New Zealand trade and production

Tuesday, 21 June 2022

Historically New Zealand has been a crucial trading partner with the UK and is still an important trading partner across certain agricultural sectors. This article explores New Zealand’s production and trade of beef, lamb, pork, dairy, wheat and barley, and for each sector compares export and import data with the UK in 2018‒2020.

Beef production and trade

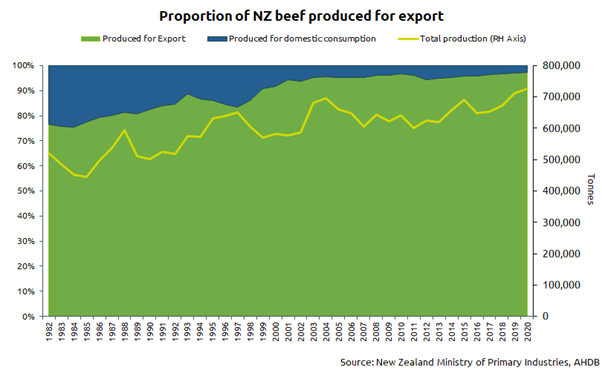

New Zealand is one of the top 10 beef exporters in the world. The proportion that it exports has increased over the past few decades to more than 90% of beef produced. This stems from two main factors:

- The New Zealand red meat sector is export-led and driven by consumer demands

- A steady increase in beef production due to an expanding dairy herd

Since the mid-1990s the increasing trend to convert from beef and sheep into dairy has meant around 70% of New Zealand beef production now derives from the dairy herd. There are constraints to expanding the herds further due to pressures on land use alongside increasingly strict environmental regulation, diversification into horticulture, and carbon farming. These pressures are expected to rise and therefore the livestock numbers are forecasted to remain at current levels if not decline. With this in mind, the sector is focusing on producing high-quality premium meat products to deliver high value, rather than increasing volume.

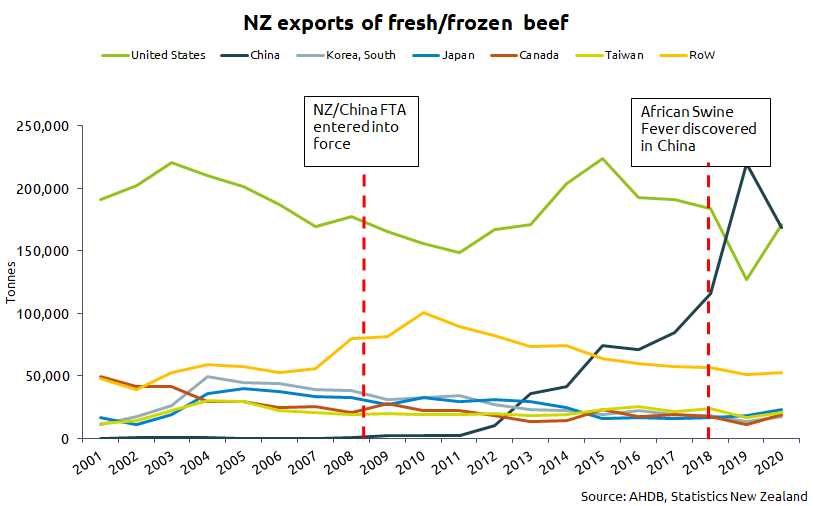

Historically the United States was the primary destination for New Zealand beef, but in recent years there has been a marked shift towards China. Demand from China has increased due to sustained economic growth over an extended period, the rise of the middle class, and the African Swine Fever epidemic, which began in August 2018. Exports to China had already been increasing since 2008 when a Free Trade Agreement (FTA) between New Zealand and China was signed. In 2019, New Zealand fresh/frozen beef exports to China surpassed those to the USA for the first time but dropped back in 2020. New Zealand sells the largest proportion of its product to these two markets, which accounted for around 72% of total exports in 2020.

