UK dairy product availability Q2 2024

Wednesday, 4 September 2024

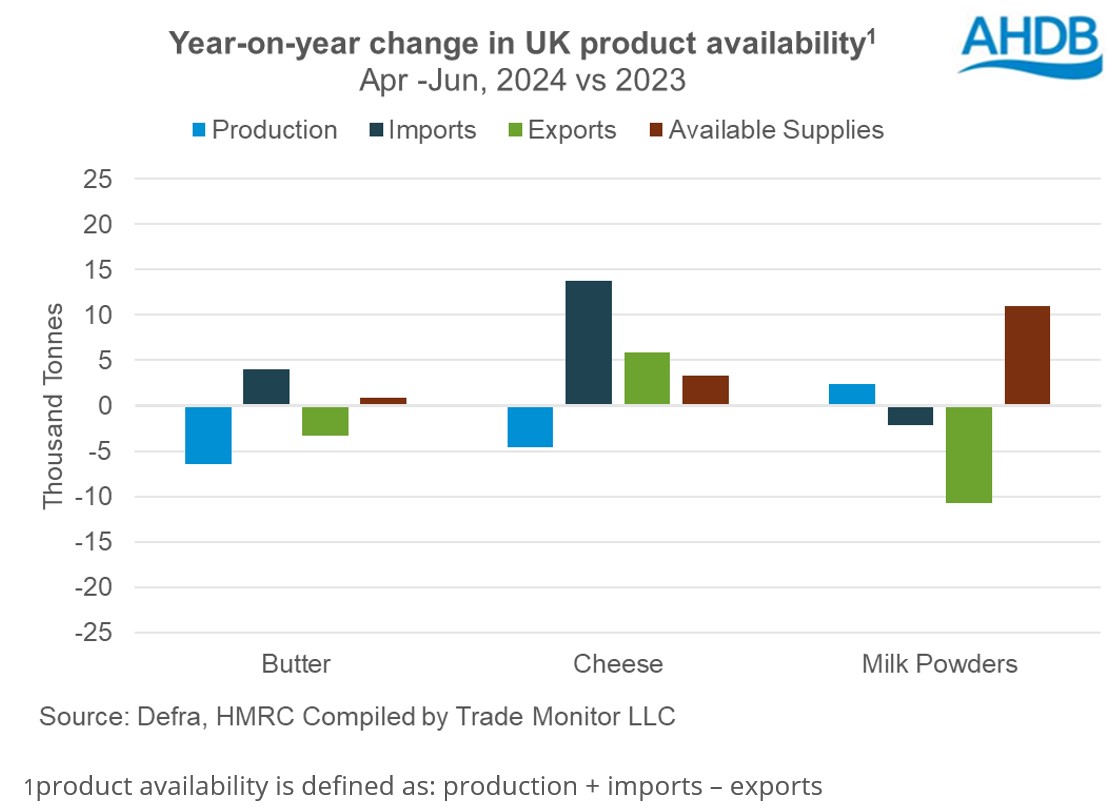

Key trends

- An excess of milk powders in Q2 2024 following lower exports

- Boost in cheese exports and lower production in Q2 tightened supplies but balanced by more product coming in from EU and New Zealand

- Concerns about butter availability alleviated by supplies from overseas

UK milk deliveries in the second quarter of the calendar year amounted to 3,965m litres (-0.8%) lower year-on-year. Milk supplies tightened following the wet spring, which has been continuing from the previous autumn. Overall, the decline in milk deliveries impacted the production of most dairy products during the second quarter of 2024. Production of butter and cheese declined during the period whilst milk powders increased marginally.

Supplies of cheese boosted by imports

Cheese availability looked challenging but was boosted by an increase in imports resulting in an increase of 2% (3,500 tonnes) in the second quarter year-on-year. Interestingly cheese imports from New Zealand have picked up beginning this year following the trade deal. Most of the imports came from the EU followed by New Zealand. Cheese production declined by 3% (4,500 tonnes) whilst exports increased by 13% (6,000 tonnes). Imports grew by 13% (14,000 tonnes) to fill the gap. Marked higher price of cheddar in the domestic market compared to global market supported the inflow of imports. Despite the higher price, overall exports was in the positive territory as consumers showed a taste for British cheese.

Butter supplies finely balanced as imports fill the gap

Butter production declined by 10% (6,000 tonnes) year-on-year in Q2 in spite of rising commodity prices. Exports fell by 20% (3,000 tonnes) as a result. Lower production resulted in higher imports and lower exports during the period. Lack of availability limited exports at a time when the domestic market is paying well. With butter supplies raising concerns, prices jumped sharply on the UK wholesale markets. Overall higher imports of 33% (4,000 tonnes) coupled with lower exports drove available supplies higher by a marginal 1% (1,000 tonnes).

Falling exports have led to a surfeit of powders, adding pressure to prices

Milk powder production increased by 7% (2,000 tonnes) in Q2, but imports declined by 23% (2,000 tonnes) year-on-year. Exports fell by 37% (11,000 tonnes) which paired with production growth led to an increase in available supplies of 11,000 tonnes. Lower demand from MENA, Asia and the EU contributed to the decline in exports. Geo-political tensions in the global market have also been affecting trade flows.

In the Asian region, demand from China remains muted due to a surplus in the domestic market and a stagnating economy is also weighing on demand. Most other economies have passed the recessionary period, however consumers are taking a cautious approach towards spending. Volatility in exchange rates and high costs of shipping due to issues in the Red Sea have also dampened exports to certain extent. The ongoing fallout between China and EU trade might further impact the market in the third quarter.

1product availability is defined as: production + imports – exports

Recent hikes in butter prices are making headlines following tight supply situation and how long the prices will go depends on the capacity of demand and supply side factors. Overall scenario looks firms and farmers will be incentivised to push production in the short -term.

Looking ahead, market commentators expect demand to pick up post summer holidays. The industry's ability to adapt to changing market conditions, weather patterns, disease outbreaks and global economic and geopolitical trends will be crucial in shaping the trajectory of available supplies for the rest of the year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.