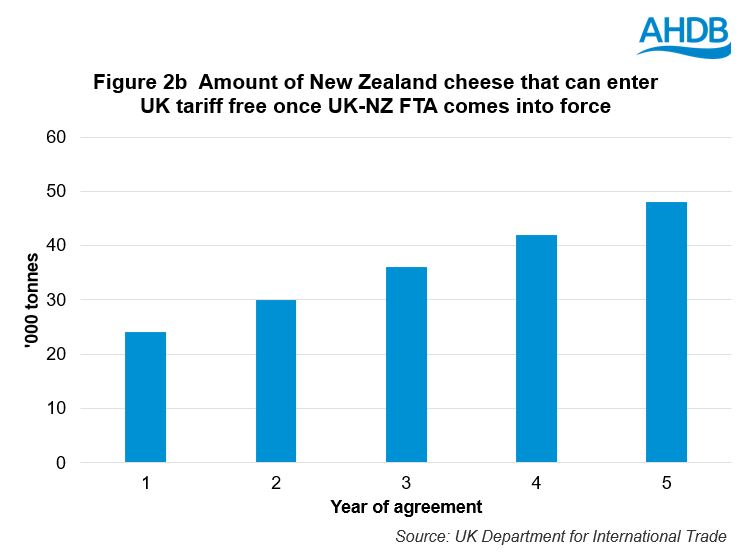

Tariffs on New Zealand butter and cheese imports will be removed six years after the UK – NZ FTA comes into force. For Years one to five, a transitional quota will be in place, starting at 7,000 tonnes for butter and 24,000 tonnes for cheese (Figures 2a and 2b).

The UK currently imports around 500 tonnes of butter from New Zealand (2017-21 average) and less than 200 tonnes of cheese. As discussed above, the transitional quota, at a first glance, signals liberalised trade from Year 1 of the FTA, but there are other factors to consider.

We have modelled the impact of the UK-NZ FTA for dairy as well as, sheep meat, beef and pork. These results are available in the trade analysis hub.

Comparison with UK – Australia FTA

The UK – New Zealand FTA is broadly similar to the UK – Australia FTA with transitional quotas in place before complete trade liberalisation for sheep meat, beef and dairy. However, as mentioned in the animal welfare section, there is a difference as text on animal welfare has been agreed between the two countries which goes beyond standard WTO text used in trade deals, such as in the UK – Australia FTA. In fact, this is the first trade deal in which New Zealand have agreed an animal welfare chapter. The UK and New Zealand have committed to increase cooperation on animal welfare standards and not to compromise animal welfare to further trade.

Comparison with the EU – New Zealand FTA

New Zealand has also concluded negotiations with the EU. Unlike the UK – New Zealand FTA, there is no liberalisation of trade but opportunity for more New Zealand products to enter the EU via tariff free or reduced tariff quotas:

- Sheep meat – Tariff rate quota (TRQ) of 38,000 tonnes phased in over 7 years once the FTA comes into force. In quota volumes will be tariff free

- Beef – TRQ of 10,000 tonnes phased in over 7 years once FTA in force, with imports within quota subject to reduced tariff rate of 7.5%

- Cheese – TRQ of 25,000 tonnes phased in over 7 years once FTA in force, with tariff-free access for in-quota volumes.

The EU also offers New Zealand some concessions for existing cheese and butter TRQs by reducing the in-quota duty.

Nevertheless, it is fair to say that, in terms of volumes and tariffs negotiated, New Zealand has arguably got a better deal for the sectors mentioned above from the UK – NZ FTA than the NZ – EU FTA.

The bigger picture

Looking at some of the other FTAs New Zealand has in place, or has negotiated, there is, unsurprisingly, a clear theme of achieving tariff-free access for its red meat and dairy products. The extent to which this is achieved depends, of course, on the trading partner in question. The UK – NZ FTA provides ample scope for New Zealand to capitalise on tariff free access for its products, but, as mentioned earlier, international trade is not as simple as that.

The UK – New Zealand (and UK-Australia) FTA has been described as a ‘stepping stone’ for the UK to join the CPTPP, where there is greater opportunity for UK agri-food products in the growing Asia Pacific markets. Time will tell if the liberalisation of trade with New Zealand and Australia bears fruit further down the line. In the meantime, we have modelled the impact of the UK – New Zealand FTA in collaboration with Harper Adams University, results of which will be available soon the trade analysis hub.