New Zealand annual exports of beef including offal to key markets 2018–2020 average

|

Country |

Volume shipped (t) |

Value (£ million) |

Unit value (£/t) |

|

China |

174,034 |

646 |

3,668 |

|

United States |

162,849 |

610 |

3,765 |

|

Japan |

22,278 |

106 |

4,754 |

|

Taiwan |

21,637 |

90 |

4,186 |

|

South Korea |

21,535 |

72 |

3,368 |

|

Source: IHS Maritime & Trade – Global Trade Atlas® |

|||

Frozen boneless cuts of beef are New Zealand’s predominant beef export, at varying prices around the world. Unit prices for boneless New Zealand beef vary, with exports to the USA and Canada at the lower end of the scale (£3,000-£3,500/t). Exports to European countries, such as the Netherlands and Germany, are more than twice the price (£8,000-£9,000/t).

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

704,000 tonnes |

917,666 tonnes |

|

Total exports |

448,385 tonnes |

118,935 tonnes |

|

Total imports |

6,738 tonnes |

253,884 tonnes |

|

Source: Defra, USDA, Beef + Lamb New Zealand, IHS Maritime & Trade – Global Trade Atlas® |

||

Lamb production and trade

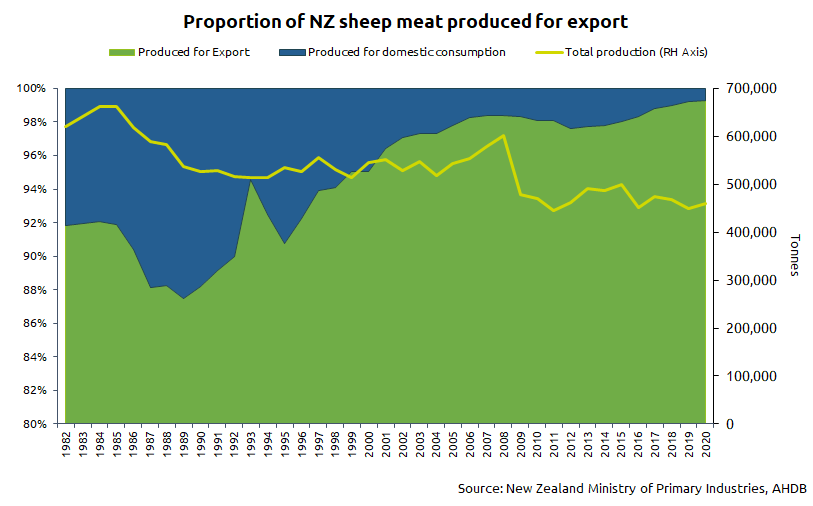

Sheep meat production, by contrast, has been declining since the 1980s. Production was then over 600,000 tonnes, whereas production is currently around 450,000 (2018–2020 average).

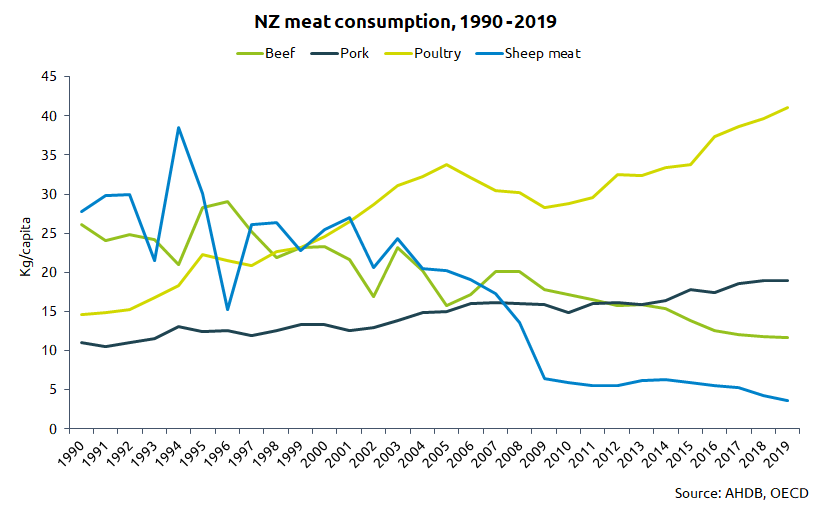

Consumption of sheep meat in the NZ domestic market has also fallen dramatically during that period. According to data by OECD, sheep meat consumption in New Zealand dropped from around 30 kg per capita in 1990 to just over 3 kg per capita in 2020.

