Q3 2024 dairy market review

Tuesday, 22 October 2024

Milk production

GB milk deliveries through the milk year to date have contracted in supply terms as a result of the poor weather seen from Autumn last year through to Spring this year. In the milk year to date GB supplies have been back by 0.9%. July was back by 0.4% and August by 0.5%. This was due to disappointing grass growth and quality going into summer and lack of farmer confidence given continued high input costs and costs of borrowing. Off the back of this trend the AHDB forecast revision in September expected the 2024/25 season to end at 0.3% down year-on-year.

However, the tide turned a little in September, with better weather and continued price increases GB milk deliveries for September were up by 0.9% compared to the same period in 2023. This is despite some reduction in cow numbers.

The milking herd has eased a little, standing at 1.61 million head, as of 1 July 2024. This is down by 0.3% on the previous year, driven by decreases across all age categories (apart from 2-4 years which saw a gain of 16,000 head due to the youngstock boom of 2021 aging into the herd). The average age of the dairy herd now stands at 4.55 years.

GB registrations of calves born to dairy dams dropped off by 2.1% in the second quarter of 2024. Birth registrations were up 3.6% in May, year on year, however this was counteracted by declines in both April and June, by 0.5% and 9.5% respectively.

This means that for the first half of 2024, total dairy births are back by 0.5% year-on-year, totalling 704,000 head.

Global milk production in July continued the ongoing decline and now sits at -0.4% year on year with growth in New Zealand and Australia being offset by declines in Argentina, the EU and the US. This meant that on a 12-month basis milk supplies continue to be tight which has fuelled the growth in milk prices. Expectations are for global milk production to remain stable over the next 12 months, with a small decline of -0.1% in the key exporting regions.

Wholesale markets

Fats prices on UK wholesale markets reached record-breaking levels in September with dwindling stocks, low milk volumes and strong demand causing buyers to scramble to cover short-term needs. Butter rose by a huge £620/t to £6,730/t and bulk cream by £450/t to £3,147 in September. Mild cheddar was up by £290/t and although SMP continued to lag, it still rose by £130/t to £2,150/t. Reports from the continent and elsewhere are already indicating that these prices may have peaked and with milk flows returning to growth in September buyers may be feeling less pressured. However, stocks of fats remain low and Christmas is just round the corner.

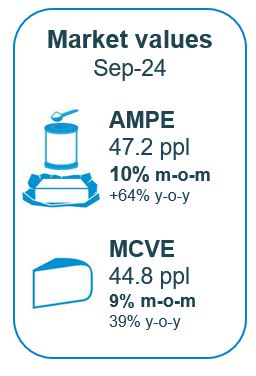

As of September, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements) have reached the highest levels seen since November 2022. AMPE rose by 10%, to 47.2ppl, MCVE rose by 9% to 44.8ppl. AMPE is ahead of this time last year by 64%. MCVE has been playing catch-up but is 39% up since last year.

Dairy product availability in the UK has remained tight, especially for fats in Q2 2024. Overall, the decline in milk deliveries impacted the production of most dairy product. Production of butter and cheese declined during the period whilst milk powders increased marginally. Cheese imports from both the EU, but also New Zealand, increased cheese supplies tempted by higher UK prices. Supplies in the EU of butter and cheese also remained tight, with greater supply of milk powders.

Farmgate milk prices

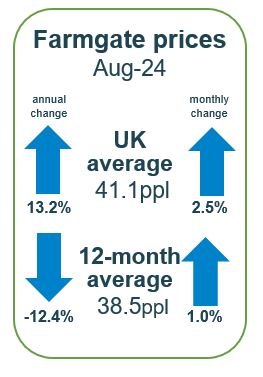

The latest published farmgate price was for August, with a UK average of 41.1ppl. Latest announced farmgate prices continued the upward trajectory with most key milk buyers included on the AHDB league table announcing further price increases for October. Price increases on aligned liquid contracts were lower with only marginal movements.

On non-aligned liquid contracts, there was positive momentum in prices. Muller and Freshways made an announcement of 1.00ppl increase each this month while Crediton Dairy and Payne’s Dairies increased by 0.75ppl and 1.50ppl respectively. This is the fifth consecutive month of increase for Crediton Dairy.

Cheese contract price increases were the show stopper and price increases varied between 0.50 to 1.50ppl. South Caernarfon Creameries announced the largest increase of 1.25ppl for the month. Belton Cheese and Saputo increased their price by 1.00ppl each. Barbers and First Milk made a positive price announcement of 0.60ppl each. Barbers have made the seventh consecutive month of price increase. Leprino Foods increased their price by 0.50ppl while Wensleydale Creamery and Wyke Farms gained 0.77ppl and 0.48ppl respectively.

Movements on manufacturing contracts were in line with cheese contracts. UK Arla Farmers Manufacturing increased for the sixth consecutive month and rose by 1.69ppl. Arla Direct Manufacturing contract grew by 0.85 ppl and Pattemores Dairy Ingredients made a positive announcement of 0.50ppl.

Demand

Global and domestic demand are mixed. Latest Nielsen figures for the last 52 weeks ending 7th September 2024 indicate volume falls in butter (-3.6%), and milk (-1.6%) although less steep than in previous months, whilst yogurt, cream and cheese have returned to growth (6.5%, 1.2% and 2.8% respectively) (source: Nielsen Homescan, 52 we 7 Sept 24).

Chinese demand has remained disappointing thus far due to increased Chinese domestic dairy production and economic challenges with imports for H1 2024 down by 14.1% compared to the same period last year driven by a significant decline in WMP and SMP volumes. Rabobank predict Chinese imports will be down by 8% this year but still scope for products such as cheese where domestic production is limited by processing capacity. Speculation over future retaliatory measures on European dairy products by China following the EU’s imposition of tariffs on Chinese electric vehicles, could indicate that Chinese demand could fall even further. Whilst some commentators see this as a potential opportunity for the UK there are complexities at play which could limit this.

Total export volumes of dairy products from the UK have declined by 2.6% in Q2 2024. Total export volumes for Q2 2024 were 330,800t, a decline of 8,800t year-on-year. Exports of dairy products to the EU declined by 1,700t and that to non-EU nations declined by 7,000t during the period.

Despite the overall decline in exports, cheese, whey, milk and cream and yoghurt saw growth year-on-year. Cheese exports grew the most, increasing by 5,900t, followed by whey products at 2,600t. Exports of yoghurt increased marginally by 800t, however it is the highest recorded in a quarter since 2021. Exports of milk and cream increased by 1,900t. Increasing consumer demand for cheese supported the growth. Exports of powders declined very significantly by 16,600t (-34%) whilst butter declined by 3,300t (20%).

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.