Likely causes are:

- Domestic consumption of other proteins, such as pork and poultry, has increased significantly over this period

- Subsidies were abolished in New Zealand, resulting in a fall in production as sheep made way for dairy in the most productive areas

- A major drive towards export markets for lamb may have contributed to higher prices domestically (around 98% of lamb production in New Zealand is now exported)

China is the leading market for New Zealand lamb, with shipments averaging 205,000 tonnes in 2018–20. The UK is the second most important market, followed by the United States. As with beef, exports of sheep meat have been pivoting towards China since the FTA between New Zealand and China was signed in 2008. Markets in Europe, particularly the UK, have seen a fall in imports from New Zealand for some years: New Zealand has not filled the EU quota on sheep meat since 2008, and is currently around 40% utilisation.

This shift towards the Chinese market is due to several reasons. Similar to beef, demand for red meat has increased due to economic growth and the rise of the middle class. Also, the demand for cereals in China was significantly higher in 2020 and is the highest on record, which suggests that the Chinese pork sector is starting to recover post-African Swine Fever. With this sector recovering there may be less demand for imported meat from places such as New Zealand. This may see exports of New Zealand lamb pivoting back towards markets in Europe. However, with demand for meat products in China increasing alongside economic growth, the demand for New Zealand lamb may remain stable.

New Zealand annual exports of sheep meat to key markets 2018–2020 average

|

Country |

Volume shipped (t) |

Value (£ million) |

Unit value (£/t) |

|

China |

204,700 |

753 |

3,661 |

|

UK |

42,704 |

218 |

5,128 |

|

United States |

24,632 |

205 |

8,297 |

|

Germany |

16,921 |

143 |

9,450 |

|

Netherlands |

14,895 |

122 |

8,201 |

|

Source: IHS Maritime & Trade – Global Trade Atlas® |

|||

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

449,933 tonnes |

307,667 tonnes |

|

Total exports |

393,995 tonnes |

87,275 tonnes |

|

Total imports |

2,994 tonnes |

65,197 tonnes |

|

Source: Defra, USDA, Beef + Lamb New Zealand, IHS Maritime & Trade – Global Trade Atlas® |

||

Pork production and trade

As in Australia, pork imported to New Zealand is subject to a rigorous set of Sanitary and Phytosanitary (SPS) measures. Only a few countries are therefore able to export to New Zealand including Australia, Canada, the European Union, Sonora State of Mexico, and the USA. Pork production in New Zealand is low, and therefore imports are required to satisfy demand. Imports make up around 60% of New Zealand's pork consumption, with many products made in New Zealand using imported product.

Domestic consumption of sheep, beef, pork, and poultry in New Zealand, 1990‒2020

Pork imports total around 47,000 tonnes (2018-2020 average). The majority of imports (98% by value) consist of frozen pork cuts, and the average price for frozen pork stands at £3,102/tonne. In value terms, the export market totals around £107m. Spain is currently the leading supplier of pork to New Zealand, and imports have been steadily increasing year-on-year as consumption of pork in New Zealand rises. Other major suppliers are Canada, Poland, Finland and the USA.

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

45,000 tonnes |

917,667 tonnes |

|

Total exports |

359 tonnes |

236,435 tonnes |

|

Total imports |

46,544 tonnes |

417,604 tonnes |

|

Source: Defra, USDA, IHS Maritime & Trade – Global Trade Atlas® |

||

Dairy production and trade

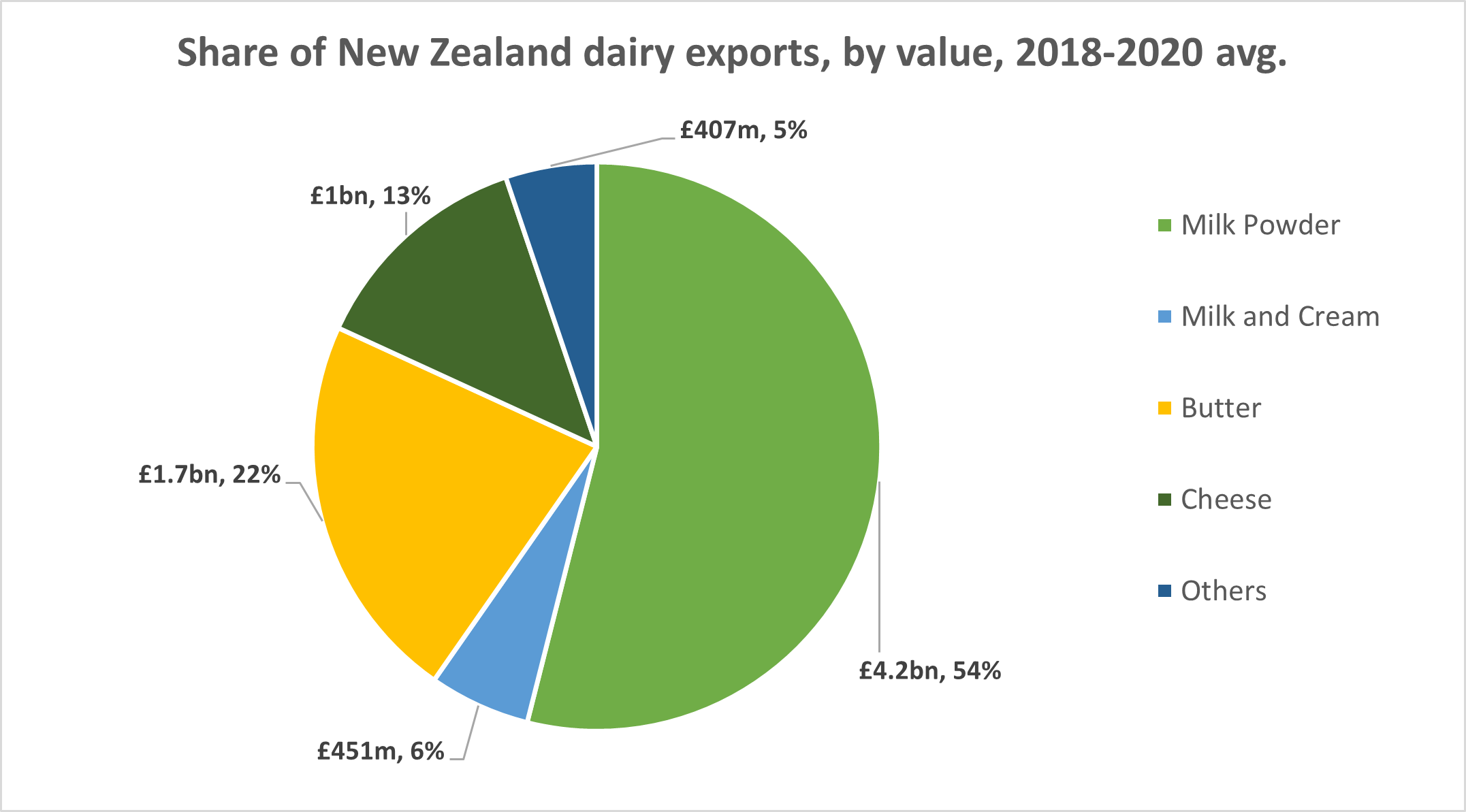

New Zealand dairy production is considerable. Much of the milk production in New Zealand is made into milk powders. Butter and cheese are also cornerstones of the New Zealand dairy market.

As with beef and sheep meat, production far outweighs domestic consumption: around 95% of dairy production is exported to trading partners across the globe. New Zealand farmers continue to improve productivity on farms; however, a steady reduction in cow numbers has meant that production has remained fairly stable recently.

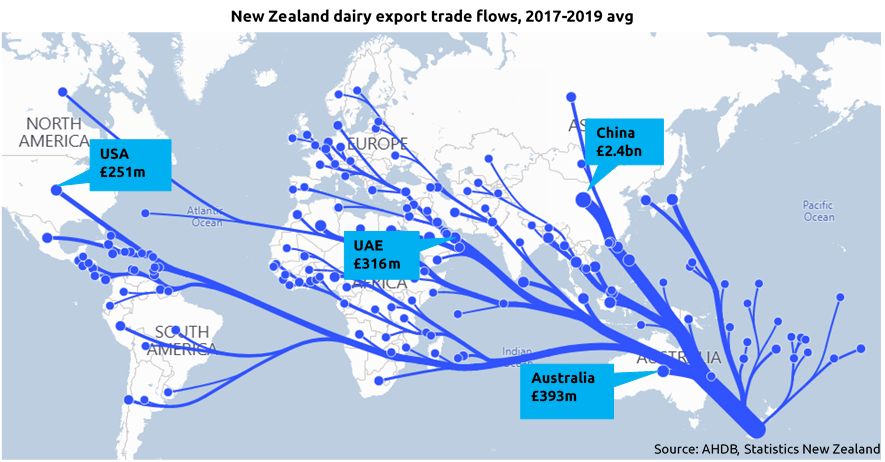

Almost one-third (32%) of all dairy exports by value go to China. Fonterra, a major dairy exporter in New Zealand, has made significant investments in both farms and processing capacity within China, to extract the most value from the growing dairy market there. Other key trading partners include Australia, as well as a variety of Asian markets including Malaysia, Indonesia and Japan.

Whole milk powders are the largest dairy export for New Zealand by value, making up over half (around 54%) of the total value of exports. The vast majority of these go to China, UAE and other Asian markets for infant milk formula. Butter and cheese exports are also substantial, totalling £1.7 billion and £1.0bn respectively per annum (2018–20 average).

Source: IHS Maritime & Trade – Global Trade Atlas®

New Zealand imports relatively little dairy, with a total market size of around £154m per annum (2018–20 average). The majority of imports by value come from cheese and whey. Cheese imports have been growing steadily, with imports totalling £47m in 2020, up from £28m in 2015. The market is predominately supplied by Australia and the United States. Very little trade for any dairy products currently occurs between the UK and New Zealand.

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

Liquid milk: 21m tonnes Butter: 525,000 tonnes Cheese: 363,333 tonnes |

Liquid milk: 6.7m tonnes Butter: 176,000 tonnes Cheese: 477,333 tonnes |

|

Total exports

|

£7.9bn Top exports: 1. Whole Milk Powder (WMP) – £4.2bn 2. Butter – £1.7bn 3. Cheese – £1.0bn

|

£1.6bn Top exports: 1. Cheese – £507m 2. Milk – 241m 3. Butter – £280m |

|

Total imports |

£154m Top imports: 1. Cheese – £50m 2. WMP – £34m 3. Butter – £3m |

£2.8bn Top imports: 1. Cheese – £1.7bn 2. Butter – £295m 3. WMP – £177m |

|

Source: Defra, USDA, IHS Maritime & Trade – Global Trade Atlas® |

||

Cereals and oilseeds production and trade

Arable production in New Zealand is on a small scale. Most grain is produced for the domestic feed sector and this complements imported grain, primarily from Australia. Barriers to the adoption of arable farming are the small-scale farming businesses and prohibitive transport costs to the major mills from areas suitable for growing crops. For example, the cost of transporting grain from Canterbury to mills in Auckland is higher than the price of shipping grain from Sydney, and similar to the cost of transporting grain from the east coast of the United States to Auckland's mills. New Zealand is a net importer of a variety of crops, with Australia the main import origin.

Wheat

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

407,977 tonnes |

13,146,000 tonnes |

|

Total exports |

150 tonnes |

651,876 tonnes |

|

Total imports |

476,128 tonnes |

1,878,015 tonnes |

|

Source: Defra, USDA, IHS Maritime & Trade – Global Trade Atlas ® |

||

Barley

|

Annual production and trade, 2018–2020 average |

||

|

|

New Zealand |

UK |

|

Production |

367,333 tonnes |

7,558,333 tonnes |

|

Total exports |

168 tonnes |

1,378,663 tonnes |

|

Total imports |

12,870 tonnes |

84,171 tonnes |

|

Source: Defra, USDA, IHS Maritime & Trade – Global Trade Atlas® |

||